How to Retire as a Small Business Owner

Saturday, August 17, 2024

Retirement is a significant milestone for anyone, and as a small business owner, the journey towards retirement requires careful planning and consideration. This article will guide you through the various aspects of retiring as a small business owner, from understanding the importance of retirement planning to preparing your business for a smooth transition. Additionally, we will explore financial planning options, life after retirement, and the legal considerations you need to keep in mind. Let’s dive in!

Understanding Retirement as a Small Business Owner

The Importance of Retirement Planning

Retirement planning is crucial for small business owners as it allows for a smooth transition to the next phase of life. It involves assessing your financial situation, setting goals, and creating a roadmap for your retirement journey. By planning ahead, you can secure a comfortable future and ensure financial stability during your retirement years.

Moreover, retirement planning for small business owners goes beyond just financial considerations. It also involves thinking about how you will spend your time once you are no longer actively running your business. Many entrepreneurs find fulfillment in pursuing hobbies, volunteering, or even starting new ventures during retirement. Having a clear plan for both your finances and your post-retirement activities can lead to a more fulfilling and purposeful retirement.

Challenges Faced by Small Business Owners

Retiring as a small business owner comes with its unique set of challenges. Unlike employees who have retirement plans provided by their employers, small business owners need to take the initiative and create their own retirement plans. Additionally, the uncertainty of business income and the emotional attachment to the business can add complexity to the retirement process.

Furthermore, small business owners often struggle with determining the value of their business and how it fits into their retirement plans. Deciding whether to sell the business, pass it on to family members, or continue its operations under new management requires careful consideration and planning. Balancing personal financial goals with the legacy of the business adds another layer of complexity to the retirement decision-making process for small business owners.

Preparing Your Business for Your Retirement

Succession Planning Strategies

One of the key considerations when retiring as a small business owner is planning for the future of your business. This involves identifying and nurturing potential successors who can maintain the growth and success of your business. Succession planning strategies may include mentoring individuals within your organization, family succession, or even selling your business to a qualified buyer.

Succession planning is not just about finding someone to take over your role; it’s about ensuring a smooth transition of leadership and maintaining the legacy you’ve built. By investing time and resources into developing future leaders, you can secure the continuity and sustainability of your business for years to come.

Selling Your Business

Selling your business can be a viable option if you do not have a successor or wish to move on to new endeavors during retirement. Before selling, it is crucial to assess the value of your business and engage in thorough market research. Working with a business broker or consulting with legal and financial professionals can help ensure that the selling process is smooth and maximizes the return on your investment.

When selling your business, it’s essential to consider not only the financial aspects but also the emotional attachment you may have to your company. Transitioning out of a business you’ve built can be a significant life change, and it’s important to approach the process with a clear understanding of your goals and vision for the future. Seeking guidance from experienced professionals can provide valuable support and expertise as you navigate this important transition.

Financial Planning for Retirement

Retirement Savings Options for Small Business Owners

Small business owners have various retirement savings options available to them. These include individual retirement accounts (IRAs), simplified employee pension (SEP) plans, solo 401(k) plans, and SIMPLE IRA plans. It is essential to evaluate each option’s benefits, eligibility criteria, and contribution limits to select the most suitable retirement savings plan for your specific needs.

Individual Retirement Accounts (IRAs) offer tax advantages and flexibility for small business owners. Traditional IRAs allow for tax-deferred growth on investments, while Roth IRAs provide tax-free withdrawals in retirement. SEP plans are popular among self-employed individuals and small business owners due to their high contribution limits and straightforward setup process. Solo 401(k) plans are ideal for sole proprietors without employees, offering higher contribution limits than traditional IRAs. SIMPLE IRA plans are a cost-effective option for businesses with fewer than 100 employees, allowing both employers and employees to contribute to the retirement fund.

Tax Considerations for Retirement

Retirement brings about changes in your tax situation, and understanding tax considerations is crucial for maximizing your retirement savings. Consult with a tax advisor to assess the tax implications of different retirement plans and strategies. They can help you optimize your retirement savings while minimizing tax liabilities and ensuring compliance with tax laws.

When planning for retirement, it’s essential to consider the tax implications of your investment choices. Different retirement accounts have varying tax treatments, impacting your taxable income in retirement. Traditional IRAs and 401(k) plans offer tax-deferred growth, meaning you pay taxes on withdrawals during retirement. In contrast, Roth IRAs require after-tax contributions but offer tax-free withdrawals in retirement. By strategically diversifying your retirement savings across different account types, you can create a tax-efficient withdrawal strategy to minimize your tax burden in retirement.

Life After Retirement for Small Business Owners

Transitioning from Business Owner to Retiree

Transitioning from managing a business to retirement can be an emotional process. Take the time to plan and prepare for the emotional adjustment that comes with leaving your business behind. Find new hobbies, explore personal interests, and embrace new opportunities that retirement offers. This transition can be fulfilling and provide a well-deserved break after years of hard work.

Retirement opens up a world of possibilities beyond the confines of the business world. It’s a chance to rediscover passions that may have been set aside during the busy years of entrepreneurship. Whether it’s traveling to new destinations, delving into creative pursuits, or simply enjoying leisurely mornings with a cup of coffee, retirement allows for the freedom to explore all that life has to offer.

Maintaining Connections with Your Business Post-Retirement

Even after retiring, you might still feel a sense of attachment to your business. Consider staying connected by mentoring or advising the new owner or participating in industry-related conferences and events. This way, you can maintain a sense of fulfillment and contribute your expertise while enjoying the benefits of retirement.

Furthermore, staying connected with your business post-retirement can also provide a sense of continuity and legacy. By sharing your experiences and knowledge with the new generation of entrepreneurs, you are not only passing on valuable insights but also leaving a lasting impact on the industry. Embracing this role can be a fulfilling way to stay engaged and involved in the business community while enjoying the relaxation that retirement brings.

Legal Considerations for Retiring Business Owners

Estate Planning for Business Owners

Estate planning is a critical aspect of retiring as a small business owner. It involves creating a comprehensive plan for the distribution of your assets and ensuring your business’s smooth transition in case of unforeseen events. Work with an experienced attorney to establish wills, trusts, and other legal documents that protect your assets and provide a clear roadmap for the future.

One important aspect of estate planning for business owners is considering the tax implications of transferring assets to your beneficiaries. Proper estate planning can help minimize estate taxes and ensure that your loved ones receive the maximum benefit from your hard-earned assets. Additionally, establishing a power of attorney and healthcare directives can provide peace of mind knowing that your affairs will be managed according to your wishes in case of incapacitation.

Legal Aspects of Business Succession or Sale

When planning to pass on your business or sell it, there are various legal aspects you must consider. Contracts, non-disclosure agreements, and other legal documents play a vital role in safeguarding your business interests throughout the transition process. Seek counsel from legal professionals to ensure compliance with legal requirements and protect your rights in the sale or succession of your business.

Moreover, it is crucial to conduct a thorough valuation of your business before succession or sale. Understanding the true value of your business can help you negotiate better deals and make informed decisions about its future. Engage with financial advisors and business valuation experts to assess the worth of your business accurately and maximize its potential during the transition process.

Retiring as a small business owner requires thoughtful consideration and planning. By understanding the importance of retirement planning, preparing your business for the future, engaging in financial planning, envisioning life after retirement, and attending to the legal aspects, you can navigate this significant transition successfully. Start early, seek professional guidance, and embrace the possibilities that retirement holds. Your hard work as a small business owner deserves a fulfilling and rewarding retirement!

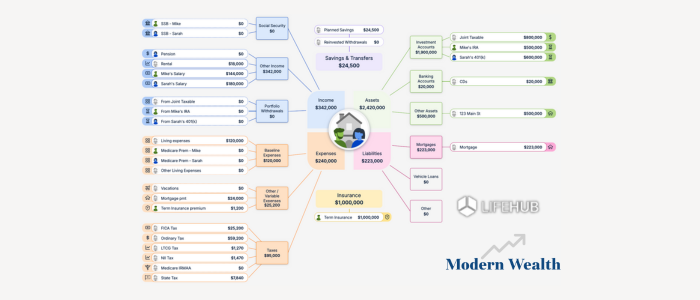

As you contemplate a well-deserved retirement and the future of your small business, remember that the journey is smoother with a trusted advisor by your side. Modern Wealth is here to guide you with Fee-Only Financial Planning and Business Advisory tailored specifically for entrepreneurs and small business owners. Our independent, transparent approach ensures that your interests always come first, free from the conflicts of commission-based models. Embrace a partnership that’s committed to your success with advisors who are ready to take a fiduciary oath for you. Schedule an Exploration Call with Modern Wealth today, and let’s build a retirement plan that celebrates your hard work and secures your legacy.

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

Life Hub at Modern Wealth