Certified Financial Planner for Business Owners

Why Choose a Certified Financial Planner for Your Business?

Running a business is a demanding endeavor. Balancing operational responsibilities with financial planning can be overwhelming. A certified financial planner (CFP) is uniquely equipped to help business owners like you go through complex financial landscapes.

With expertise in cash flow management, tax strategies, retirement planning, and risk management, a CFP ensures your business thrives while securing your personal financial future.

Partnering with a certified financial planner isn’t just about numbers—it’s about creating a roadmap tailored to your business and personal goals. Their financial designation guarantees the highest standards of expertise and ethical conduct.

Whether you’re a seasoned entrepreneur or launching your first venture, a financial planning specialist designation clarifies your finances. It empowers you to focus on growth and innovation.

With our certified business advisor services, you’ll gain strategic insights into managing your finances efficiently. Let us simplify the complexities of financial planning so you can focus on what you do best: running your business.

Strategic Cash Flow Management

Cash flow is the lifeblood of any business. Our certified financial planners specialize in developing cash flow strategies customized to small businesses. We create a sustainable plan to maintain liquidity and fund your business operations by analyzing your revenue streams and expenditures.

Through detailed cash flow projections, we identify opportunities to optimize your earnings and reinvest in growth. Our small business financial planners provide actionable insights. We will enable you to anticipate and address potential cash flow challenges proactively.

Tax Strategies for Business Owners

Tax planning is vital for financial success. Our financial planning designations ensure we can craft tax strategies that align with your business structure. From deductions and credits to retirement contributions, we identify ways to reduce your tax burden while ensuring compliance.

Whether you’re exploring corporate taxes, self-employment taxes, or capital gains, our financial certified planners simplify the complexities. We collaborate with your accountant to ensure a seamless approach to tax management, keeping more of your hard-earned money in your pocket.

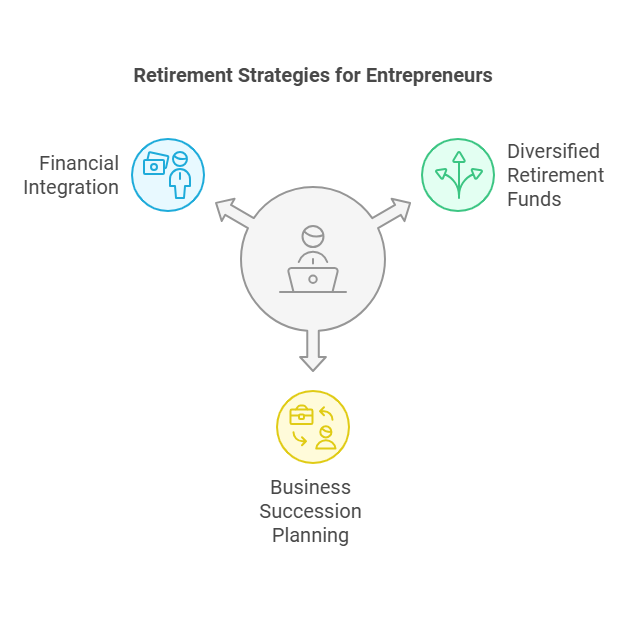

Retirement Planning for Entrepreneurs

As a business owner, your retirement savings may be tied to your business’s success. Our certified financial consultants help you diversify and secure your retirement funds. From individual retirement accounts (IRAs) to employer-sponsored plans like SEP IRAs or Solo 401(k)s, we provide strategies that align with your long-term goals.

We also evaluate your business succession plan, ensuring you can transition seamlessly when retiring. Integrating your personal and business finances, we help you build a strong and effective foundation for a financially secure future.

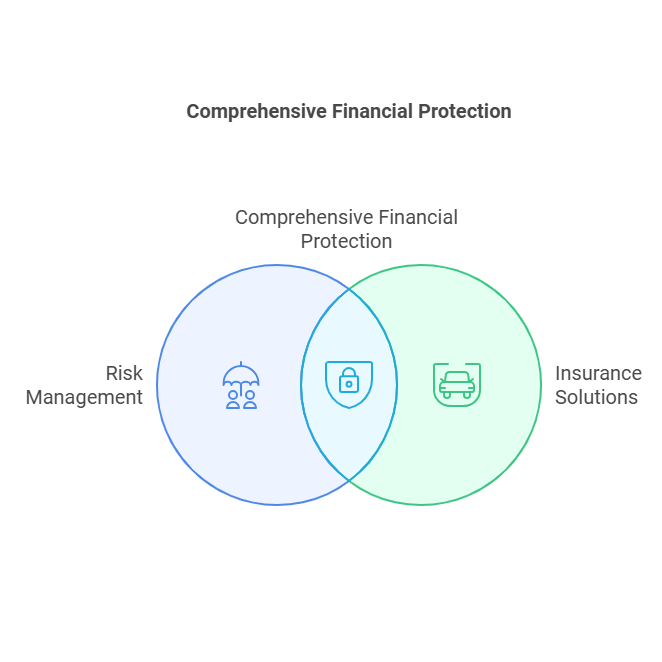

Risk Management and Insurance

Protecting your business wealth and personal assets is essential. Our certified financial consultants assess your risk exposure and recommend tailored insurance solutions. We ensure comprehensive protection, including liability coverage, key person insurance, or personal policies.

By incorporating risk management into your overall financial strategy, we safeguard your investments and provide peace of mind. With our guidance, you can confidently navigate uncertainties, knowing your business and personal finances are secure.

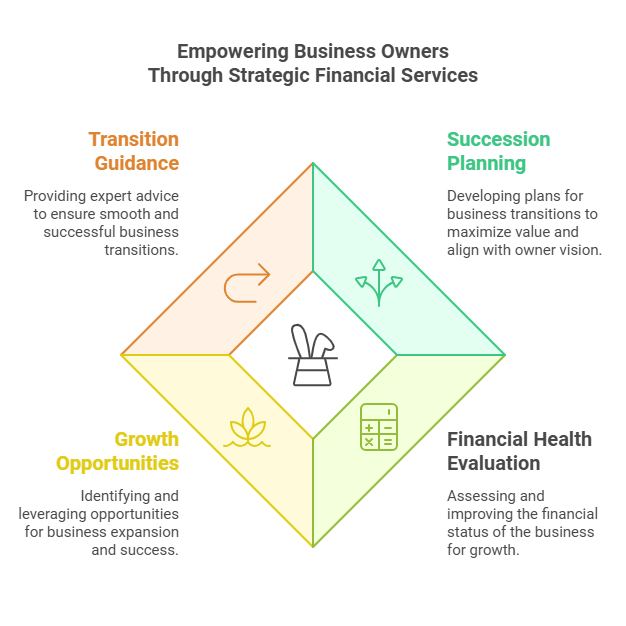

Specialized Services for Business Owners

Planning for your business’s future is critical. Our small business financial consultants specialize in creating succession plans that align with your vision. Whether transitioning to a family member, employee, or external buyer, we ensure a smooth process that maximizes your business’s value.

Our financial planning specialists evaluate your business’s financial health, identify growth opportunities, and guide you through the transition process. With our support, you can ensure your legacy continues while achieving your personal financial goals.

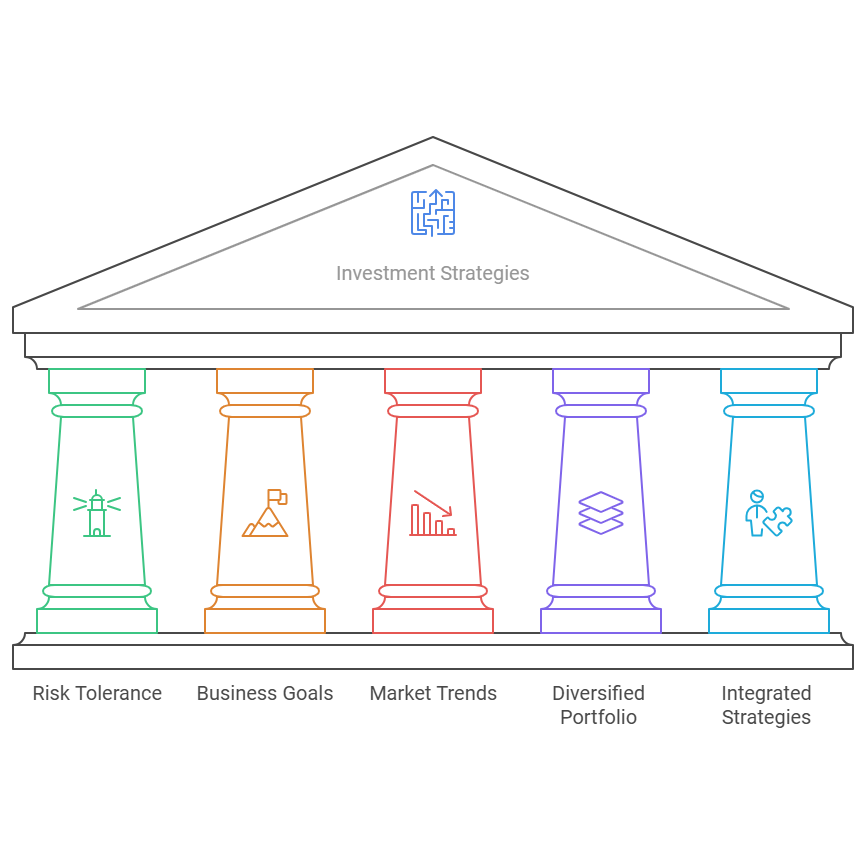

Investment Strategies

Growing your wealth requires a thoughtful investment strategy. Our certified financial planners analyze your risk tolerance, business goals, and market trends to develop a diversified portfolio. We customize solutions from stocks and bonds to real estate and alternative investments to meet your unique needs.

Our advisors help you navigate market fluctuations and capitalize on opportunities. We maximize your wealth potential by integrating your business and personal investment strategies.

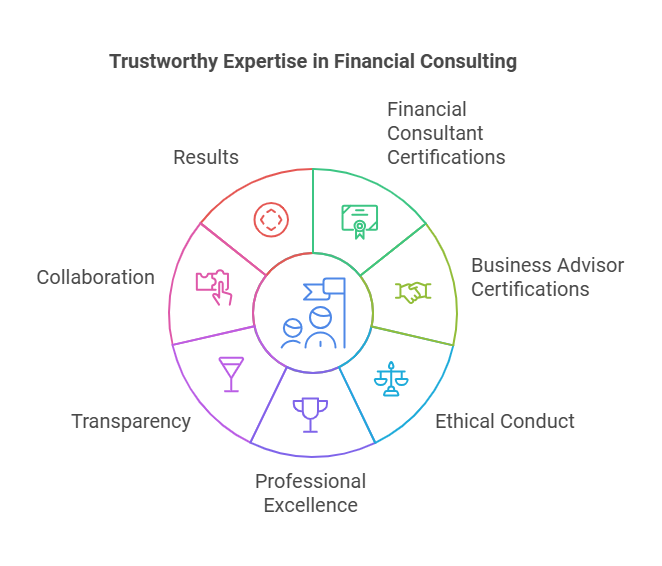

Expertise You Can Trust

Our team holds financial consultant certifications and business advisor certifications, ensuring we’re equipped with the latest knowledge and skills. Our advisor certification guarantees ethical conduct and professional excellence in every interaction.

By choosing Modern Wealth, you gain access to certified business advisors who understand the challenges of entrepreneurship. We prioritize transparency, collaboration, and results, providing a service that exceeds your expectations.

Customized Solutions for Entrepreneurs

No two businesses are alike, and neither are our financial plans. We take the time to understand your unique circumstances, goals, and challenges. Our personalized approach ensures your financial plan reflects your priorities, whether that’s scaling your business, securing retirement, or leaving a legacy.

From budgeting to advanced financial planning, we’re here to support you at every stage of your entrepreneurial journey. With our financial planning designations, you can trust us to deliver solutions that drive results.

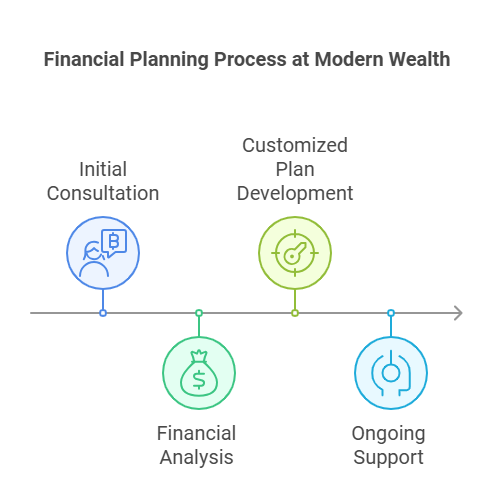

How to Get Started?

Certified financial planner for business owners at Modern Wealth works in the following ways:

Step 1: Initial Consultation

We provide a comprehensive consultation to understand your financial goals and challenges. This discussion sets the foundation for a plan tailored to your business and personal needs.

Step 2: Financial Analysis

Our team reviews your finances, including cash flow, investments, taxes, and retirement plans. This analysis enables us to identify opportunities for growth and improvement correctly.

Step 3: Customized Plan Development

Using insights from our analysis, we create a comprehensive financial plan. This roadmap includes actionable steps to achieve your goals and secure your financial future.

Step 4: Ongoing Support

Financial planning is an ongoing process. We provide continuous support and adjust your plan to ensure you stay on track. Our certified financial planners are always available to answer questions and provide guidance.

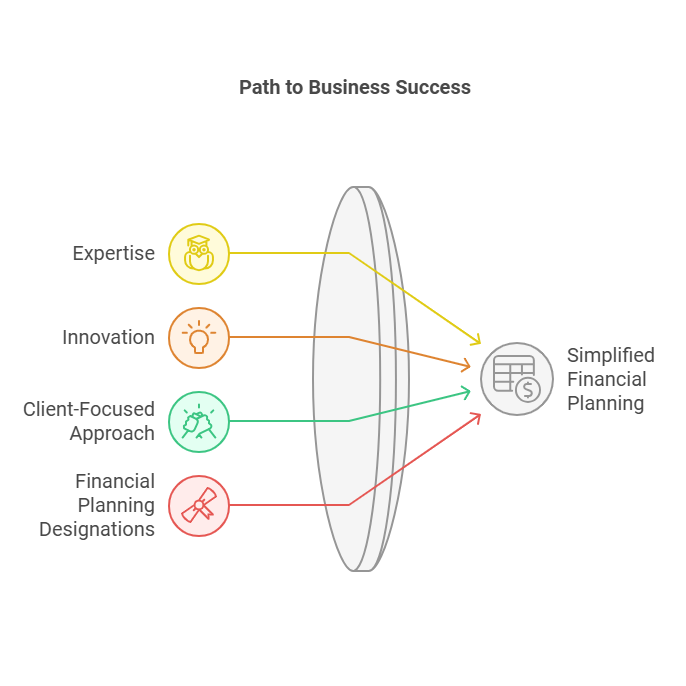

Why Modern Wealth?

At Modern Wealth, we combine expertise, innovation, and a client-focused approach to deliver unparalleled service. Our financial planning designations ensure we provide the highest-quality advice and solutions.

Whether you’re seeking a small business financial consultant, a certified financial consultant, or assistance with financial advisor certification, we’re here to help. Let us simplify the complexities of financial planning so you can focus on expanding your dream business.

Contact us today to schedule your consultation.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!