Estate Planning

Last Will and Testament

A Last Will & Testament is a cornerstone of estate planning basics. It lets you clearly outline what should happen to your belongings after you pass away. This is essential to estate planning, ensuring your wishes are followed and your loved ones are cared for.

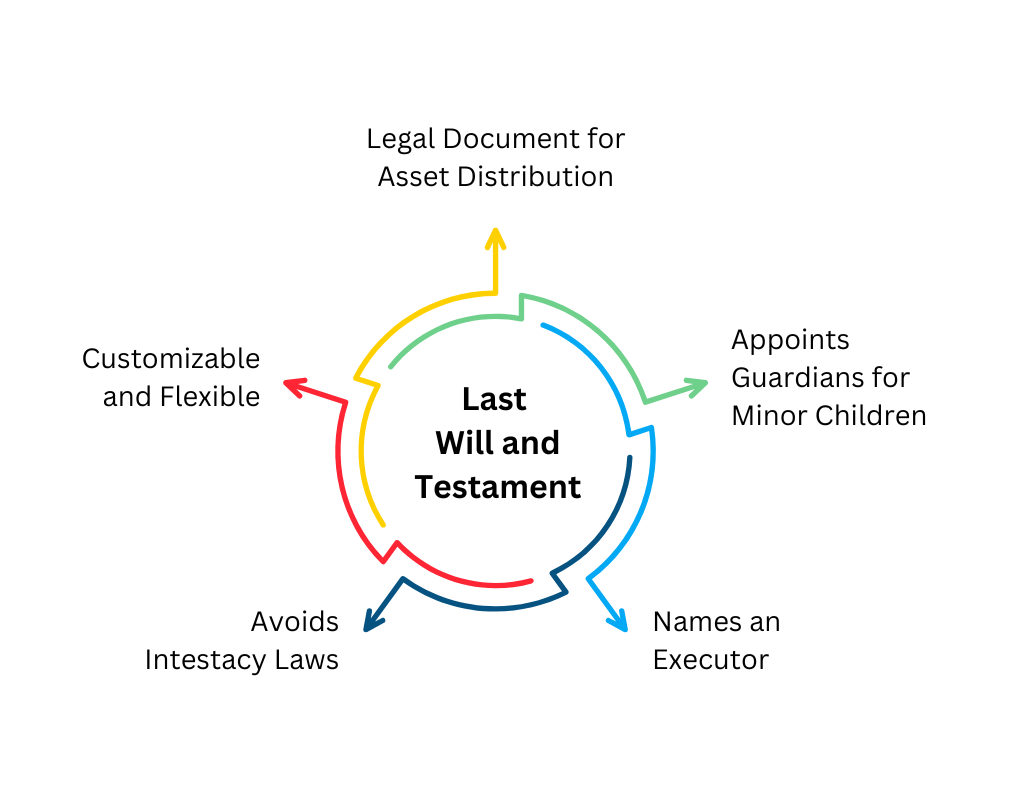

Last Will and Testament includes:

- Legal Document for Asset Distribution: A last will and testament is a legal document that explains how your assets will be divided after you pass away. It ensures your wishes are followed and helps prevent disagreements among your heirs.

- Appoint Guardians for Minor Children: In your will, you can name your children’s guardians. This provides clear instructions on who will care for them if something happens to you.

- Names an Executor: This will allow you to choose an executor. This person or professional manages your estate, pays debts, and ensures your assets are given to the right people, as stated in the will.

- Avoids Intestacy Laws: Without a will, state laws decide how your assets are divided, which might not match your wishes. A will gives you control over this process.

- Customizable and Flexible: A will can be changed as your life changes, like after getting married, divorced, having a child, or gaining new assets. This keeps your plans updated and relevant.

HIPAA Authorization

A HIPAA Authorization is a key component of estate planning basics, granting designated individuals access to your medical information. This is crucial in estate planning, especially for Healthcare Agents managing your care if you cannot communicate your preferences.

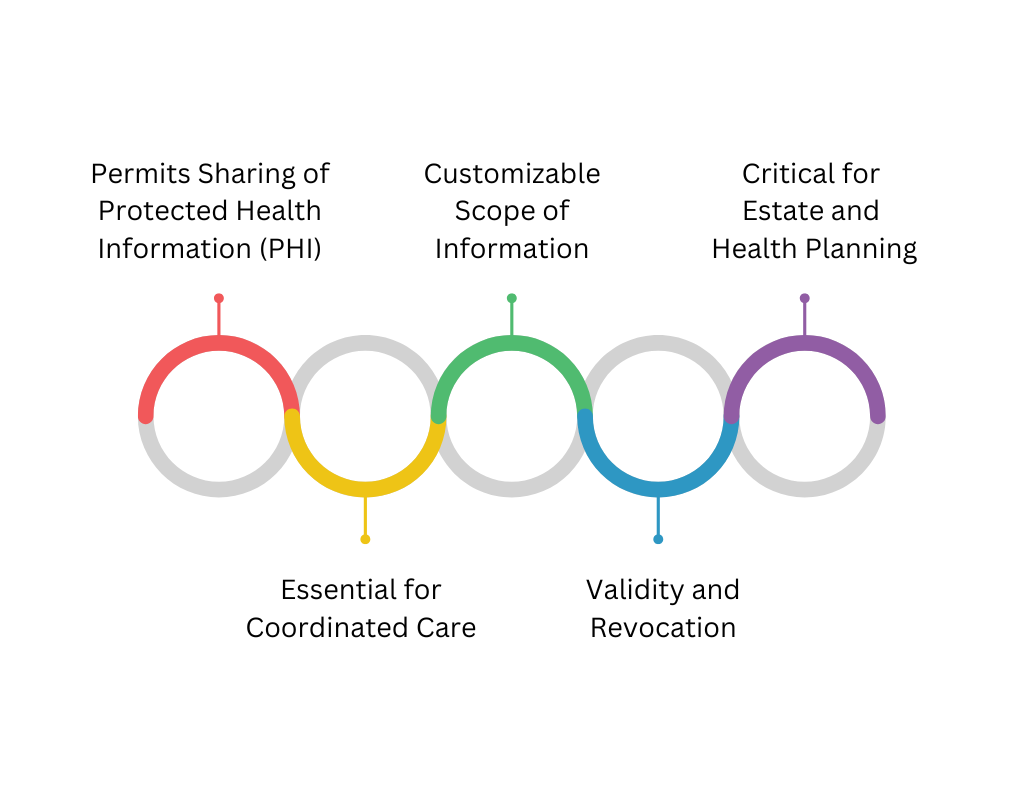

- Permits Sharing of Protected Health Information (PHI): A HIPAA Authorization allows specific people or organizations to access your protected health information. This information is normally kept private under the Health Insurance Portability and Accountability Act (HIPAA).

- Essential for Coordinated Care: It helps healthcare providers share your medical records with family, caregivers, or legal representatives. This ensures smooth coordination of your care when needed.

- Customizable Scope of Information: The authorization lets you decide what information can be shared, why it’s being shared, and who can access it. This gives you control over your medical privacy.

- Validity and Revocation: A HIPAA Authorization lasts until the date or event you specify. You can cancel it at any time by giving written notice.

- Critical for Estate and Health Planning: This document is essential for estate planning and medical emergencies. It ensures your chosen representatives have the information they need to decide for you.

Power of Attorney

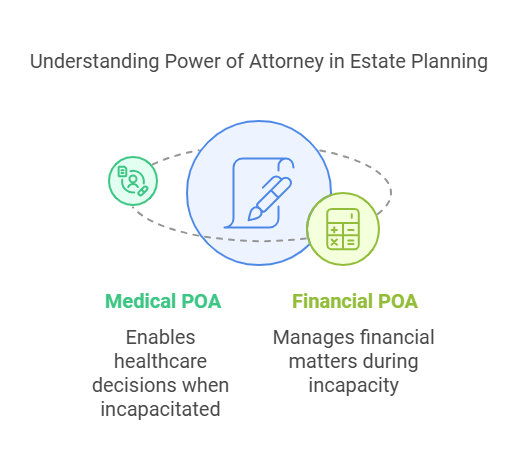

A Power of Attorney (POA) is fundamental to estate planning basics. It enables a designated individual, an Agent or Attorney-in-Fact, to make decisions on your behalf. It is a critical part of estate planning and can be a key feature of your estate plan. There are two different types of POAs: Medical and Financial.

A Medical Power of Attorney enables an agent to make healthcare decisions for you. It ensures your preferences are honored when you’re unable to express them. It may work alongside a living will or healthcare directive, making it valuable for estate planning.

A Financial Power of Attorney, on the other hand, grants authority to manage financial and business matters. It ensures your financial estate planning is handled effectively even if you become incapacitated.

Including Powers of Attorney in your estate planning options ensures that your medical and financial affairs are in trusted hands. These documents ensure that your wishes are respected and your needs are managed according to your preferences.

As part of basic estate planning, a POA is an essential tool for achieving the best estate planning outcomes. It’s important to carefully choose your agents and clearly define their responsibilities to ensure your estate planning process is seamless and secure.

Trusts

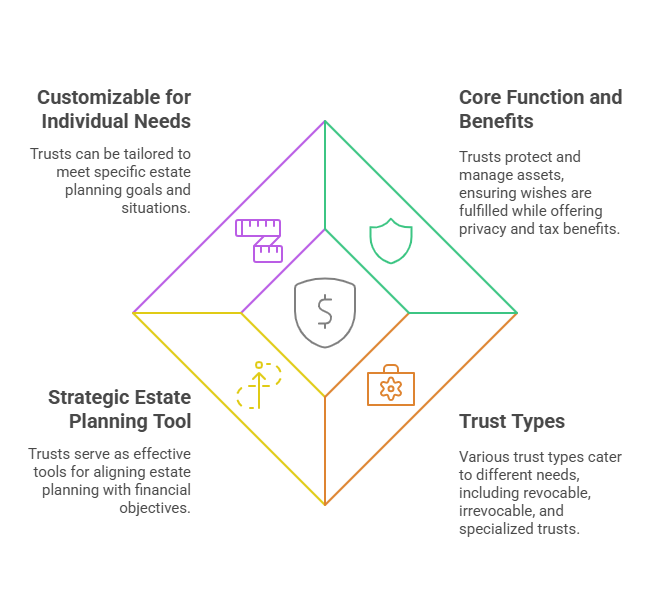

A Trust is a key component of the estate planning process, providing a way to manage and protect assets through a third party, known as a Trustee. This legal arrangement ensures your assets are handled according to your wishes, making it a valuable part of personal estate planning.

- Core Function and Benefits: Trusts are used to manage and protect your assets through a Trustee who follows your instructions. They help avoid probate, keep your financial matters private, protect your assets, and can reduce estate and gift taxes.

- Trust Types: Different types of trusts fit your needs. Revocable trusts can be changed, while irrevocable trusts are permanent. Living trusts take effect during your lifetime, and testamentary trusts are created after your death. Specialized trusts, like Charitable Trusts or Special Needs Trusts, serve specific purposes.

- Strategic Estate Planning Tool: Trusts make estate planning easier by managing your assets efficiently. They help reduce taxes, protect your legacy, and maintain your privacy.

- Customizable for Individual Needs: Trusts can be designed to fit your unique situation and goals. They work for estates of all sizes, helping secure your assets and meet your estate planning needs.

Nomination of Guardian

Being nominated as a guardian in an estate plan is a significant responsibility and a crucial part of personal estate planning. This role involves caring for a minor child if the parents pass away.

- Significant Responsibility: Being chosen as a guardian is essential to estate planning. It means caring for a minor child if their parents pass away. This role signifies trust and honor but requires careful thought and preparation.

- Legal Appointment by Court: A guardian’s duties start only after the court approves the nomination and officially appoints them. This ensures the process follows legal rules and respects the parents’ wishes.

- Proactive Communication is Essential: Talking openly with the person who nominates you as a guardian helps understand their expectations for their children’s care. This ensures their wishes are clear and respected.

- Incorporated Through Estate Planning Documents: Guardians are usually nominated in a will or other estate planning documents. Including this in an estate plan ensures children are cared for as intended.

- Critical for Securing the Future: Adding guardianship nominations to an estate plan protects minor children. It helps create a clear and effective strategy for their well-being and security.

Beneficiary Designations

Beneficiary designations are a vital part of personal estate planning. They allow you to specify who will inherit assets or retirement accounts after passing. This direct assignment bypasses probate, simplifying the estate planning process and ensuring the intended recipients receive assets without unnecessary delays.

- Direct Asset Transfer: Beneficiary designations let assets or retirement accounts skip probate. This ensures a quicker and smoother transfer to your chosen recipients without delays.

- Integration with Estate Planning: Naming your estate as a beneficiary ties these assets into your estate plan. This helps manage complex strategies, like dividing assets among multiple people or following the terms of a will or trust.

- Essential for Reducing Legal Complications: Adding beneficiary designations to your estate plan reduces legal issues. It ensures your wishes are followed and makes managing your estate easier.

- Regular Review and Updates: Reviewing and updating beneficiary designations regularly keeps them in line with your current goals. This supports an efficient transfer of assets and a strong estate plan.

Advanced Directives

Advance Directives, including Healthcare Directives like a Durable Healthcare Power of Attorney and a Living Will, are essential components of personal estate planning. These legal documents ensure that your healthcare preferences are followed if you cannot decide for yourself.

Durable Healthcare Power of Attorney

A Durable Healthcare Power of Attorney allows you to choose someone you trust to make medical decisions if you cannot do so yourself. This person, called your agent, will ensure your healthcare preferences are followed during critical moments.

Living Will

A Living Will outlines your specific choices for medical treatments, such as artificial hydration, nutrition, and CPR. It guides doctors and loved ones, making your wishes clear in various healthcare scenarios.

Many people combine a Durable Healthcare Power of Attorney and a Living Will into one document. This creates a comprehensive plan for healthcare decisions, ensuring your preferences are respected and upheld.

Including these Advance Directives in your estate plan is a responsible step. It provides peace of mind, reduces stress for loved ones, and ensures your medical wishes are fulfilled. Whether starting your estate plan or updating it, these documents are essential for protecting your future healthcare decisions.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!