Modern Wealth’s Retirement Optimizer

Wednesday, January 22, 2025

Retirement is one of life’s most significant milestones. It’s a transition that brings freedom, but also requires careful planning to ensure that financial resources align with a lifetime of evolving needs. At Modern Wealth, we understand that no two retirements are the same, which is why we’ve developed the Retirement Optimizer, a state-of-the-art tool designed to provide adaptable, precise guidance throughout your retirement journey.

In this post, we’ll explore the key features of Modern Wealth’s Retirement Optimizer and how it empowers residents of Blue Bell, PA, to make confident, informed decisions in an ever-changing financial landscape.

What Is the Retirement Optimizer?

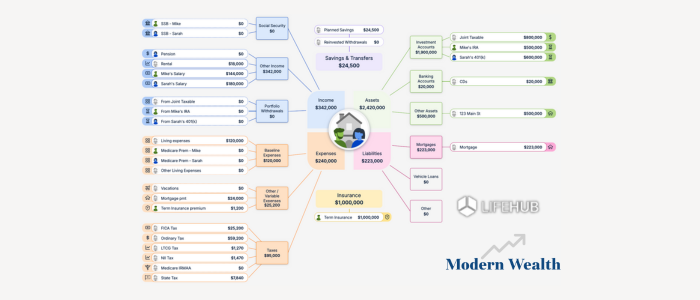

The Retirement Optimizer is not just another financial planning tool. It’s a dynamic, interactive system that enables continuous, personalized retirement income planning. Instead of relying on static, one-size-fits-all projections, the Retirement Optimizer uses advanced modeling to adapt your financial strategy in real time, ensuring your retirement plan remains resilient and aligned with your goals.

At its core, the Retirement Optimizer focuses on:

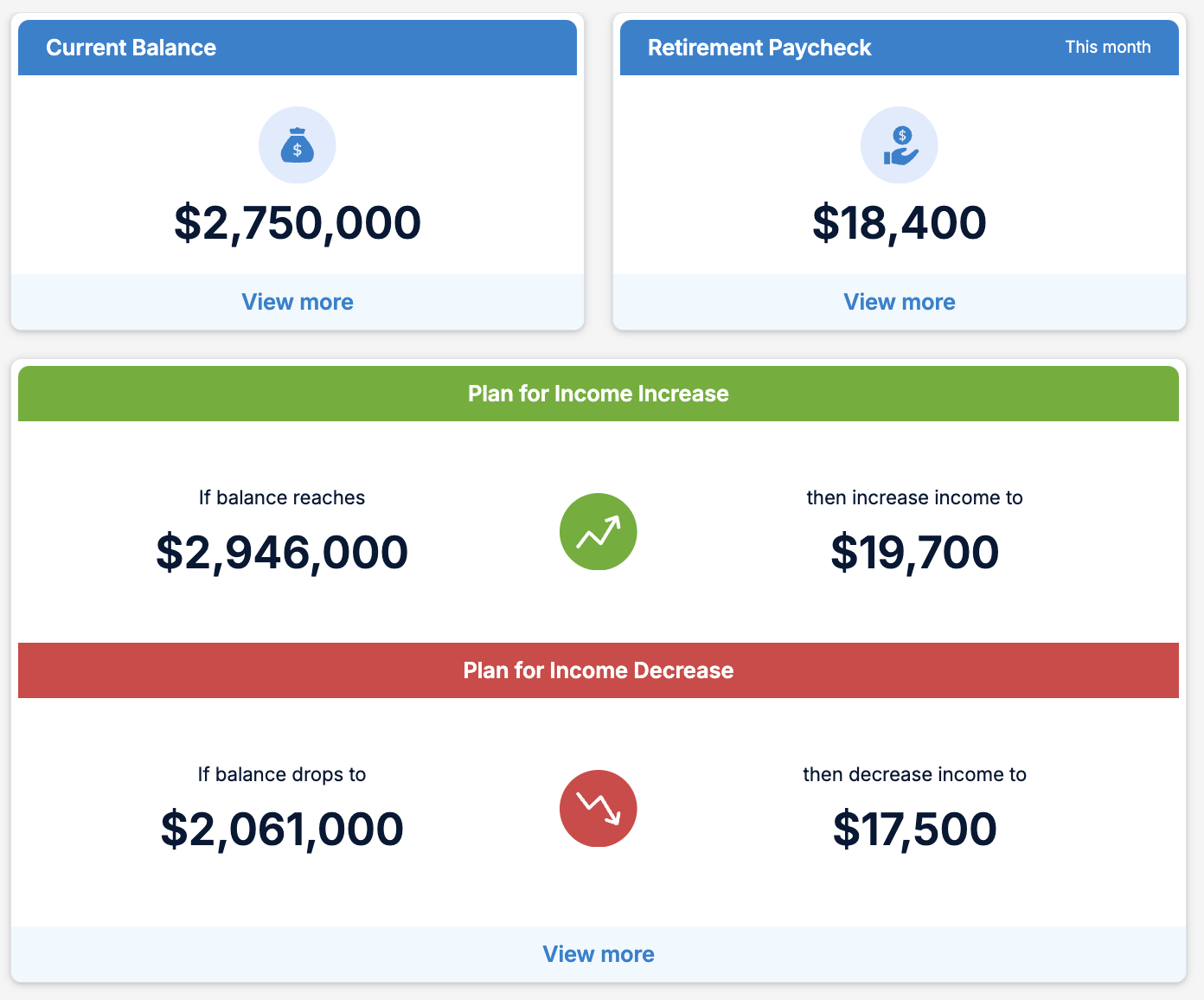

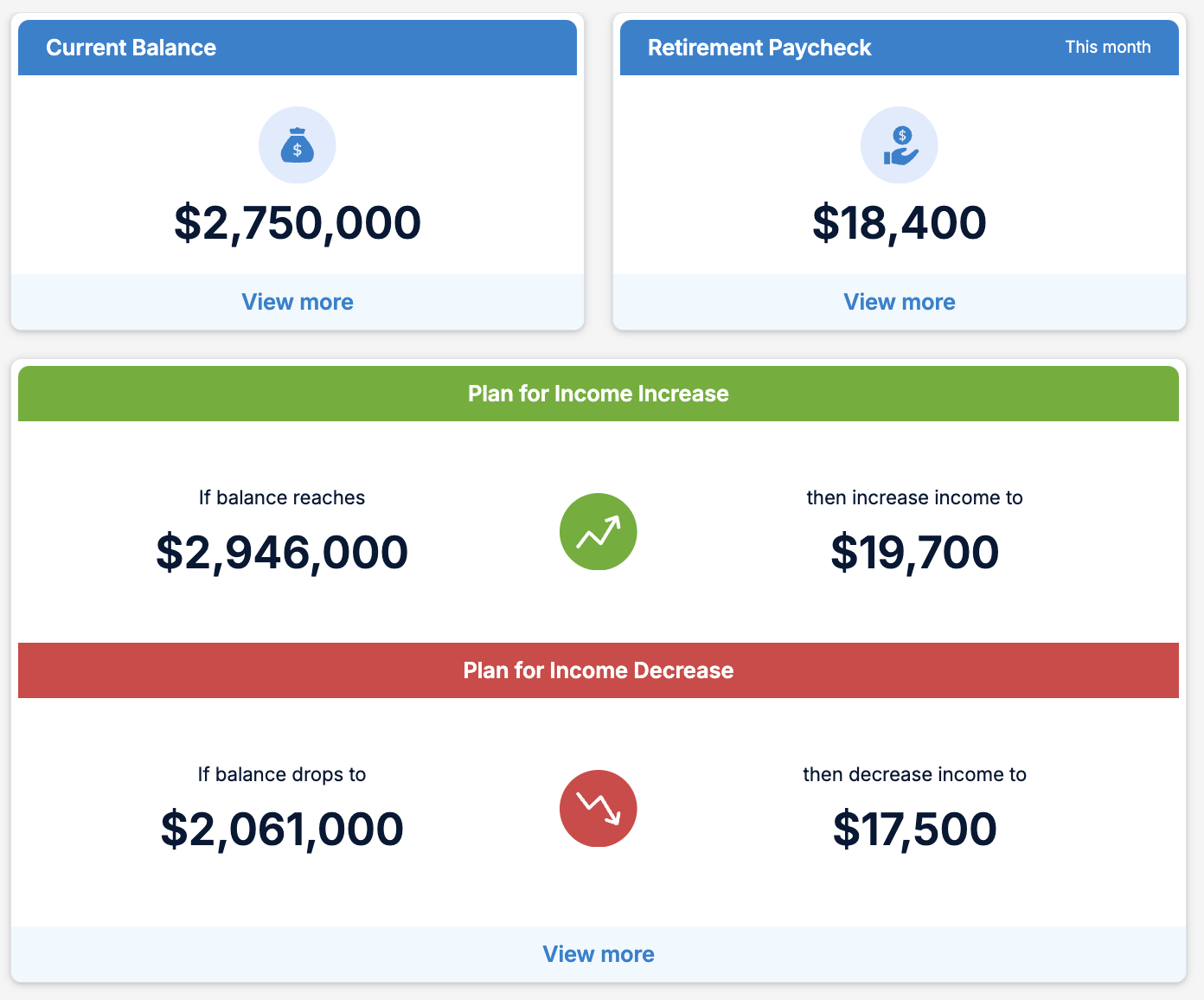

Risk-Based Guardrails: Setting spending limits to protect against market downturns.

Automated Plan Monitoring: Continuously adjusting strategies based on current conditions.

Enhanced Confidence: Providing clarity and assurance about your financial future.

Let’s take a closer look at each of these features and their benefits for retirement planning in Blue Bell, PA.

Retirement Guardrails: Adapting to Life’s Changes and Risks

One of the standout features of the Retirement Optimizer is its risk-based guardrails. These guardrails are tailored specifically to your financial situation, helping to create a spending plan that adapts to changes in market conditions, portfolio performance, and personal circumstances.

How the Retirement Optimzer Works:

The guardrails establish a framework within which your retirement spending can flex. For example:

If your portfolio performs better than expected, the tool may recommend increasing your discretionary spending, allowing you to enjoy more of your retirement.

Conversely, if market conditions turn unfavorable, the guardrails will prompt adjustments to protect your long-term financial health.

This approach ensures that your retirement plan remains sustainable, no matter what life throws your way. It’s like having a personal financial co-pilot who’s always prepared to adjust course when needed.

Automated Retirement Plan: Staying Ahead of the Curve with Monitoring

Financial plans should never be “set and forget.” Life changes, markets fluctuate, and your priorities may shift over time. The Retirement Optimizer’s automated plan monitoring ensures that your financial strategy evolves with these changes.

Proactive Retirement Adjustments:

The Retirement Optimizer continuously evaluates your financial plan against the latest market data, tax laws, and personal circumstances. If conditions warrant an update, the tool automatically notifies you and your financial advisor, providing recommendations for adjustments.

For instance:

If a new tax law presents an opportunity for savings, the Retirement Optimizer will integrate this into your plan.

If your portfolio hits a critical threshold, the tool will suggest recalibrating your spending or investment strategy.

This proactive approach takes the guesswork out of retirement planning, ensuring your strategy is always optimized for success in Blue Bell, PA.

Retirement Confidence: Achieving Peace of Mind

Studies show that individuals with a written retirement plan feel significantly more confident about their financial future. The Retirement Optimizer takes this a step further by providing a dynamic living plan that evolves with you.

Why Retirement Confidence Matters:

Retirement can be a time of uncertainty. Will your savings last? Are you prepared for unexpected expenses? The Retirement Optimizer addresses these concerns by:

Providing clear, actionable insights into your financial situation.

Simulating potential scenarios to show how your plan would fare in different market conditions.

Offering detailed spending recommendations to balance your lifestyle needs with long-term security.

With the Retirement Optimizer, you’re not just planning for retirement—you’re planning for a confident, fulfilling future in Blue Bell, PA.

Real-Life Applications of the Retirement Optimizer

To illustrate how the Retirement Optimizer works, let’s consider a couple of real-life scenarios:

Scenario 1: Navigating a Market Downturn During Retirement

Jane and Mike, a recently retired couple living in Blue Bell, PA, rely on their investment portfolio for a significant portion of their income. A sudden market downturn causes their portfolio’s value to drop by 15%.

Using the Retirement Optimizer, their advisor identifies opportunities to temporarily reduce discretionary spending, such as postponing a planned vacation. By making small adjustments now, Jane and Mike can preserve their portfolio and avoid jeopardizing their long-term financial health.

Scenario 2: Capitalizing on Market Gains in Retirement

Tom, a retired engineer in Blue Bell, PA, has been following a conservative spending plan. After several years of strong market performance, his portfolio exceeds expectations. The Retirement Optimizer suggests increasing his annual withdrawal rate slightly, allowing Tom to take that dream trip to Europe without compromising his future security.

Modern Wealth’s Retirement Optimizer

The Retirement Optimizer sets itself apart from traditional retirement planning tools in several key ways:

Customized Retirement Plans: Plans are tailored to your unique financial situation and goals.

Real-Time Retirement Adjustments: Strategies evolve with changes in the market, tax laws, and personal circumstances.

Collaborative Approach: The tool works seamlessly with your Modern Wealth advisor, ensuring expert guidance every step of the way.

Proactive Retirement Planning: Alerts and recommendations keep you ahead of potential challenges.

Comprehensive Retirement Insights: From spending adjustments to tax strategies, the Retirement Optimizer covers every aspect of retirement planning.

The Role of Your Financial Advisor and Retirement Planner

While the Retirement Optimizer is a powerful tool, it’s even more effective when paired with the expertise of a Modern Wealth advisor. Your advisor provides the human touch, helping to interpret the tool’s recommendations and integrate them into a broader financial strategy.

Together, the Retirement Optimizer and your advisor create a partnership that empowers you to:

Understand the long-term impact of financial decisions.

Explore tax-efficient withdrawal strategies.

Plan for legacy goals, such as leaving an inheritance or supporting charitable causes.

Getting Started with the Retirement Optimizer in Blue Bell, PA

Taking control of your retirement planning has never been easier. Here’s how to get started:

Schedule an Initial Consultation: Meet with a Modern Wealth advisor in Blue Bell, PA, to discuss your retirement goals and financial situation.

Develop a Personalized Retirement Plan: Using the Retirement Optimizer, your advisor will create a customized plan that aligns with your needs.

Monitor and Adjust: Stay engaged with regular updates and adjustments to ensure your plan remains on track.

Retirement Planning Conclusion

Modern Wealth’s Retirement Optimizer is more than just a financial tool—it’s a roadmap to financial freedom. By combining cutting-edge technology with expert guidance, we help residents of Blue Bell, PA, navigate the complexities of retirement with confidence and clarity.

Whether you’re just starting to plan for retirement or looking to optimize an existing strategy, the Retirement Optimizer is here to help you achieve your goals. Contact Modern Wealth today to learn how we can help you turn your retirement dreams into reality.

January 31, 2025

Life Hub at Modern Wealth

January 22, 2025

Modern Wealth’s Retirement Optimizer