Modern Wealth Market Minutes for Q1 2025

Thursday, January 2, 2025

As Founder and CEO of Modern Wealth, I’m always seeking ways to help our clients make informed financial decisions. Understanding the broader market context is essential, especially in today’s dynamic economic environment. That’s why I’m sharing highlights and analysis from the latest J.P. Morgan Asset Management “Guide to the Markets.”

Market Performance Overview

The S&P 500: A Historical and Current Perspective

The S&P 500 has seen significant growth over the decades, with its forward price-to-earnings (P/E) ratio sitting at 21.5x as of December 31, 2024. This is above the 30-year average of 16.9x, suggesting valuations are stretched compared to historical norms. Despite these higher valuations, annual returns have remained robust, with the index gaining 23% in 2024, reflecting the resilience of U.S. equities.

The forward P/E ratio suggests caution for investors seeking value opportunities.

Profit margins for S&P 500 companies have risen to 12.8%, indicating strong corporate performance.

Sectors like Technology and Consumer Discretionary have driven much of the index’s growth, accounting for substantial earnings increases.

At Modern Wealth, we encourage clients to remain focused on their long-term goals rather than short-term market movements. Elevated valuations require disciplined investment strategies.

Sector Insights: Leaders and Laggards

Technology: A Continued Powerhouse

Technology remains the largest sector in the S&P 500, representing 32% of the index. Earnings for the sector grew 20% year-over-year in 2024, driven by advancements in artificial intelligence (AI), cloud computing, and semiconductors. Companies investing heavily in R&D are leading the charge.

Financials: A Mixed Bag

The Financials sector has shown a 15% EPS growth forecast for 2025, rebounding from earlier challenges. Higher interest rates have benefited traditional banking margins, but regulatory pressures remain a headwind.

Energy: A Volatile Ride

Energy’s performance has been marked by volatility, with declining oil prices in 2024 offsetting earlier gains. Nevertheless, the sector’s long-term prospects are bolstered by the global shift toward renewable energy sources.

Economic Indicators: What They Mean for Investors

GDP Growth

Real GDP growth in the U.S. stood at 2.9% in 2024, with projections moderating to 2.0% for 2025. Key contributors include consumer spending and business fixed investment.

Inflation Trends

Inflation pressures have eased, with headline CPI at 2.7% and core CPI at 3.3% as of November 2024. While this is a positive development, wage growth at 3.9% may keep inflation elevated longer than desired by the Federal Reserve.

Interest Rates

The Federal Reserve has maintained a restrictive stance, with the 10-year Treasury yield ending 2024 at 4.58%. Higher rates have implications for:

Bond portfolios: Longer-duration bonds face price pressure.

Equity valuations: Higher discount rates impact growth stocks disproportionately.

Global Markets: Opportunities Abroad

Emerging Markets

Emerging markets have shown resilience, with China and India driving much of the growth. India’s GDP is projected to grow 6.9% annually, supported by structural reforms and a young, growing population.

International Valuations

International equities remain attractively valued compared to U.S. stocks. The MSCI All Country World ex-U.S. Index trades at a P/E of 13.3x, a steep discount to the S&P 500.

Investors seeking diversification should consider allocating more to international markets. At Modern Wealth, we carefully assess opportunities to balance risk and reward.

Fixed Income: A Shifting Landscape

Corporate Bonds

Investment-grade corporate bonds yield 5.33%, while high-yield bonds offer 7.49%. The narrowing credit spreads signal investor confidence in corporate fundamentals.

Treasury Securities

The inverted yield curve, with 2-year Treasuries yielding 4.25% versus 10-year Treasuries at 4.58%, indicates potential recessionary concerns. However, historical data suggests that inversions do not immediately translate to economic downturns.

Fixed-income strategies must be adaptive. At Modern Wealth, we integrate bonds into portfolios to provide stability and income, even in uncertain environments.

Key Trends to Watch

The Rise of Artificial Intelligence

AI is transforming industries, particularly technology, healthcare, and financial services. Hyperscalers like Alphabet, Amazon, and Microsoft have ramped up capital expenditures, contributing to increased productivity and innovation.

Energy Transition

The global shift to renewable energy is creating investment opportunities in solar, wind, and battery storage technologies. These sectors are expected to see double-digit growth over the next decade.

Consumer Behavior

Consumer sentiment has improved, with the University of Michigan Consumer Sentiment Index reaching 74.0 in December 2024. Higher confidence typically translates to increased spending, which supports GDP growth.

How Modern Wealth Can Help

Navigating these complex market dynamics requires expertise, discipline, and a clear financial plan. At Modern Wealth, we pride ourselves on delivering:

Tailored Investment Strategies: Customized to your goals, risk tolerance, and timeline.

Holistic Wealth Management: Integrating tax planning, estate strategies, and more.

Proactive Monitoring: Regular reviews to ensure your portfolio aligns with evolving market conditions.

The data shared by J.P. Morgan provides valuable insights, but it’s how we apply these insights to your unique situation that makes the difference.

Final Thoughts

The financial markets are a dynamic ecosystem influenced by countless factors. By understanding key trends and economic indicators, we can better position ourselves for success. At Modern Wealth, we combine deep market insights with a client-first approach to ensure your wealth is not only preserved but also thrives in any market environment.

Let’s work together to create a roadmap tailored to your aspirations. Contact us today to start the conversation.

March 13, 2025

Understanding the Link Between Tariffs and Inflation

January 31, 2025

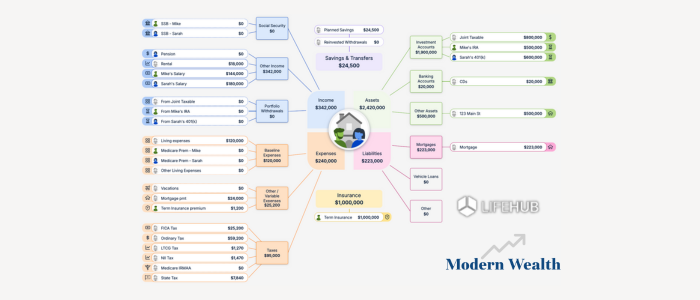

Life Hub at Modern Wealth