Market Minutes for the Week of 10/14/24

Monday, October 14, 2024

Hey everyone! Let’s dive into last week’s market moves and break down some key insights from the latest inflation data. Here’s what happened with the major indexes:

S&P 500: Up by 1.11%

Nasdaq 100: Increased by 1.18%

Dow Jones Industrial Average: Rose by 1.21%

The markets had a positive week, but inflation data added a bit of intrigue!

Inflation: A Mixed Bag

Last week, we saw consumer inflation tick up slightly with a monthly increase of 0.2%, which was a little higher than estimates. This brought the annual inflation rate to 2.5% — the lowest since February 2021 but just above expectations of 2.4%.

When we zoom in on core CPI (which excludes food and energy), we saw a 0.3% increase for the month, pushing the annual rate to 3.3%. The usual suspects — shelter and food prices — were the biggest drivers of this rise, making up more than three-quarters of the overall increase.

“Janky” Data? Let’s Discuss

Ever heard the term “janky” used in a financial context? Atlanta Fed President Raphael Bostic dropped this colorful term when discussing the recent inflation and jobs data. He pointed out that sometimes data can appear “janky” or choppy, suggesting we should see if these individual data points form a trend before acting.

Investors took this “janky” data to heart, increasing their bets on future rate cuts. Even though we saw a slight inflation rise, the overall sentiment seems to lean towards the Fed continuing its planned rate cuts. We’re in a wait-and-see mode, especially with the November meeting just around the corner.

Market Reaction to CPI and PPI Data

After the CPI release, U.S. stock futures dipped but later recovered, with the S&P 500 managing to regain its footing. It seemed that investors took the report in stride, digesting the potential impact on future Fed decisions.

The day after the CPI data, the Producer Price Index (PPI) showed no change, countering inflation concerns and helping the markets rally to close out the week on a high note. The latest PPI data supports a trend of easing inflation, with the annual rate at 1.8%.

What’s Ahead?

As October rolls on, we’re seeing the markets navigate the latest data. With CPI and PPI behind us, this week’s spotlight turns to retail sales data, giving us a snapshot of consumer activity. It’s a relatively quiet week on the economic data front, but that means investors will be reflecting on the recent numbers.

So there you have it! A quick rundown of the week’s market action and the inflation data that has everyone talking. Let’s see what the rest of October has in store for us. Stay tuned and stay informed! If you feel like your financial plan or portfolio could use a real fiduciary by it’s side, please schedule an Intro Call here!

January 31, 2025

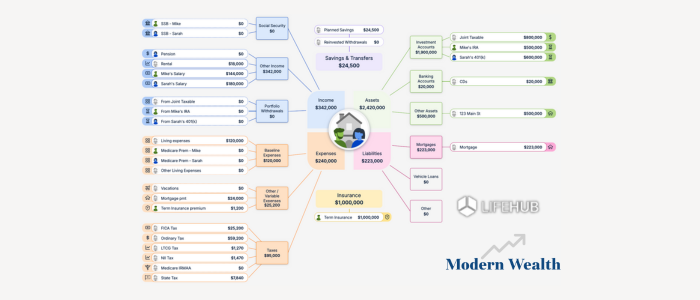

Life Hub at Modern Wealth

January 22, 2025

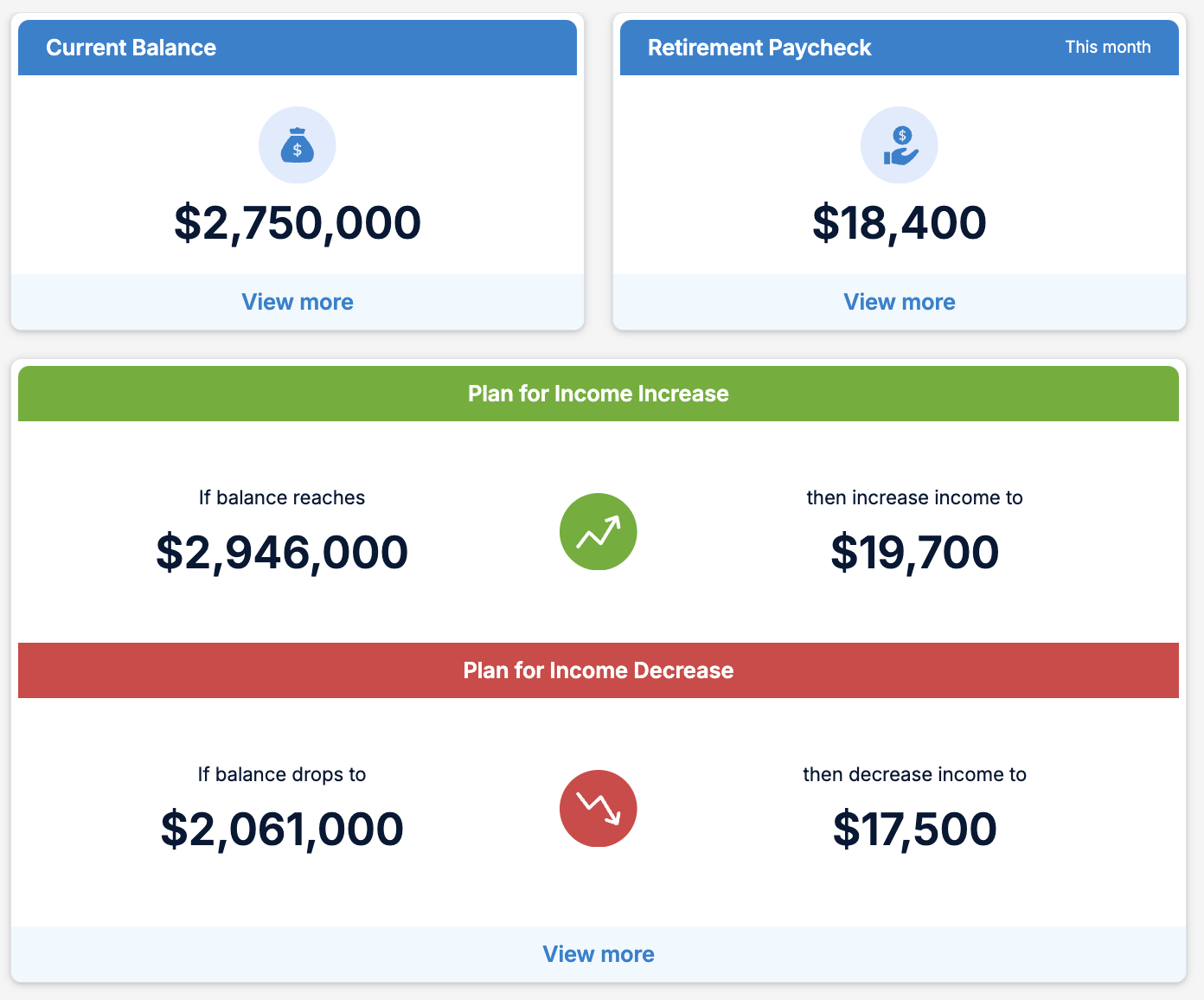

Modern Wealth’s Retirement Optimizer