Market Minutes for the Week of 10/21/24

Tuesday, October 22, 2024

This past week, markets continued to digest the slight rise in the Consumer Price Index (CPI) and payrolls data, remaining optimistic that the Federal Reserve may have hit the sweet spot with its recent 50-basis-point rate cut. There’s growing confidence that another rate cut could be in store at the November 7th meeting.

Major Market Movements

Reviewing the performance of the major U.S. equity indices last week, we saw positive momentum across the board:

The S&P 500 rose by 0.85%

The Nasdaq 100 gained 0.26%

The Dow Jones Industrial Average led the way with a 0.96% increase

Steady as It Goes

Despite the typical volatility of October in a presidential election year, U.S. markets have demonstrated remarkable resilience. It’s a reminder of the power of long-term investing. Staying the course, even during periods of market turbulence, often rewards investors who remain patient.

The benefits of sticking to a long-term plan are clear for those who have weathered inflation and high prices. Cheers to long-term investing!

Six Weeks of Gains

The S&P 500, Dow, and Nasdaq closed in positive territory for the sixth consecutive week. It’s the longest winning streak of 2024 for both the Dow and S&P 500, primarily driven by solid earnings reports.

Netflix was a standout performer last week. It surged by about 11% on Friday after reporting better-than-expected earnings for Q3.

Gold Shines Bright

Gold has continued its impressive rally this year, hitting all-time highs. Spot gold closed last week at nearly $2,721 per troy ounce, while silver also saw gains, finishing at $33.71 per ounce.

Interestingly, this surge in gold prices has occurred alongside a rising U.S. dollar, breaking the traditional inverse correlation between the two. Some market veterans are speculating on the potential for a return to a gold-backed currency system, but for now, gold’s upward trend is unmistakable.

Strong Retail Sales and Falling Jobless Claims

Regarding economic data, retail sales in September surpassed expectations with a 0.4% gain, highlighting the strength of the American consumer. Consumer spending remains robust despite rising credit card balances and higher interest rates.

Weekly jobless claims also dropped, indicating continued strength in the labor market. These figures reassure investors, with the consumer representing two-thirds of U.S. economic activity.

Looking Ahead: Earnings and Economic Data

This week, all eyes will be on earnings reports from major companies like Boeing, IBM, and Tesla. While it’s a relatively quiet week for economic releases, traders will pay close attention to unemployment claims and flash manufacturing and services data.

With the November 7th Fed meeting fast approaching, the markets are closely watching for any further clues on the likelihood of another rate cut.

A Note on Long-Term Investing

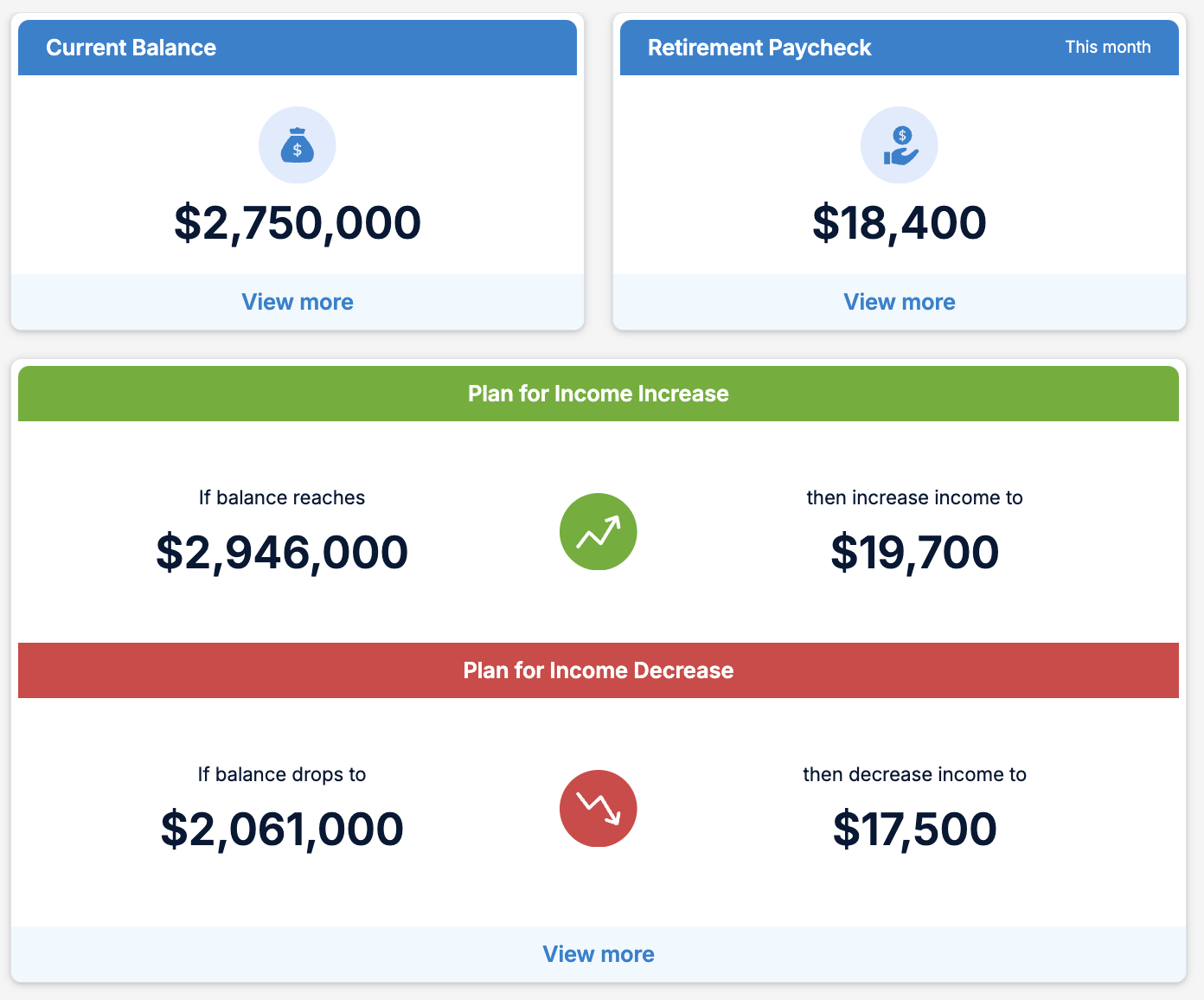

As the markets continue to march higher, it’s a good time to reflect on the importance of time in the market over attempting to time the market. Volatility is inevitable, but staying invested through the ups and downs has historically been the best strategy for long-term growth.

While inflation data showed a slight increase, the markets have taken it in stride, buoyed by the recent rate cut. Our advice remains: stick to your long-term plan and let time do the heavy lifting.

At Modern Wealth, we’re here to help you navigate the financial markets and keep you informed every step of the way. Stay tuned for more updates in next week’s Market Minutes! If your financial plan or portfolio could use a real fiduciary by its side, please schedule an Intro Call here!

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

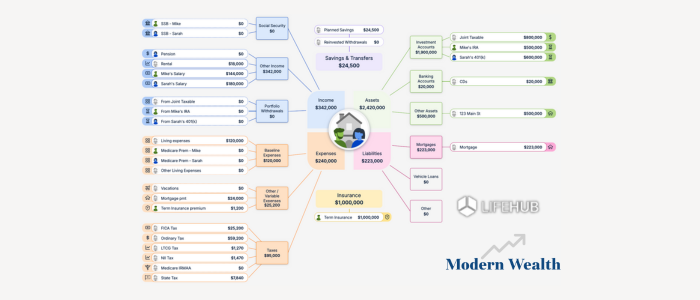

Life Hub at Modern Wealth