Market Minutes for October 2024

Monday, November 4, 2024

Hello, everyone, and welcome to our weekly edition of Market Minutes. Here, we digest the latest market happenings, keeping you informed with clarity and confidence. October brought us no shortage of news, and as we step into November, the landscape remains vibrant with evolving data, earnings, and market behavior. Let’s dive in.

A Look Back at October

October, traditionally known for volatility, didn’t disappoint this year. As the month closed, the S&P 500 declined by 0.99%, the Nasdaq 100 dropped 0.85%, and the Dow Jones Industrial Average slid 1.34%. However, while October proved to be a challenging month for equities, the first day of November showed a different tone, even amidst weak payroll data.

Earnings Season Unfolds

This earnings season has been anything but straightforward. As of November 1st, 70% of S&P 500 companies had reported results, and 75% of those reported actual earnings per share (EPS) above estimates. However, the average beat of 4.6% falls short of the five-year average of 8.5% and the 10-year average of 6.8%, per FactSet.

Results among the high-profile “Magnificent 7” tech companies have been mixed. While shares of Meta and Microsoft saw declines due to cautious future guidance despite surpassing earnings estimates, Amazon brought a touch of optimism, rallying after its positive results.

Inflation Data: A Mixed Bag

October’s inflation data brought both relief and concern:

Consumer Price Index (CPI): September data released in October showed a slight uptick in consumer inflation. The monthly increase was 0.2%, higher than the 0.1% estimate. Year-over-year, CPI stood at 2.5%, the lowest since February 2021, but just above the Dow Jones consensus of 2.4%.

Core CPI: Excluding food and energy, Core CPI rose 0.3%, higher than the expected 0.2%, pushing the annual rate to 3.3%.

Shelter and food prices continued to be the primary drivers of inflation, accounting for the bulk of the increase in consumer prices.

Producer Price Index (PPI): The September PPI showed no change, defying the forecast 0.1% rise. The markets reacted positively on the day of this data release.

Core Personal Consumption Expenditures (Core PCE): October concluded with mixed results. Annual core inflation remained at 2.7%, against forecasts of a slight dip to 2.6%. Monthly PCE aligned with estimates at a 0.2% increase, with the annual headline rate at 2.1%, the lowest since February 2021.

Labor Market Dynamics

Labor data has been pivotal, influencing market sentiment and the Federal Reserve’s policy stance. September’s robust figures (254,000 jobs added versus the 150,000 estimate) painted a picture of a still-heated economy with a slight dip in unemployment to 4.1%.

However, the November 1st release flipped the script: October saw just 12,000 new jobs, and combined revisions for August and September cut an additional 112,000 jobs. While this sharp slowdown raises concerns about labor market health, it might be welcomed by rate-cut advocates as evidence of cooling economic conditions. Notably, the decline was partly attributed to the impacts of Hurricanes Helene and Milton.

Despite this weak data, major stock indexes remained steady, with the Nasdaq, Dow, and S&P 500 all posting positive performances on the day.

Looking Ahead: Bullish Seasonal Strength?

Historically, November and December are known for strong equity performances. Per CFRA Research, the S&P 500 has seen gains in 66% of November and 77% of December since 1945. This seasonality could provide a backdrop of cautious optimism as we move deeper into the fourth quarter.

An Important Reminder

As we enter a week with both an election and a Federal Reserve meeting, it’s essential to approach investment decisions with a clear head. Markets may react swiftly, but timing them perfectly is near impossible. Take lessons from 2020 as an example of the unpredictable nature of markets during major events.

Our stance remains firm: Stay focused on the long-term plan, avoid emotional decision-making, and remember that both market corrections and rallies are part of the investment journey. Stick to your strategy and remember the timeless advice—it’s not about timing the market but time in the market that counts.

Thank you for reading this week’s Market Minutes. Stay tuned, stay informed, and as always, we’re here to guide you through every twist and turn in the market. Feel free to ask any questions or discuss how these developments may impact your investment strategy. You make book an Exploration Call here!

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

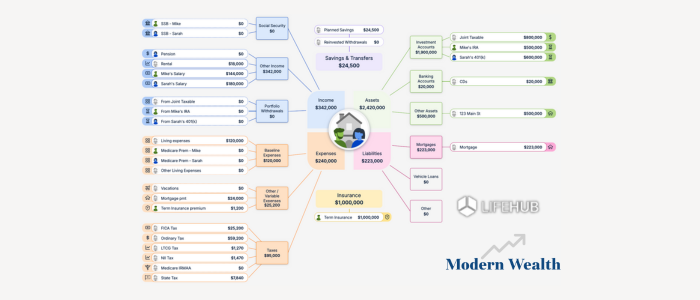

Life Hub at Modern Wealth