The Ultimate Guide to Retirement Plans for Small Businesses

Friday, March 29, 2024

As a small business owner or self-employed professional, it’s essential to understand the variety of retirement options available. The right plan offers financial security for the future and can also provide current tax benefits. Here’s an in-depth look at the top retirement plans tailored for small businesses and self-employed individuals.

1. Individual 401(k) / i401(k)

The Individual 401(k), or i401(k), is tailored for self-employed professionals and partners in businesses where the partners and their spouses are the sole employees. This type of plan uniquely positions the business owner to contribute both as the employer and the employee. Key highlights:

- Entities: Suitable for C corporations, S corporations, and LLCs without common-law employees.

- Employer Contribution: Employers can contribute up to 25% of compensation, with a maximum cap of $69,000 for the 2024 tax year.

- Employee Contribution: Eligible individuals can defer up to $23,000. For those aged 50 and over, the catch-up contribution limit is $30,500.

2. SEP-IRA (Simplified Employee Pension)

The SEP-IRA is celebrated for its straightforwardness, making it an ideal choice for freelancers, the self-employed, and business owners. In this plan, only the employer makes contributions. Highlights include:

- Employer Contribution: They can allocate up to 25% of an employee’s compensation, capped at $6,000. For self-employed persons, the typical contribution is around 20% of their net income.

- Employee Role: While employees can’t defer their salaries into the SEP-IRA, they might be able to make traditional IRA contributions.

- Eligibility: Employees aged 21 or older who have earned at least $750 in the tax year and served in 3 of the past five years usually qualify. However, flexibility exists, and employers can opt for less restrictive rules.

3. SIMPLE-IRA (Savings Incentive Match Plan for Employees)

Designed for small enterprises with 100 or fewer employees, the SIMPLE-IRA is an excellent retirement plan for those without another existing retirement scheme. This savings incentive plan is beneficial for both employers and their staff. Crucial features include:

- Employer Contribution Options: Either match employee contributions dollar-for-dollar up to 3% of each employee’s compensation or offer a 2% non-elective contribution for every employee’s compensation.

- Employee Contribution: Employees can contribute a maximum of $16,000, with a higher limit for those 50 years and above.

- Eligibility: Typically, employees earning at least $5,000 in any two preceding years and expecting a similar amount in the current year are eligible.

4. Traditional 401(k)

While often associated with larger corporations, the traditional 401(k) can cater to small businesses with over 20 employees. Employees can contribute pre-tax dollars through this plan, and employers may choose to match these contributions. Essentials to know:

- Employee Contribution: For 2024, employees can contribute up to $23,000. Those aged 50 or older have an additional contribution limit of $7,500.

- Tax Benefits: Employees enjoy the advantages of tax-deferred growth potential and pre-tax contributions. At the same time, employers can benefit from tax-deductible contributions.

Conclusion

Choosing the ideal retirement plan is a pivotal step for small business owners. Each of these plans offers unique advantages tailored to various business dynamics. The underlying principle remains unchanged: investing in retirement is a commitment to a secure financial future. Whether you’re self-employed, run a startup, or manage a small team, there’s a retirement plan suited for you. It’s always wise to seek financial advice to select the optimal strategy for your business’s future.

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

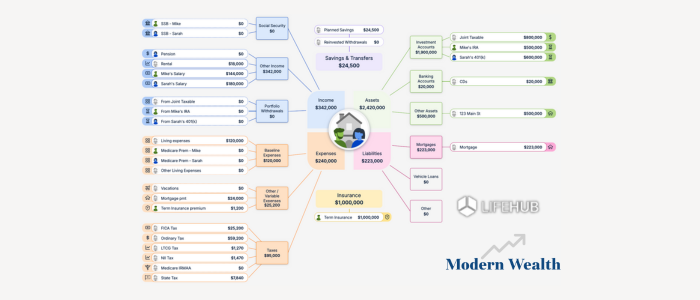

Life Hub at Modern Wealth