The Five Stages of Value Maturity for a Business

Friday, March 29, 2024

Running a business is akin to embarking on a journey. Just like any journey, it requires careful planning, a sense of direction, and the right tools to navigate potential obstacles. Christopher Snider’s book, “Walking to Destiny,” provides a roadmap for business owners in the form of the Five Stages of Value Maturity. This framework, a cornerstone of the Value Acceleration Methodology, lays out a structured approach to maximize the value of a business and make it attractive for eventual sale or transition.

Let’s take a deep dive into each of these stages, understanding their essence and how they interlink to form a cohesive strategy.

1. Identify

The journey begins with a realization. Imagine you’re sitting atop a goldmine, but you’re unaware of its worth. Most business owners find that a staggering 80-90% of their net worth is trapped within the walls of their business. The first step is to dig deep and evaluate the business’s intrinsic value. A professional business valuation is an instrumental tool at this stage.

Performing an annual business valuation offers multiple benefits. Firstly, it uncovers hidden areas of risk, offering insights into potential pitfalls. Secondly, it charts out improvements and growth trajectories, acting as a report card for the business. Lastly, it aligns the business operations with the owner’s goals, ensuring that the business remains a reflection of its creator’s vision.

2. Protect

Awareness of your business’s value is only the beginning. The next logical step is safeguarding that value. Think of it as insurance for the future. By addressing and mitigating risks, business owners fortify their operations against unforeseen circumstances.

Risks can be broadly categorized into three segments – personal, financial, and business. The essence of this stage is captured in Snider’s words, “protecting value is the first step in building value.” One of the most proactive strategies here is to decentralize the business’s dependence on the owner. Having robust written procedures, detailed financials, and a diversified customer base ensures the business remains resilient in the owner’s absence.

3. Build

With a fortified foundation, the focus shifts to expansion and growth. In the business realm, building value revolves around two pivotal points: augmenting cash flow and enhancing the business’s multiple. The latter is an intriguing aspect that delves into the intangible assets of a business.

Four types of intangible assets come to the fore – Human, Structural, Customer, and Social Capital. The strength of these assets often determines the business’s value trajectory. For instance, the capability to attract and retain top talent underscores the Human Capital, while a company’s vision and purpose manifest in its Social Capital. On the other hand, Structural Capital reflects in the business’s efficiency derived from its processes, tools, and equipment. Customer Capital, arguably the most influential, encapsulates the lifetime value of a customer and their financial significance.

4. Harvest

Every diligent farmer knows that after a season of meticulous care and nurturing, comes the time to harvest. Similarly, having built a strong, value-driven business, owners arrive at a crossroads. Here, they must decide the path forward, whether to sell, transition, or continue growing.

A key challenge many face is distinguishing between the enterprise value and the actual net proceeds. The gross value may seem enticing, but the net amount, after deductions like taxes, fees, and debts, is what truly matters. Thus, seeking advice from seasoned investment bankers and business advisors can illuminate the best course of action.

5. Manage

Contrary to what one might believe, the journey doesn’t end post-harvest. Management, especially while exiting a business, is the true test of an owner’s foresight and planning. This stage underscores the importance of managing both the business value and personal financial worth.

Chris Snider emphasizes, “Manage Value represents full maturity.” An integral part of this maturity is planning for wealth deployment post the business sale. Whether it’s investing in new ventures, securing one’s retirement, or philanthropy, envisioning the path for wealth ensures a fulfilling “next act” for business owners.

The Roadmap to Value Maturity

Alongside these stages, the Value Maturity Index offers a tangible tool for introspection and growth. By scoring their business across the stages, owners can identify strengths and weaknesses, making informed decisions and tracking progress. This cyclical review, undertaken every 90 days, acts as a compass, ensuring the business stays on course.

In conclusion, the Five Stages of Value Maturity is not just a conceptual framework but a strategic guide for every business owner. By embracing and integrating this methodology, businesses can transform from fleeting success stories to lasting legacies, ready to fetch their true worth in the market.

January 31, 2025

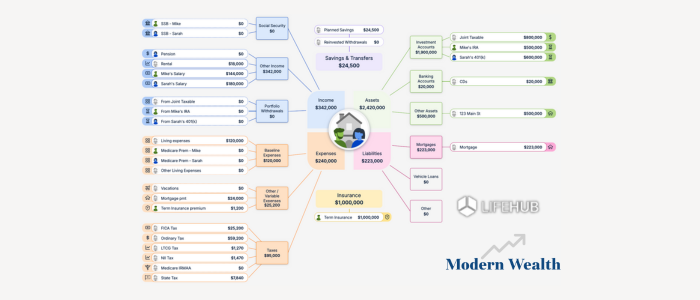

Life Hub at Modern Wealth

January 22, 2025

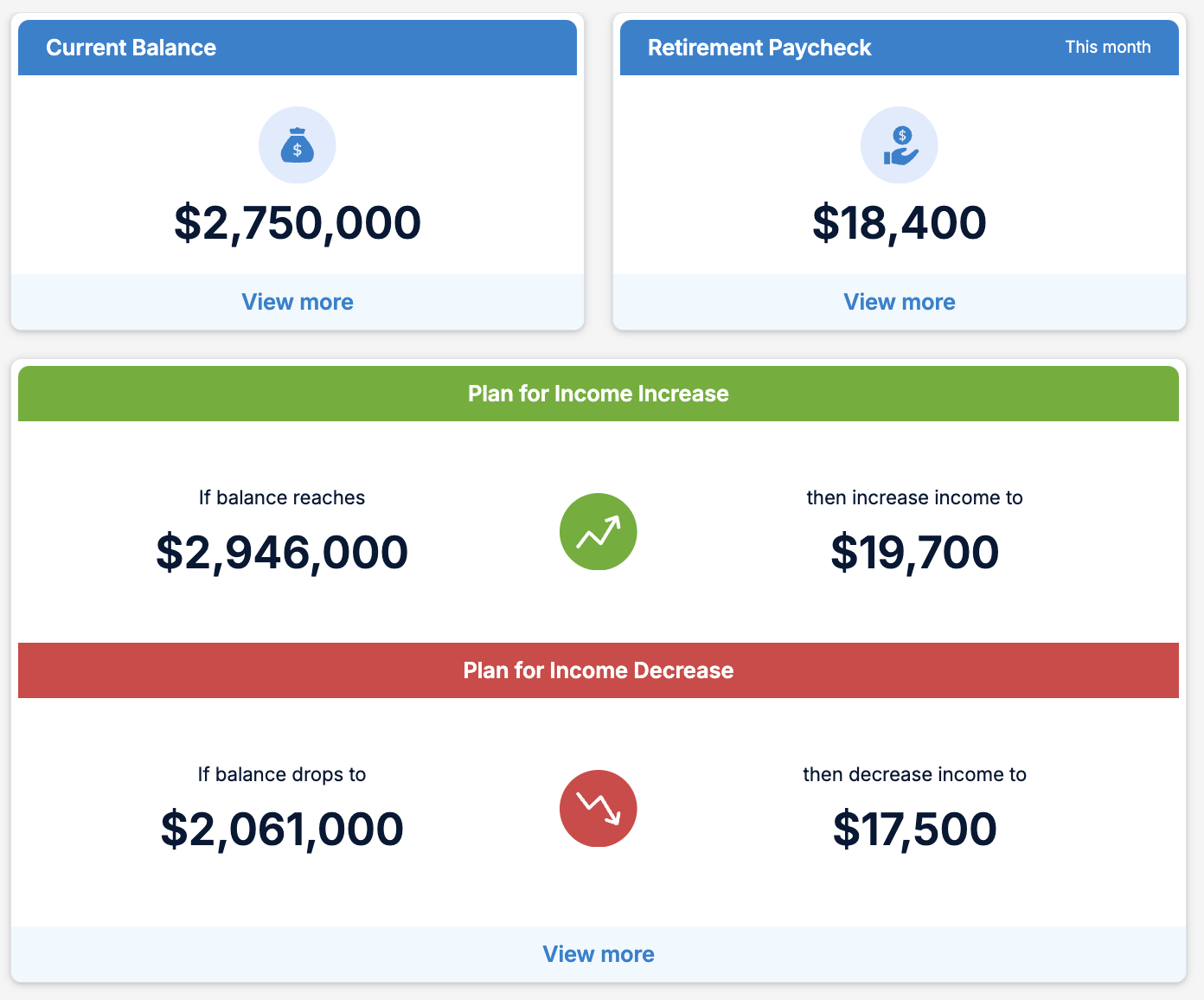

Modern Wealth’s Retirement Optimizer