What Should Business Owners Do In the Current Interest Rate Environment

Tuesday, July 30, 2024

Hello small business owners! Navigating the current economic landscape with rising interest rates can be a daunting task. But don’t worry; I’m here to help you understand what’s happening and what you can do to ensure your business not only survives but thrives. Let’s dive into practical strategies and tips to manage the challenges posed by high interest rates.

Understanding the Impact of High Interest Rates

High interest rates can affect your business in multiple ways. Let’s break down the main impacts:

1. Increased Borrowing Costs: When interest rates rise, the cost of borrowing goes up. This means higher interest payments on loans and credit lines, which can strain your cash flow and reduce your profit margins.

2. Reduced Consumer Spending: Higher interest rates often lead to reduced consumer spending as people face higher costs for mortgages, credit cards, and other loans. This can result in lower sales for your business, especially if you rely on consumer spending.

3. Higher Operating Expenses: Along with borrowing costs, other expenses such as leases, supplier credit, and variable-rate debts can also increase, impacting your overall operating budget.

4. Lower Business Valuations: If you’re planning to sell your business or attract investors, high interest rates can lower business valuations. This is because potential buyers or investors may find it more expensive to finance the purchase, reducing their willingness to pay a premium.

Short-Term Actions to Take

Given these impacts, it’s crucial to take immediate steps to mitigate the effects of high interest rates. Here are some practical actions:

1. Review and Reduce Debt: Start by reviewing your current debt situation. Focus on paying down high-interest debt as quickly as possible. If you have multiple loans, consider consolidating them into a single loan with a lower interest rate if possible.

2. Optimize Cash Flow: Cash flow management becomes even more critical in a high-interest-rate environment. Here are some tips to optimize your cash flow:

• Invoice Promptly: Ensure that you invoice your customers promptly and follow up on overdue payments.

• Negotiate Payment Terms: Negotiate longer payment terms with suppliers to keep cash in your business longer.

• Offer Discounts for Early Payment: Encourage customers to pay early by offering discounts.

3. Cut Unnecessary Costs: Evaluate your expenses and look for areas where you can cut costs without compromising the quality of your products or services. This could include renegotiating contracts with suppliers, reducing energy usage, or streamlining operations.

4. Diversify Revenue Streams: Relying on a single source of income can be risky. Look for ways to diversify your revenue streams. This could involve introducing new products or services, exploring new markets, or expanding your online presence.

5. Adjust Pricing Strategies: With increased costs, you might need to adjust your pricing strategy. Consider a modest price increase if the market allows, or introduce tiered pricing to offer premium options.

Long-Term Initiatives

While short-term actions are crucial, it’s also important to think about long-term strategies that will help your business thrive despite high interest rates.

1. Strengthen Financial Management: Strong financial management is key to navigating any economic environment. Here are some steps to take:

• Build a Cash Reserve: Aim to build a cash reserve that can cover at least three to six months of operating expenses. This will provide a buffer during tough times.

• Regular Financial Reviews: Conduct regular financial reviews to stay on top of your business’s financial health. Use these reviews to identify trends and make informed decisions.

2. Invest in Technology: Investing in technology can help you streamline operations, reduce costs, and improve efficiency. Look for software solutions that can automate repetitive tasks, improve inventory management, and enhance customer service.

3. Focus on Customer Retention: Acquiring new customers is often more expensive than retaining existing ones. Focus on building strong relationships with your current customers. Offer loyalty programs, personalized services, and excellent customer support to keep them coming back.

4. Develop a Strong Online Presence: In today’s digital age, having a strong online presence is essential. Invest in a professional website, engage with customers on social media, and consider online marketing strategies like SEO, PPC, and content marketing to attract and retain customers.

5. Explore Alternative Financing Options: If traditional loans are becoming too expensive, consider alternative financing options. These could include:

• Crowdfunding: Platforms like Kickstarter or Indiegogo allow you to raise small amounts of money from a large number of people.

• Angel Investors: Seek out angel investors who are willing to provide capital in exchange for equity.

• Venture Capital: If your business has high growth potential, venture capitalists may be interested in investing.

Preparing for the Future

While the current interest rate environment presents challenges, it’s also an opportunity to strengthen your business and prepare for the future. Here are some additional tips to keep in mind:

1. Stay Informed: Keep yourself informed about economic trends and interest rate forecasts. This will help you anticipate changes and adjust your strategies accordingly.

2. Seek Professional Advice: Consider seeking advice from financial advisors, accountants, or business consultants. They can provide valuable insights and help you develop strategies to navigate the current environment.

3. Network with Other Business Owners: Networking with other business owners can provide support and ideas. Join local business groups or online forums to share experiences and learn from others.

4. Focus on Innovation: Innovation is key to staying competitive. Encourage your team to come up with new ideas and be open to experimenting with new products, services, or business models.

What to Do When Interest Rates Lower

Now, let’s talk about the flip side: what to do when interest rates lower. A decrease in interest rates can present significant opportunities for small business owners. Here’s how you can take advantage of a low-interest-rate environment:

1. Refinance Existing Debt: Lower interest rates provide an excellent opportunity to refinance existing high-interest debt. This can reduce your monthly payments and improve your cash flow. Evaluate your current loans and speak to your lender about refinancing options.

2. Invest in Growth: With borrowing costs reduced, it becomes cheaper to finance expansion projects. Consider investing in growth initiatives such as opening new locations, upgrading equipment, or launching new products and services. Low-interest loans can make these investments more feasible.

3. Increase Marketing Efforts: Lower interest rates can stimulate consumer spending. Capitalize on this by increasing your marketing efforts to attract new customers. Invest in advertising, promotions, and customer acquisition strategies to boost sales.

4. Build Up Cash Reserves: Take advantage of lower interest rates to build up your cash reserves. Strong cash reserves can provide a buffer in case of future economic downturns. Consider setting aside a portion of your savings in a high-yield savings account or other low-risk investments.

5. Evaluate Lease Agreements: If your business operates from leased premises, lower interest rates may also affect rental costs. Negotiate better lease terms with your landlord, or consider relocating to a more favorable location with lower rent.

6. Strengthen Supplier Relationships: Lower interest rates can improve the overall business climate, making it an excellent time to strengthen relationships with suppliers. Negotiate better payment terms, bulk discounts, or long-term contracts to secure favorable conditions for your business.

7. Enhance Employee Benefits: With improved cash flow from lower borrowing costs, consider investing in your employees. Enhanced benefits, such as higher salaries, better health insurance, or professional development opportunities, can improve morale and reduce turnover.

8. Explore Mergers and Acquisitions: Lower interest rates can make mergers and acquisitions more attractive. If you’re looking to expand your business, consider acquiring a competitor or merging with another company. This can provide economies of scale and increase market share.

Conclusion

High interest rates present significant challenges for small business owners, but with the right strategies and a proactive approach, you can navigate these challenges successfully. By focusing on debt reduction, cash flow optimization, cost management, and long-term initiatives, you can build a resilient business that thrives in any economic environment.

When interest rates lower, seize the opportunity to refinance debt, invest in growth, and strengthen your financial position. Staying informed, seeking professional advice, and being open to innovation are key to overcoming the hurdles posed by varying interest rates. With careful planning and strategic actions, you can turn these challenges into opportunities for growth and success.

If you have any questions or need personalized advice, feel free to reach out. I’m here to help you navigate the financial landscape and achieve your business goals. Let’s work together to ensure your business not only survives but thrives in the current interest rate environment and beyond.

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

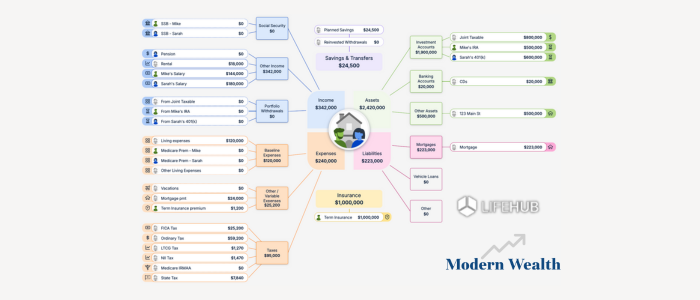

Life Hub at Modern Wealth