Business Transactions: Asset vs. Share Purchase

Friday, March 29, 2024

Two paths stand out when diving into the world of business acquisitions: asset purchase and share purchase. Each has its perks and pitfalls; understanding these can guide your choices. Let’s break these down in a more approachable manner.

Quick Overview

Asset Purchase: Here, the buyer handpicks specific assets like equipment, inventory, or even customer lists. They might also take on a few liabilities, but it’s a more tailored approach.

Share Purchase: This is like buying the whole package. The buyer grabs all company shares, getting every asset and liability in the mix.

Asset Transactions – What’s the Deal?

- Flexibility: Choose what you want. Whether it’s tangible goods or intangible contracts.

- Less Risk: Generally, you can avoid unexpected liabilities.

- Fresh Starts: Use what you bought to kick off a new venture.

- Paperwork Galore: Transferring assets might mean lots of documentation and approvals.

- Employee Changes: There’s no guarantee for non-union employees to keep their roles, leading to potential disputes.

Unraveling Share Transactions

- Easy-Peasy: Less paperwork than asset deals.

- Tax Wins: Sellers get a tax break with capital gains. Buyers can also get some tax perks.

- Smooth Sailing: The business continues as usual, from permits to employees.

- Full Baggage: Every asset comes with every liability, known or hidden.

- Deep Dive Due Diligence: Buyers must inspect everything in the company.

Key Considerations

- Liabilities: Asset buys let you choose liabilities. Share deals? You get them all.

- Taxes: Asset buys can offer tax perks through depreciation, but double taxation risks might exist. Share buys usually make taxes simpler for sellers.

- Third-party Deals: Asset buys might need extra permissions for licenses or contracts. Share buys keep things rolling without extra steps.

- Employees: In asset buys, you pick who stays. Share buys keep the team as it is.

- Homework Time: Asset buys focus on specific items, while share buys demand a thorough company examination.

- Complexity: Asset buys can get tricky, especially when outlining the deal’s details. Share buys, despite in-depth checks, often mean a smoother handover.

Final Thoughts

Choosing between asset or share purchases hinges on what the buyer and seller want and their risk comfort. But remember, expert advice is gold. Professional insight will guide you through business buy decisions, including tax nuances or potential pitfalls. So, research well, seek advice, and sail smoothly through your business ventures!

January 31, 2025

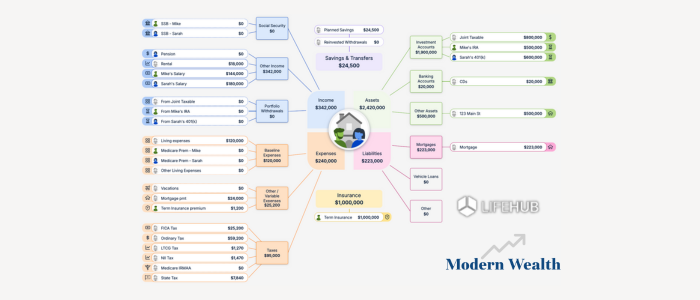

Life Hub at Modern Wealth

January 22, 2025

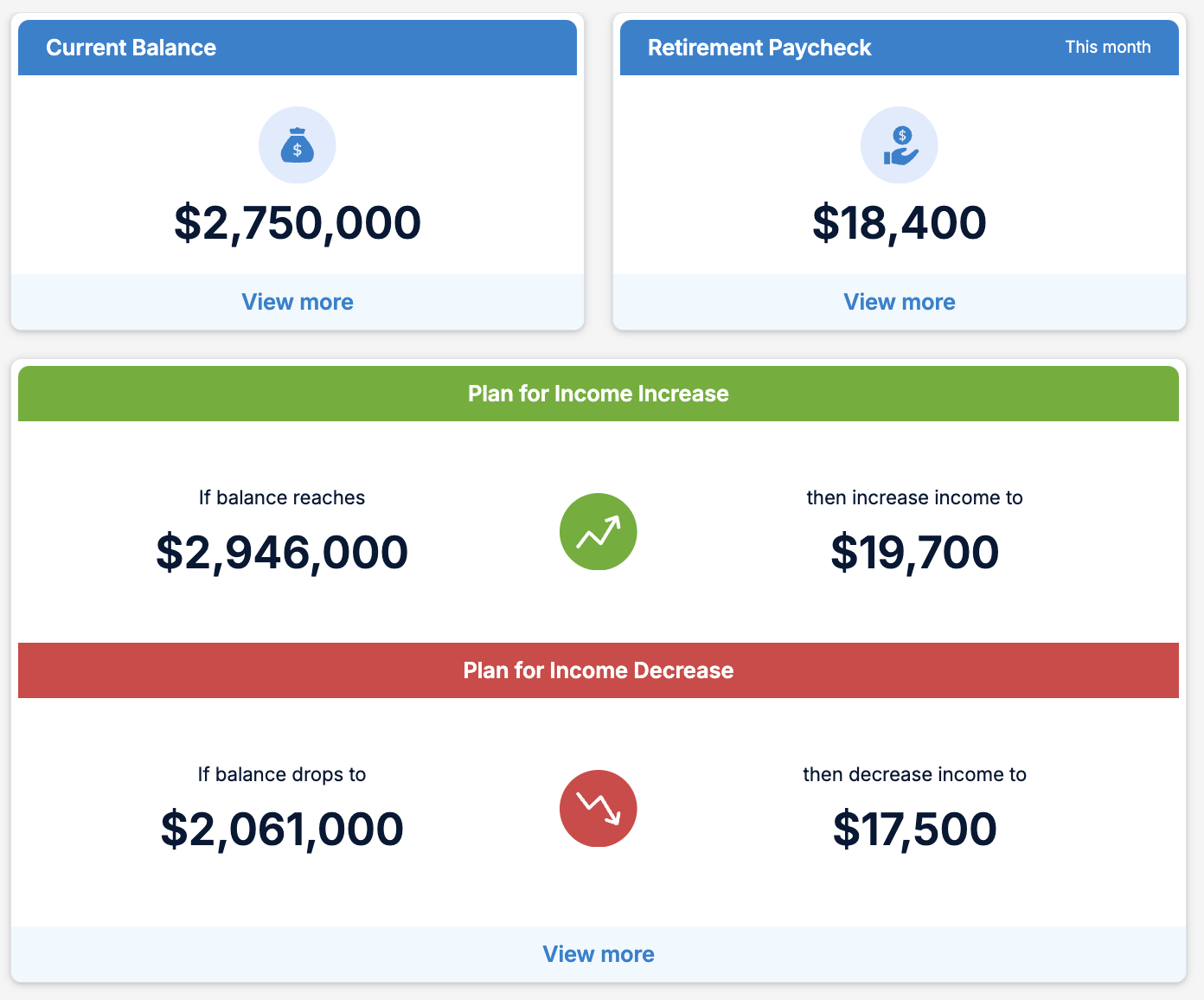

Modern Wealth’s Retirement Optimizer