The Discover Gate

Saturday, March 30, 2024

When considering the Value Acceleration Methodology, which is pivotal to strategic exit planning as a small business owner, the very foundation rests upon the Discover Gate. This initial phase is all about understanding the present state of your business, aligning with personal and financial goals, and charting a path forward. Let’s dive into the intricacies of the Discover Gate and why it’s the linchpin of the entire methodology.

1. The Essence of Discovering

Before plotting the course forward, one must understand where they currently stand. This is the guiding principle behind the Discover Gate. It’s about understanding the nuances of your business, assessing its actual value, and identifying your needs as an owner. By accomplishing this, business owners can formulate actionable steps that are not just rooted in aspiration but backed by data and introspection.

2. The Significance of Business Valuation

The first cornerstone of the Discover Gate is the Business Valuation. At its core, it’s a comprehensive assessment that quantifies the worth of a business. It’s not just about top-line revenue or profit margins; it encapsulates every tangible and intangible asset.

Rick Feltenberger, a renowned Value Advisor at ForwardFocus, rightly points out the significance of annual business valuations. He likens them to the “Gold Standard,” essential for understanding whether a business is progressing toward becoming more substantial and more valuable.

Often, business owners operate with a perceived notion of their business’s worth, which can be skewed by biases or market hearsay. The absence of regular business valuations can lead to overestimations. This could hamper potential mergers or sales, with a reported 95% of mergers and acquisitions professionals highlighting overvaluation as a critical factor in failed deals.

Julie Keyes, CEO of KeyeStrategies, emphasizes the importance of understanding your business’s genuine worth. By identifying any gap between the actual value and the perceived worth, businesses can tailor strategies to bridge this disparity.

3. Assessing the Needs of an Owner

After business valuation, it’s vital to align the findings with the owner’s personal and financial needs. This assessment involves introspection, as it’s about aligning the business’s trajectory with the owner’s life goals, both immediate and long-term.

This holistic approach ensures that business objectives are not just about the bottom line but are intricately tied to the owner’s personal aspirations and financial objectives. Such alignment propels the company towards strategies that not only boost business value but also enhance the owner’s life quality.

4. Crafting a Prioritized Action Plan

Having determined the business’s value and assessed the owner’s needs, the next logical step is formulating a plan. Julie Keyes accentuates the need for a robust strategic action plan. She elaborates on the pressing need for business owners to always focus on value augmentation, ensuring that they’re ready to seize opportunities as they emerge.

One of the systematic ways to create this plan is through benchmark assessments and SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis. These tools not only pinpoint the areas of improvement but also identify strengths that can be capitalized upon.

Justin Goodbread’s approach exemplifies this methodology. By starting the year identifying weaker business areas and potential opportunities, businesses can set clear objectives. Mapping out annual strategies, including prioritized action plans during team retreats, keeps the entire organization aligned and focused.

Conclusion

The Value Acceleration Methodology’s Discover Gate is not just a phase; it’s a mindset. It nudges business owners to shift from assumptions to data-driven decisions. By understanding the business’s current worth, aligning with personal and financial objectives, and then crafting a clear, actionable strategy, businesses can transition from merely operational entities to value-centric establishments.

In the grand scheme of exit planning, the Discover Gate sets the stage. It establishes the foundation upon which the rest of the exit planning strategy is built, ensuring the seamless integration of business goals with personal and financial objectives. As business owners navigate the complex journey of entrepreneurship, the Discover Gate serves as the compass, pointing them in the direction of tangible growth and sustained value.

January 31, 2025

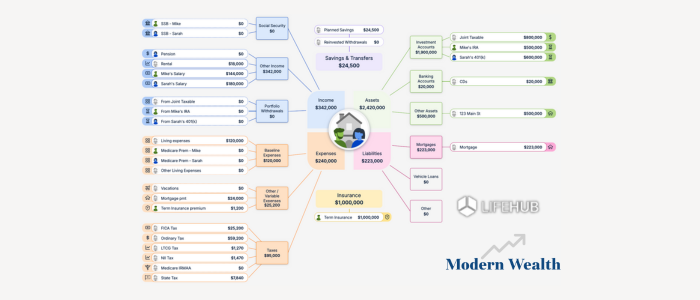

Life Hub at Modern Wealth

January 22, 2025

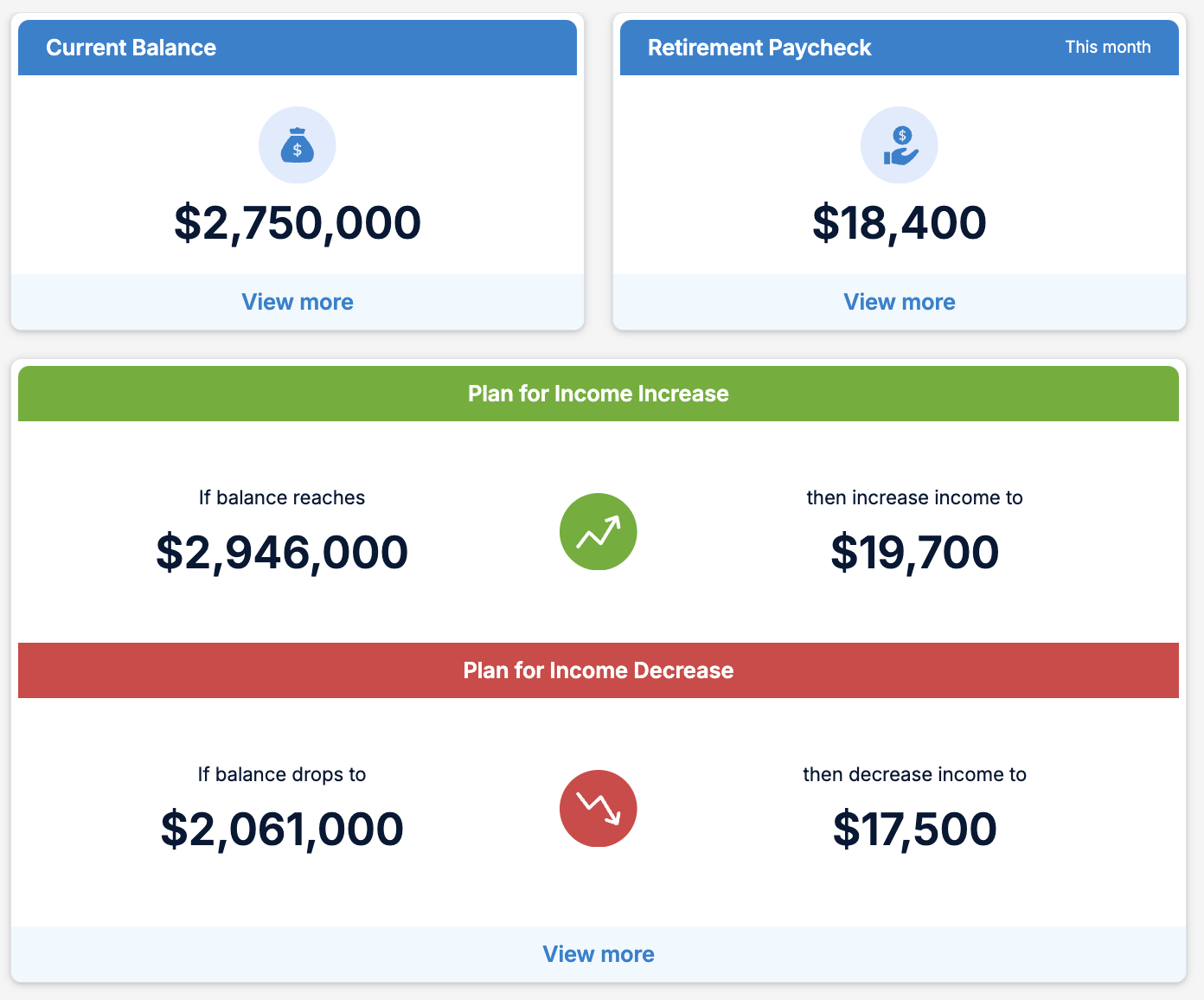

Modern Wealth’s Retirement Optimizer