Business Valuation and Inflation

Wednesday, May 1, 2024

In the current economic landscape, inflation is a hot topic, especially in the United States where the inflation rate has slightly decreased to 8.52% from 9.06% earlier this summer. Inflation refers to the rise in the prices of goods and services, leading to a decreased purchasing power of money. This rise affects not only daily living costs such as groceries, commuting, and rent, but also poses significant challenges for small business owners.

Small business owners, in particular, are feeling the pressure. A survey of over 1,500 small business owners revealed that 34% view inflation as their most pressing concern, surpassing issues like labor quality and taxes. This environment creates a complex scenario for businesses, with many seeking advice on how to navigate these turbulent times.

Historically, this is not the first instance of high inflation, but current circumstances are uniquely challenging due to factors like the war in Ukraine, the aftermath of the COVID-19 pandemic, and fluctuating policies in major manufacturing hubs like China. The Consumer Price Index (CPI) rose 1.3% in June alone, with an annual increase of 9.1%, marking the largest rise in four decades. Specific categories like fuel have seen prices soar by over 70%.

Inflation today is driven by both supply-side factors, like reduced oil supply leading to higher prices across the board, and demand-side factors, such as expansive fiscal policies by governments leading to increased money chasing fewer goods. This complex scenario is exacerbated when inflationary expectations become entrenched in a shrinking economy, leading to a vicious cycle of wage increases and rising prices.

Businesses are experiencing common pain points during this period. The cost of goods and labor are rising, consumer spending is shifting, and interest rates are increasing, affecting investment decisions. The ability of a business to pass these increased costs onto customers without losing market competitiveness is a crucial strategy for maintaining profitability.

Three major areas need focus: understanding the industry-specific impacts (using NAICS codes), assessing the ability to pass on cost increases, and the broader economic influences on business profitability over the coming years. Additionally, questions about the longevity of government support and its impact on market demand are critical.

The broader implications of inflation include increased costs of raw materials and production, impacting profit margins. Consumers, facing higher essential costs, may reduce discretionary spending, affecting businesses dependent on such expenditures. Key uncertainties that will shape future developments include the duration of supply chain disruptions, inflation expectations on wage negotiations, evolving consumer spending habits, and the impact of monetary policy and political changes.

For businesses, inflation often means reduced sales, lower profits, and increased costs. However, some sectors like luxury goods or large corporations with established pricing power might be less affected. For small businesses, the challenges are more acute as they need to adjust prices and potentially face customer loss if they cannot effectively manage these adjustments.

The shift from historical performance metrics to forecasted data is becoming crucial in business valuation. The pandemic introduced significant risks, which, combined with inflation, have led to higher interest rates and therefore higher discount rates, affecting business valuations negatively.

Companies must now focus on profit protection and potentially expanding their profits to maintain value. This involves creating detailed and accurate future cash flow projections that account for expected inflation and having proactive discussions with customers and suppliers about price adjustments.

Different businesses will experience the impacts of inflation based on whether they are considered essential or non-essential. Essential businesses might pass on cost increases more easily than non-essential businesses, which face reduced customer demand.

Inflation also introduces variability in the valuation of companies. Those with pricing power, where demand remains stable despite price increases, will manage better than those in competitive markets where price increases can lead to significant demand drops.

Moreover, various industries will experience the impacts of inflation differently. For instance, real estate and energy sectors might benefit in the short term, while transportation and construction might face greater challenges due to rising costs.

In conclusion, the current inflationary period is shaping up to be a formidable challenge for businesses, particularly small ones. The ability to adapt pricing strategies, enhance efficiency, and make informed decisions will be key to navigating this period. Businesses are advised to review their expense structures, consider new operational models like hybrid work, and embrace technologies such as automation to mitigate the impacts of inflation. Interested in the value of your business, feel free to start the business valuation process here.

January 31, 2025

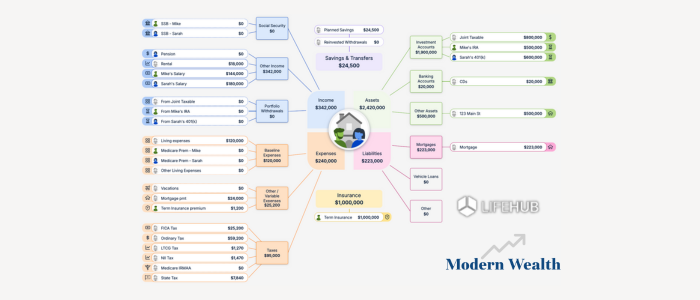

Life Hub at Modern Wealth

January 22, 2025

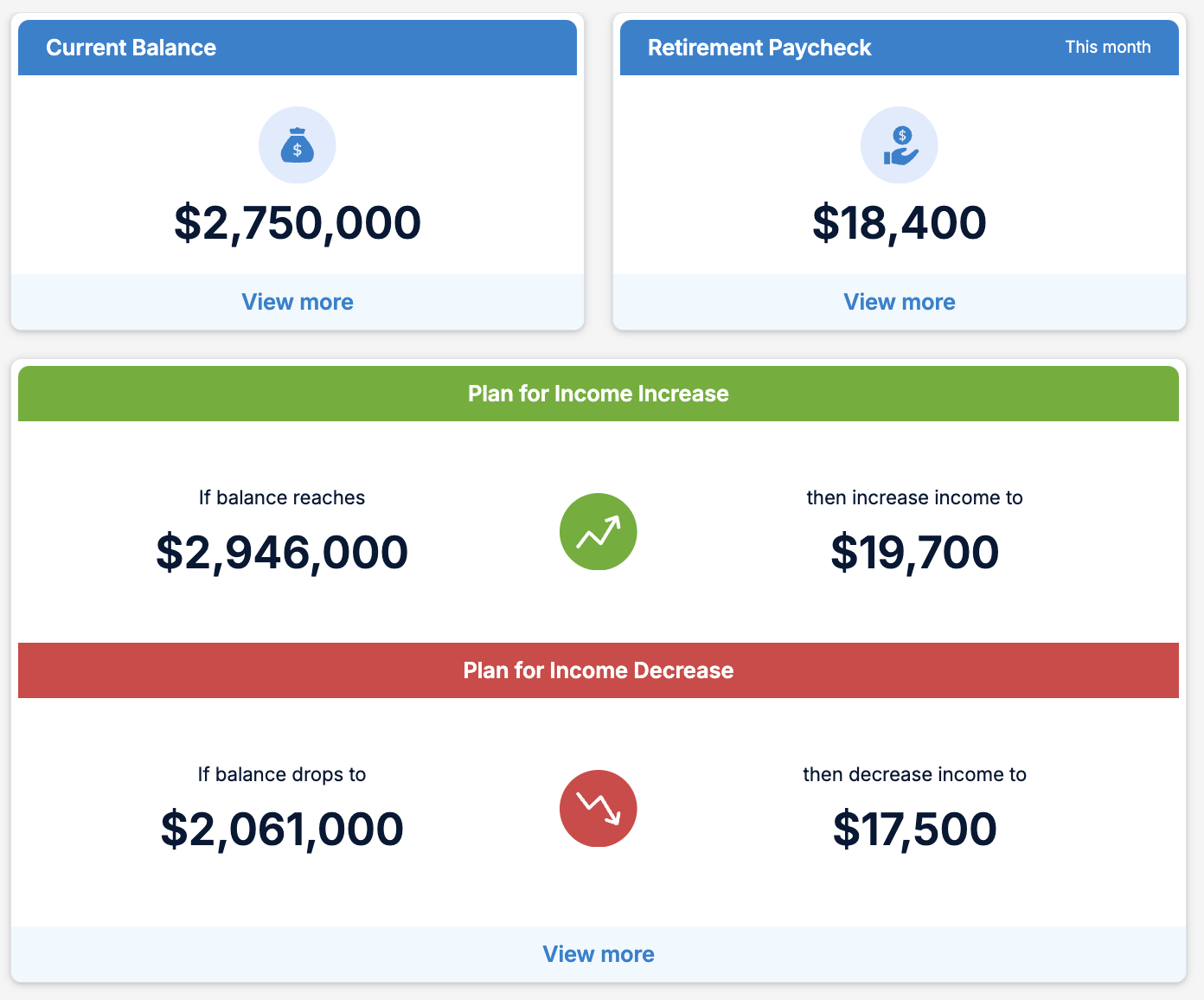

Modern Wealth’s Retirement Optimizer