Business Advisory Services

Current and Potential Business Valuation

The Value Opportunity Profile (VOP) is a diagnostic tool that offers a comprehensive assessment of a company’s current worth and potential for growth or transition. It evaluates the business’s intrinsic value, highlighting areas of strength and identifying risks that could hinder its success in the marketplace.

Intrinsic value reflects a business’s underlying worth, incorporating both tangible and intangible factors like operational efficiency, leadership quality, and financial stability.

Understanding this value allows business owners to focus on what drives growth and ensures long-term sustainability. Business advisory services often use tools like the VOP to help clients develop a robust business advisory plan that aligns with their goals.

The VOP evaluates businesses across eight critical areas: Planning, Leadership, People, Sales, Marketing, Operations, Finance, and Legal. These categories provide a 360-degree view of the company, enabling a detailed analysis of where value is created or diminished. Business advisors uses these insights to craft strategies that align with the findings.

The VOP introduces proprietary metrics to guide decision-making. The Quality Score measures the development and effectiveness of each functional area, while the Risk Score highlights vulnerabilities that could deter potential buyers or investors, such as unstable cash flow or compliance issues. Business advisory firms frequently utilize these metrics as part of their evaluation.

A key feature of the VOP is its ability to uncover hidden risks while pinpointing opportunities for growth. For example, weak leadership structures might expose the business to operational disruptions, while strong customer relationships could be used for scalability. This approach is integral to any comprehensive business advisory plan.

By assessing both strengths and weaknesses, the VOP provides a solid foundation for strategic decision-making. The insights received from this evaluation are crucial for improving operational efficiency, enhancing market competitiveness, and maximizing overall value. Business advisory firms rely on such evaluations to help clients achieve long-term success.

Value Optimization Plan

The Value Optimization Plan (VOP) builds on the diagnostic findings of the Value Opportunity Profile, transforming insights into actionable strategies. It provides a clear and structured roadmap to address challenges, reduce risks, and capitalize on growth opportunities.

The Value Optimization Plan is customized to each business’s unique needs, offering specific recommendations for improvement. Whether the company is seeking growth, preparing for an exit, or aiming for operational stability, the plan adapts to align with those objectives. Business advisory firms utilize this approach to ensure that each client receives a customized roadmap designed to maximize value and minimize risks.

The VOP divides its recommendations into three levels. Level 1 focuses on stabilizing the business by addressing critical risks. Level 2 enhances core operations to increase efficiency and profitability, while Level 3 positions the company for long-term growth through strategic initiatives like market expansion or leadership development. These levels provide a clear structure, making the Value Optimization Plan a vital tool for business advisors working to drive sustainable growth.

Operational improvements are a significant focus of the Value Optimization Plan. From streamlining workflows to implementing better financial controls, the plan ensures the business operates at peak performance, reducing inefficiencies that erode value. Business advisory services emphasize these improvements as critical steps in any effective business advisory plan.

For companies looking to scale or attract investors, the VOP lays out strategies to build market readiness. This might include developing a strong sales pipeline, creating scalable systems, or enhancing customer retention to support sustainable growth. Business advisors guide these initiatives, helping businesses prepare for opportunities and challenges.

The ultimate goal of the Value Optimization Plan is to create a business that thrives today and is prepared for future challenges. The business advisory firms enable businesses to achieve a sustainable competitive edge, driving value for years to come.

Exit Plan

Exit planning prepares business owners for the transition of their company, whether through a sale, family transfer, or buyout. It aligns personal, financial, and business goals to ensure a smooth transition. Early planning, often facilitated by business advisory services, is critical for success.

Starting the process years in advance allows owners to identify weaknesses, enhance efficiency, and address risks. This proactive approach, guided by a comprehensive business advisory plan, increases the likelihood of a successful transition, ensures readiness, and helps achieve both financial and personal objectives for life post-transition.

Exit planning isn’t just about the business; it includes strategies to meet the owner’s personal financial goals. These might involve retirement planning, tax minimization, or preparing for post-exit ventures like philanthropy. Business advisors work closely with owners to align these elements, ensuring financial security while achieving their broader aspirations.

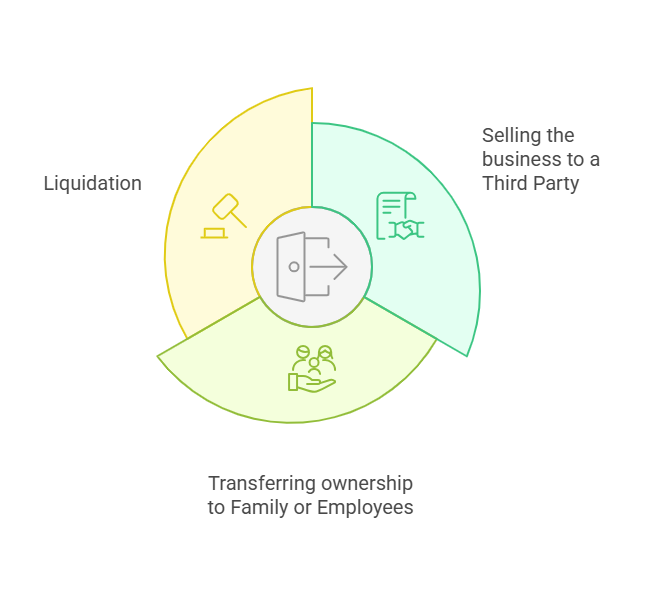

One common exit strategy is selling the business to a third party, such as a competitor or private equity firm. This approach can maximize sale price, especially for companies with strong financials and growth potential.

However, thorough preparation is required to enhance the company’s appeal and ensure a smooth transaction. Business advisory firms are instrumental in guiding owners through this process, ensuring every aspect of the sale aligns with their goals.

Another option is transferring ownership to family or employees. A family transfer preserves legacy but requires addressing tax implications and succession planning. For employees, options like management buyouts (MBOs) or Employee Stock Ownership Plans (ESOPs) reward loyalty while maintaining company culture.

When a business is heavily owner-dependent or lacks marketability, liquidation might be the only option. This involves selling assets, settling debts, and distributing remaining funds. Though less lucrative, it offers a straightforward exit strategy when other approaches aren’t viable. Business advisors provide valuable insights and support during this process, helping owners go through the challenges and optimize outcomes.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!