The Modern Entrepreneur Blog

Thursday, March 13, 2025

Understanding the Link Between Tariffs and Inflation

When discussing inflation, tariffs often enter the conversation as a key concern. Many fear that new tariffs on imported goods will trigger rising prices across the board, fueling inflation and squeezing household budgets. While this may seem logical on the surface, the broader economic reality is more complex. At Modern Wealth, we aim to provide financial clarity so you can make informed decisions. Let’s explore the true impact of tariffs on inflation and what it means for your financial plan.

Understanding the Link Between Tariffs and Inflation

At their core, tariffs are a form of taxation on imported goods. When a tariff is imposed, the price of the affected product generally increases. However, the price hike is not always equal to the full tariff amount, as exporters and supply chain intermediaries absorb some of the cost before it reaches consumers. Given this, the logic seems straightforward: tariffs raise the price of certain goods, so they must be inflationary. But does this mean inflation will rise across the economy? Not necessarily.Tariffs as a Disinflationary Force

While tariffs may increase the price of specific goods, they do not automatically lead to sustained, broad-based inflation. Instead, tariffs act as a form of fiscal contraction—reducing consumer spending power. When consumers have less disposable income due to higher costs on tariffed goods, they often cut back on spending elsewhere. This, in turn, can lead to lower demand for non-tariffed goods, causing their prices to stagnate or even decline. A real-world example of this effect is seen in gas taxes. Suppose the U.S. government imposed a $2 per gallon gas tax on the 135 billion gallons of fuel sold annually. If the full tax were passed to consumers, gas prices would jump by 67% from a national average of $3 per gallon to $5. This shock would initially push the Consumer Price Index (CPI) up by roughly 2%, making inflation appear high in the short term. However, as a result, consumers would have $270 billion less to spend on other goods and services. After accounting for demand elasticity, the net gas tax revenue collected would be $306 billion, leading to an overall consumption drop of about 1.39%. That shift in spending behavior would eventually lower prices in non-energy sectors, reducing inflationary pressure over time. In fact, assuming a general elasticity of -1, about 0.7% would be knocked off the overall inflation rate after the initial shock.What This Means for Investors and Financial Planning

Understanding the true economic impact of tariffs can help us make smarter financial decisions. Here’s what you should keep in mind: Market Reactions Can Be Overblown – Tariffs often create short-term market volatility. However, the Federal Reserve and long-term economic trends matter more in shaping inflation than isolated policy changes. Interest Rates May Not Respond as Expected – Since tariffs can ultimately be disinflationary, they may not lead to higher interest rates as some fear. The Federal Reserve looks past one-time price increases and focuses on sustained inflation trends when making rate decisions. Diversification is Key – If tariffs shift consumer spending patterns, certain sectors may feel the impact more than others. A well-diversified investment portfolio helps mitigate risks associated with these economic shifts. Long-Term Perspective Wins – Economic conditions fluctuate, but a well-structured financial plan accounts for uncertainties like tariffs, inflation, and market swings. By staying disciplined and avoiding reactionary decisions, you can keep your financial goals on track.A Final Thought on Tariffs

At Modern Wealth, we believe in cutting through financial noise and focusing on what truly matters for your long-term financial well-being. While tariffs can affect prices in the short term, they don’t necessarily drive long-term inflation. Instead, they may act as a drag on economic growth and consumer spending. If you have concerns about how inflation, tariffs, or other economic changes could impact your financial plan, let’s talk. Schedule a free consultation today, and let’s navigate the evolving market landscape together.

Friday, January 31, 2025

Life Hub at Modern Wealth

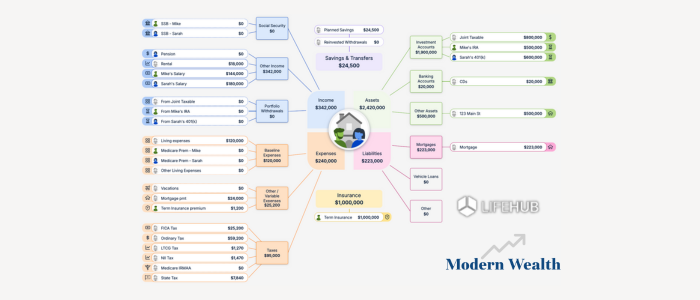

At Modern Wealth, we believe that financial planning should be more than just numbers on a page—it should be a dynamic, interactive experience that brings your financial future to life. That’s why we leverage Life Hub, an innovative financial visualization tool designed to provide clarity and confidence in retirement income strategies, scenario analysis, and tax planning. In this article, we’ll introduce Life Hub, explore how it enhances financial planning, and explain how we integrate it with our comprehensive approach at Modern Wealth.

What is Life Hub?

Life Hub is a financial planning visualization platform that allows clients to see their complete financial picture in an intuitive, interactive format. Unlike traditional spreadsheets or static reports, Life Hub presents financial data in a way that is easy to understand, enabling clients to engage with their financial plan dynamically. It helps answer critical financial questions such as: How much can I spend in retirement? How do my income sources—like Social Security, pensions, and investments—work together? What impact do Roth conversions or different withdrawal strategies have on my long-term wealth? What happens if I buy a vacation home, retire earlier, or adjust my savings strategy? How does longevity risk affect my plan? Life Hub allows us to model different financial scenarios in real time, providing clients with immediate insights into how different decisions will impact their future financial well-being.How Life Hub Enhances Financial Planning

1. Visualizing Your Retirement Income Strategy One of the biggest challenges in financial planning is understanding where your income will come from in retirement. Life Hub simplifies this by clearly illustrating: How different income sources (Social Security, pensions, withdrawals, rental income, etc.) interact over time. The impact of delaying Social Security on portfolio withdrawals and longevity. How different spending levels affect asset depletion and sustainability. By mapping out your retirement income visually, we can create a strategy that aligns with your lifestyle goals while ensuring financial security. 2. Scenario Analysis for Better Decision-Making Financial planning is not static—your circumstances, goals, and economic conditions evolve. Life Hub allows us to run multiple “what-if” scenarios to compare different financial choices, such as: Retiring at different ages to assess the impact on income sustainability. Purchasing or selling real estate, including the effect of mortgages and liquidity. Adjusting investment allocations to understand risk and return trade-offs. Legacy planning considerations and how different withdrawal rates affect estate values. With Life Hub, you can see how various financial decisions impact your long-term wealth before making them. 3. Optimizing Tax Planning and Roth Conversion Strategies Taxes play a major role in financial planning, and optimizing tax efficiency can lead to significant long-term benefits. Life Hub integrates tax-aware planning by: Illustrating the impact of different withdrawal sequences on tax liability. Showing how Roth conversions can reduce required minimum distributions (RMDs) and future tax burdens. Allowing us to model withdrawal strategies that align with the most tax-efficient approach for your situation. By incorporating Tax Lab, we take this a step further to ensure that clients are making tax-efficient decisions that maximize long-term wealth. 4. Pre-Retirement Planning & Savings Optimization Life Hub isn’t just for retirees—it’s also a powerful tool for those still accumulating wealth. With its interactive projections, we can: Show how increasing savings rates impacts financial independence. Illustrate the trade-offs between spending now vs. saving for the future. Help clients determine when they can retire based on current savings and future goals. By visualizing the journey from accumulation to distribution, Life Hub helps clients make informed decisions at every stage of their financial life. 5. Addressing Longevity Risk and Survivor Planning A key concern for many clients is whether their money will last throughout retirement, especially if they or their spouse live longer than expected. Life Hub incorporates mortality tables and longevity risk analysis, allowing us to: Adjust plan lengths based on different life expectancy scenarios. Show how spending and income sources adjust after the passing of a spouse. Ensure financial security for surviving spouses by modeling different withdrawal strategies and Social Security claiming options. With this level of detailed planning, clients gain peace of mind knowing they have a plan that accounts for both expected and unexpected longevity.Integrating Life Hub into Our Process at Modern Wealth

At Modern Wealth, we take a holistic approach to financial planning, integrating multiple advanced tools to provide the highest level of clarity and strategy for our clients. Life Hub is a core component of our process, working alongside Income Lab and Tax Lab to create a truly comprehensive plan. Here’s how it fits into our process: Exploration & Vision Meetings – We introduce Life Hub early in our process to help clients visualize their financial future and identify key planning priorities. Obstacles & Knowledge Meetings – Life Hub is used to illustrate different scenarios and develop a tax-efficient withdrawal strategy, integrating insights from Income Lab and Tax Lab. Execution & Ongoing Planning – As life evolves, we continuously update Life Hub to reflect changes in income, tax laws, market conditions, and client goals, ensuring an adaptive financial plan.Why Clients Love Life Hub

Clients consistently tell us that Life Hub makes financial planning more engaging and accessible. Instead of feeling overwhelmed by spreadsheets and financial jargon, they can interact with their plan, see how different choices impact their future, and gain the confidence to make informed decisions. Some of the key benefits our clients appreciate include: ✅ Clear visualization of income, spending, and assets over time. ✅ Instant feedback on financial decisions and scenarios. ✅ Interactive tax and withdrawal planning to maximize efficiency. ✅ Personalized insights tailored to their unique financial situation. ✅ Peace of mind knowing their financial future is mapped out.Experience Life Hub for Yourself

Financial planning should be a process of discovery, not stress. With Life Hub, we provide a clear, engaging, and insightful way to plan for the future. At Modern Wealth, we are dedicated to helping our clients achieve financial freedom with cutting-edge tools and personalized strategies. Whether you’re approaching retirement, optimizing your tax strategy, or simply looking for a clearer financial plan, Life Hub is here to help. Are you ready to take control of your financial future? Schedule an intro call with us today and experience firsthand how Life Hub can bring clarity and confidence to your financial plan. 📅 Schedule Your Intro Call Here

Wednesday, January 22, 2025

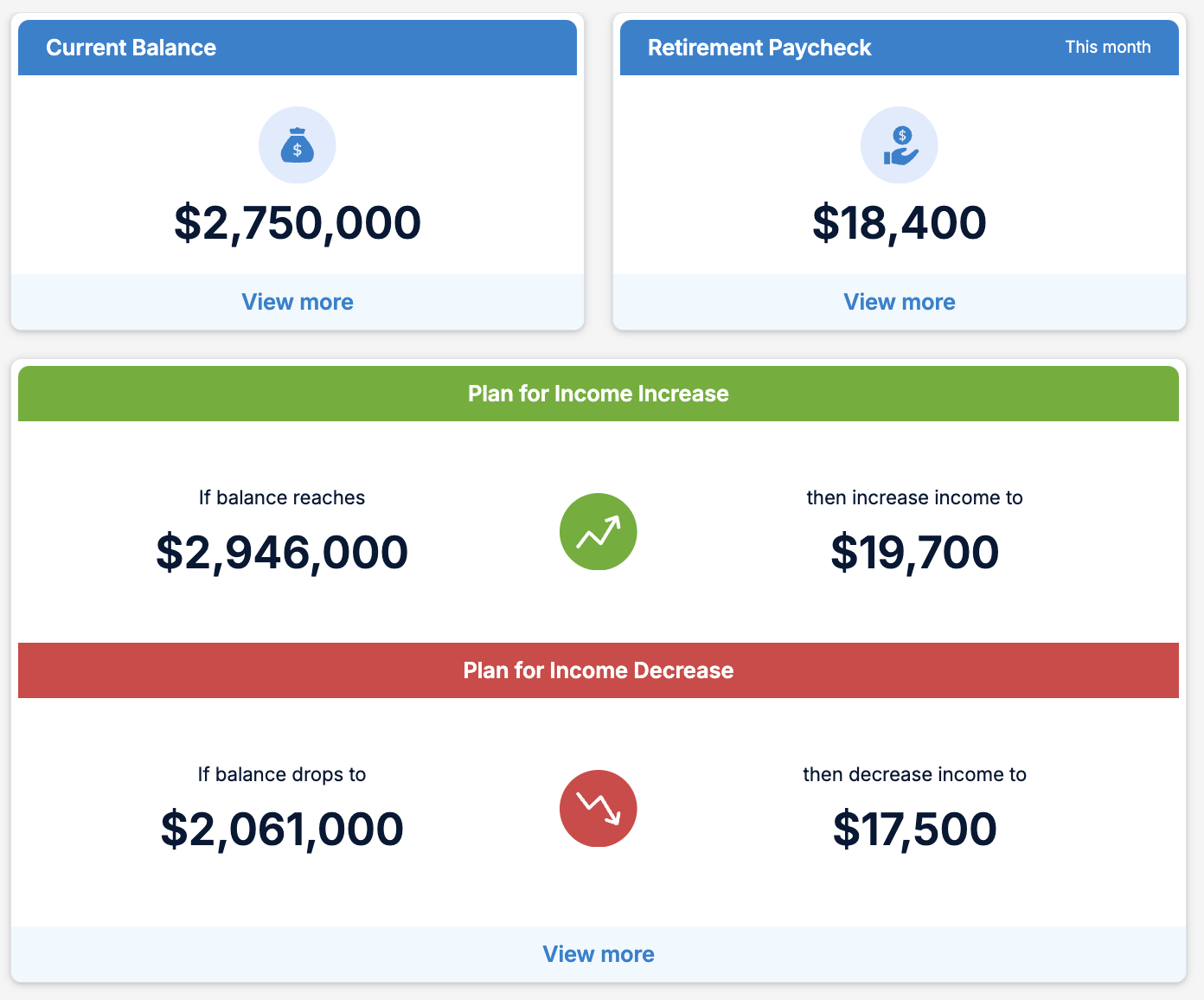

Modern Wealth’s Retirement Optimizer

Retirement is one of life’s most significant milestones. It’s a transition that brings freedom, but also requires careful planning to ensure that financial resources align with a lifetime of evolving needs. At Modern Wealth, we understand that no two retirements are the same, which is why we’ve developed the Retirement Optimizer, a state-of-the-art tool designed to provide adaptable, precise guidance throughout your retirement journey. In this post, we’ll explore the key features of Modern Wealth’s Retirement Optimizer and how it empowers residents of Blue Bell, PA, to make confident, informed decisions in an ever-changing financial landscape.