Market Minutes for the Week of 11/11/24

Wednesday, November 13, 2024

Last week delivered an exciting rally across major stock indexes, driven by the election results and a much-anticipated Federal Reserve rate cut. This blog will summarize critical developments that led to impressive gains in the S&P 500, Nasdaq, and Dow and provide insight on what these shifts mean for long-term investors like us. Let’s dive in.

Election Boost Fuels Stock Market Rally: S&P 500 Crosses 6,000

The week kicked off with a bang following the recent election results. Investors reacted with optimism, pushing the S&P 500, the largest benchmark of the U.S. economy, above the symbolic 6,000-point mark, though it settled slightly below this level at the week’s close. The large-cap S&P 500 gained 4.66%, the tech-heavy Nasdaq 100 rose by 5.41%, and the Dow Jones Industrial Average increased by 4.61%—marking all-time highs for the week.

For long-term investors, a rally of this nature is highly constructive. Fresh highs for these indexes suggest investor confidence is strong and that, for the time being, the focus remains on growth and stability within the U.S. economy. Such performance aligns with the historical trend of post-election market rallies, particularly when election results are viewed favorably by the market.

Federal Reserve Rate Cut Provides Further Economic Support

As expected, the Federal Reserve announced a 25-basis-point rate cut at its November meeting. This was widely anticipated by the market and marks a continued effort by the Fed to support economic growth by maintaining favorable lending conditions. With this recent rate adjustment, the Fed’s target lending range is now 4.50% – 4.75%, following an earlier 50-basis-point cut in September.

The Fed’s decision to lower rates was a strategic move to keep the economy buoyant, particularly as inflation concerns persist. Lower rates generally support borrowing and spending, which can boost business growth and, by extension, job opportunities. As a result, markets reacted calmly, with stocks holding steady as bond yields softened following an initial rise earlier in the week. For long-term investors, the Fed’s steady hand provides confidence that economic conditions remain conducive to growth, even as inflation challenges persist.

Insights from Powell’s Press Conference: A Look at Fiscal Policy and Debt

Federal Reserve Chair Jerome Powell’s press conference, which followed the rate decision, brought valuable insights into the Fed’s stance on fiscal policy and national debt. Powell underscored the current fiscal path as unsustainable, with national debt levels rising relative to the size of the economy. His call for attention to this issue reflects a broader economic challenge: managing debt in a way that doesn’t jeopardize future growth.

Powell’s comments serve as a reminder that while we enjoy current market gains, structural issues like national debt remain significant. For investors, this highlights the importance of having a well-diversified portfolio that can withstand shifts due to fiscal policy changes or economic slowdowns. The Fed’s approach and the economic stimulus provided by low interest rates are currently beneficial, but awareness of these underlying challenges is essential for making informed investment decisions.

Volatility Dips as Election Uncertainty Resolves

The $VIX, known as the “Fear Index” and a popular measure of market volatility, saw a dramatic decline last week, closing below $15.00, which is near its lowest levels for the summer. A dip of this magnitude in the $VIX generally indicates that investor anxiety is easing. Following the election and Fed rate cut, markets appear more confident, with uncertainty significantly reduced.

While volatility is currently low, it’s worth noting that markets can quickly shift in response to major economic data releases. In the short term, decreased volatility is a positive signal, giving investors a more stable landscape to navigate. For those of us focusing on the long term, it’s also a reminder to stay consistent with our strategies, even if volatility returns due to future uncertainties or inflation concerns.

Bitcoin Breaks Out, Hits New All-Time Highs

Bitcoin enthusiasts saw substantial gains as the cryptocurrency surged over 12% last week, reaching above $77,000 per Bitcoin on the Coinbase exchange. Bitcoin’s limited supply and deregulation hopes have been primary factors behind its bullish trend, and last week’s rally underscores the renewed interest among both institutional and retail investors.

Bitcoin’s impressive breakout reflects the evolving financial landscape and the increasing interest in decentralized assets. For investors with a higher risk tolerance, Bitcoin can represent a way to diversify their portfolios with assets that move independently of traditional markets. However, for most long-term investors, it remains prudent to keep crypto exposure to a manageable portion of one’s portfolio, balancing potential growth with volatility risks.

Consumer Sentiment Reflects Resilience and Optimism

With all the focus on markets and policy last week, consumer sentiment quietly posted a positive reading, showing resilience among consumers. The University of Michigan’s November consumer sentiment index rose to 73.0, outperforming expectations of 71.0. Consumer confidence is a vital economic indicator as it signals the likelihood of robust consumer spending, a key driver of economic growth.

Improved sentiment reflects that despite inflation and potential rate hikes, consumers remain relatively optimistic. Strong consumer confidence is often a good indicator for sectors like retail, travel, and housing. For investors, this data supports the case for a diversified portfolio that includes consumer-driven sectors, which can benefit when sentiment is strong.

Inflation Watch: CPI Data to Set the Tone for Coming Weeks

Looking ahead, this week brings the release of the Consumer Price Index (CPI) data, which will provide further insight into inflationary trends. After last week’s rate cut and the upward pressure on bond yields, the CPI will be closely watched by markets as they look for signs of whether inflation is stabilizing. Any significant movement in the CPI could impact both market sentiment and the Fed’s future rate decisions.

The inflation trend remains a focal point for both policymakers and investors. If inflation shows signs of cooling, it could ease pressure on the Fed to continue aggressive rate hikes, providing a more favorable backdrop for equities. However, if inflation persists, we may see more volatility as markets adjust to a potential continuation of tighter monetary policy.

A Strong Start to November for Long-Term Investors

Overall, the start of November is setting a positive tone for investors, with last week’s market performance serving as a reminder of the potential for growth, even amid challenging economic conditions. Historically, November tends to be a constructive month for markets, and this year appears to be following suit. With election uncertainty largely behind us, investor attention will likely shift back to inflation data and how the Fed navigates economic growth alongside price stability.

The U.S. dollar and bond yields will also remain in focus, as shifts in these areas can impact international and domestic investments. By staying informed and maintaining a diversified portfolio, we can continue to make sound decisions that align with our long-term financial goals.

Staying Informed: The Importance of a Long-Term Perspective

As we move forward, I will be closely monitoring these developments and providing updates to keep you informed. Last week’s strong performance reminds us of the value of a steady, long-term investment approach. While market shifts may tempt short-term reactions, history has shown that disciplined investing based on sound financial principles is the best path to wealth building.

Thank you for reading, and as always, I’m here to answer any questions you may have about how recent economic trends impact your financial plan. Let’s keep looking forward to continued success in achieving your financial goals. Feel free to schedule an Exploration Call if you believe we may be of assistance.

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

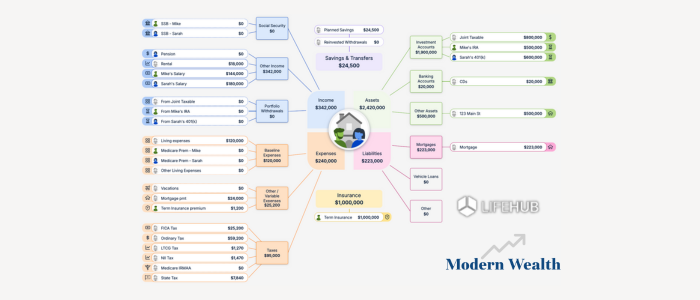

Life Hub at Modern Wealth