The Federal Reserve’s Bold Move: The Impact of a Half-Point Rate Cut

Thursday, September 19, 2024

In a significant turn of events, the Federal Reserve recently cut interest rates by half a percentage point, marking the first reduction since 2020. This move, which sets the benchmark federal funds rate at a range between 4.75% and 5%, has sparked discussions about its implications for various sectors of the economy. From small businesses to housing and inflation to retirement savings, this decision by the Fed is poised to have wide-reaching effects.

Why Did the Fed Cut Rates?

The Federal Reserve’s decision to cut rates is part of a strategy to maintain economic stability, particularly in the labor market. Fed Chair Jerome Powell stated, “This decision reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 percent.”

The economy has shown signs of cooling down in recent months, especially in the labor market. The unemployment rate has risen slightly, and job growth has slowed. While this could be seen as a cause for concern, Powell and the Fed view this as a natural progression toward a more balanced economy. With inflation easing significantly from its peak of 7% to an estimated 2.2%, the Fed aims to avoid tipping the economy into a recession while ensuring price stability.

The Global Context

It’s important to note that the Federal Reserve isn’t acting in isolation. Central banks worldwide have been adjusting their monetary policies in response to changing economic conditions. For example, the Bank of England (BOE) recently kept its interest rate unchanged, signaling a more cautious approach compared to the Fed’s bold rate cut. The BOE is particularly concerned about the rapid pace of rising service prices and wages, even though it expects inflation to drop to its 2% target by next year.

Similarly, Taiwan’s central bank has opted to hold interest rates steady, citing a gradual downward trend in domestic inflation and concerns about the global economic situation. These varying approaches highlight the global challenges economies face and the delicate balance central banks must strike in managing growth and inflation.

How Does the Rate Cut Affect Small Businesses?

The Fed’s rate cut can be both a blessing and a challenge for small businesses. On the one hand, lower interest rates can reduce the cost of borrowing, making it easier for small businesses to finance expansions, invest in new equipment, or manage cash flow. This can be particularly helpful for companies with variable-rate debt or those looking to refinance existing loans. Reducing borrowing costs can free up resources for growth and innovation, potentially leading to job creation and economic expansion.

On the other hand, if the rate cut signals a slowing economy, small businesses may face reduced consumer demand. In periods of economic uncertainty, consumers often cut back on spending, impacting small businesses’ sales and profitability. Additionally, if inflation remains stubborn, even with lower rates, small businesses might struggle with rising costs for goods and services, which can squeeze profit margins.

Impact on Retirement and Savings

The Fed’s decision also has implications for savers and retirees. Interest rate cuts tend to lower the returns on savings accounts, certificates of deposit (CDs), and other fixed-income investments. For retirees who rely on interest income from these sources, a prolonged period of low rates can be challenging. It may force them to seek higher yields in riskier assets, potentially exposing them to greater market volatility.

However, for those with fixed-rate mortgages or other loans, the Fed’s move could result in lower interest payments, freeing up more disposable income. This extra cash flow can benefit consumers and the economy, potentially offsetting some of the negative impacts of lower savings rates.

Housing Market Implications

The housing market is another area where the Fed’s rate cut will have an impact. Lower interest rates generally make mortgages more affordable, potentially boosting home demand. However, the relationship between interest rates and housing prices is complex. While cheaper borrowing costs can encourage home buying, the current housing market faces other challenges, such as limited supply and high prices.

As Powell mentioned, “The housing market is partly frozen because of lock-in with low rates. People don’t want to sell their homes because they have a very low mortgage; refinance would be quite expensive.” Even with lower rates, the lack of available homes and high prices may continue to hinder new buyers.

Additionally, while the Fed’s rate cut could relieve prospective homebuyers, it might also lead to increased demand, potentially driving up prices further in some markets. This dynamic could make affordability a persistent issue, particularly in areas where housing supply is already constrained.

Inflation and the Broader Economy

One primary reason for the Fed’s rate cut is to ensure that inflation remains in check while supporting maximum employment. The Fed aims to encourage borrowing and spending by lowering rates, which can help stimulate economic growth. However, this strategy comes with the risk of reigniting inflation if not carefully managed.

The challenge lies in finding the right balance. If the Fed moves too slowly in reducing rates, it could unduly weaken economic activity and employment. Conversely, if it cuts rates too quickly or by too much, it could reignite inflationary pressures. Powell acknowledged this delicate balance, stating, “Reducing policy restraint too quickly could hinder progress on inflation. At the same time, reducing restraint too slowly could unduly weaken economic activity and employment.”

The Path Forward

The Federal Reserve’s recent rate cut marks a significant shift in its approach to managing the economy. While the move has been well-received, it also underscores the uncertainties ahead. The Fed’s decision to cut rates by half a percentage point was seen as an aggressive step to provide a buffer against potential weaknesses in the labor market and broader economy.

For individuals and businesses alike, this period of economic adjustment will require careful navigation. The impacts of the Fed’s actions will vary across sectors, influencing borrowing costs, savings, and investment decisions. As the economy evolves, staying informed and understanding how these changes affect different aspects of the financial landscape will be crucial.

Ultimately, the Fed’s goal remains clear: maintaining a strong economy with maximum employment and stable prices. How this journey unfolds will depend on a complex interplay of factors, from consumer behavior and business investment to global economic trends and fiscal policies. As always, policymakers, economists, and the public will watch the path forward closely.

If you think we may be a great partner for you, your family, or your business, please schedule an Exploration Call here!

January 31, 2025

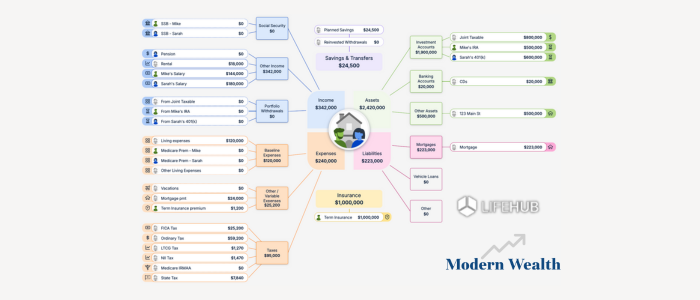

Life Hub at Modern Wealth

January 22, 2025

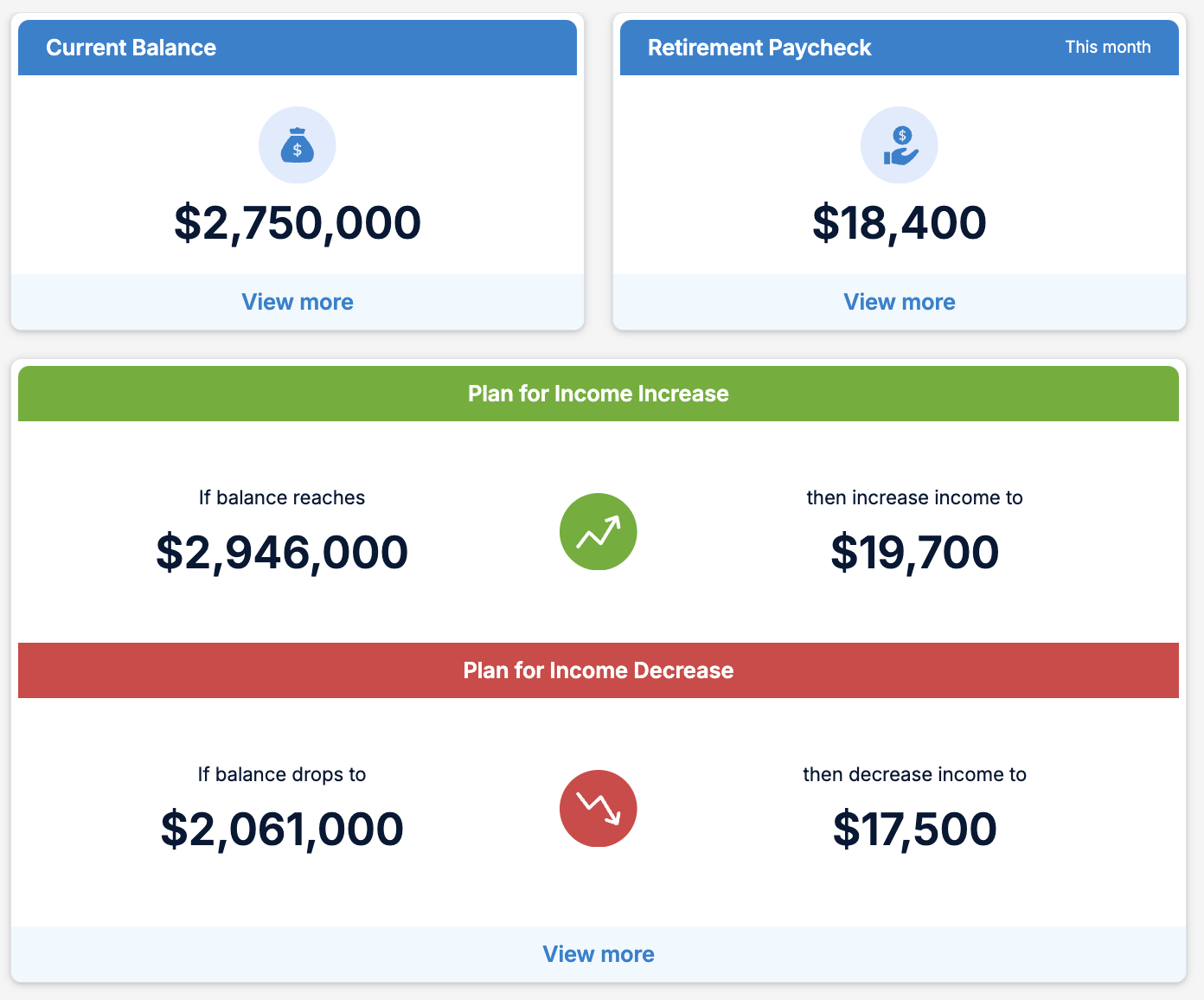

Modern Wealth’s Retirement Optimizer