Market Minutes for the Week of 10/28/24

Thursday, October 31, 2024

Last week, we saw a relatively calm U.S. stock market with some divergence in performance across different sectors. While the industrial sector struggled, the Nasdaq composite hit an all-time high.

Looking at the numbers, the S&P 500 was down 0.96%, the Nasdaq 100 managed a slight gain of 0.14%, and the Dow Jones Industrial Average fell by 2.68% as we saw a shift in focus among investors.

Q3 Earnings Season – A Tale of Two Perspectives

As we move further into the Q3 earnings season, there’s a bit of a disconnect between analysts and company executives when it comes to expectations. Analysts are predicting a 4.2% rise in earnings for the S&P 500 companies, down from their earlier forecast of 7%. However, the companies themselves are more optimistic, forecasting a 16% earnings increase.

By last Friday, 37% of S&P 500 companies had reported their Q3 results, and the good news is that 75% have delivered positive earnings surprises. Additionally, 59% reported better-than-expected revenues, giving us some mixed but mostly encouraging signals.

Big Week Ahead for the ‘Magnificent Seven’

This week, all eyes will be on five of the “Magnificent Seven” tech giants — Alphabet, Meta, Microsoft, Amazon, and Apple. They’re all set to release their earnings, and their results could play a significant role in how the markets move. Tesla, which reported last week, exceeded expectations, and NVIDIA will report later in November.

Since these companies hold a substantial share of the S&P 500’s market cap, their performance will be crucial for the stock market.

Treasury Yields on the Rise

While stocks were mixed, Treasury yields continued their upward trend. The 10-year Treasury yield ended last week at 4.233%, marking its fifth rise in six weeks. This makes borrowing, such as mortgages, a bit more expensive, and raises questions about where interest rates and inflation are headed.

The shorter-term 2-year Treasury yield also ticked up slightly to 4.131%, and the yield curve (which compares the difference between short- and long-term interest rates) continued to normalize last week.

Mixed Employment Data

In employment news, initial jobless claims came in lower than expected, with 227,000 new claims, better than the anticipated 241,000. However, continuing claims are at their highest levels since 2021, showing some ongoing challenges.

On a positive note, both manufacturing and services data for October came in strong, pointing to a mostly healthy economic backdrop as we head into the fourth quarter.

What’s Coming Up This Week?

This week could be a real treat for market watchers! We’ll get earnings from some of the largest tech companies, wrap up what’s historically the most volatile month for stocks, and see key data releases, including the Fed’s preferred inflation measure on Thursday and the jobs report on Friday.

Globally, the UK will unveil its budget, and elections were held in Japan over the weekend. Plenty to keep an eye on!

Hope this helps keep you up to speed on what’s happening in the markets! Feel free to reach out with any questions or if you’d like to discuss how this might impact your portfolio.

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

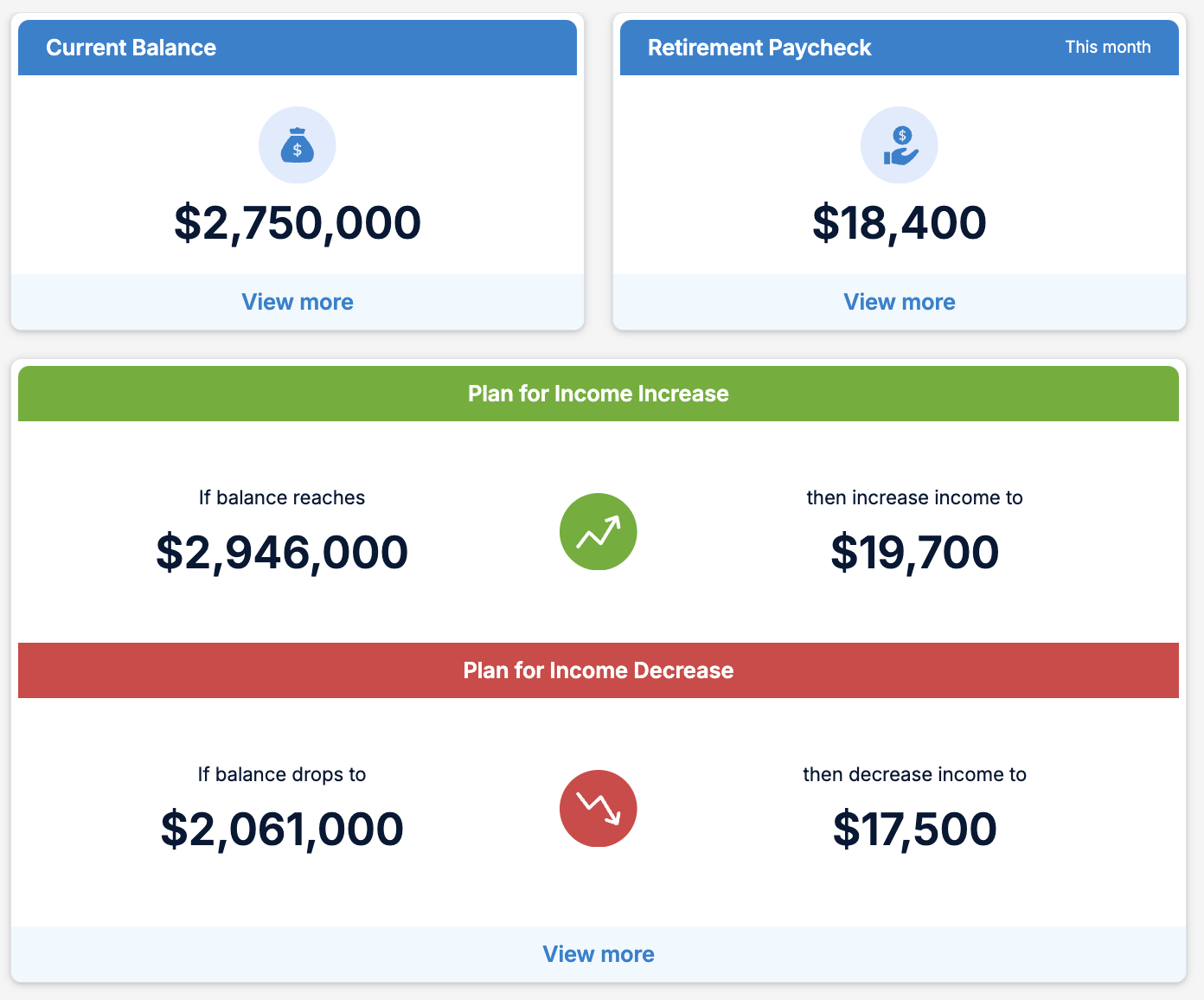

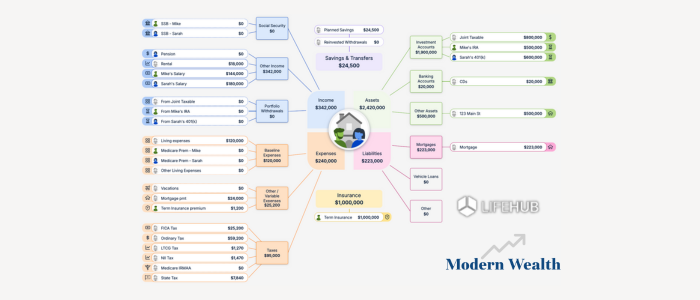

Life Hub at Modern Wealth