Retirement Planning for Entrepreneurs

Customized Retirement Planning for Entrepreneurs

At Modern Wealth, we specialize in providing bespoke retirement planning for entrepreneurs. We offer strategies personalized to business owners’ unique financial challenges and opportunities.

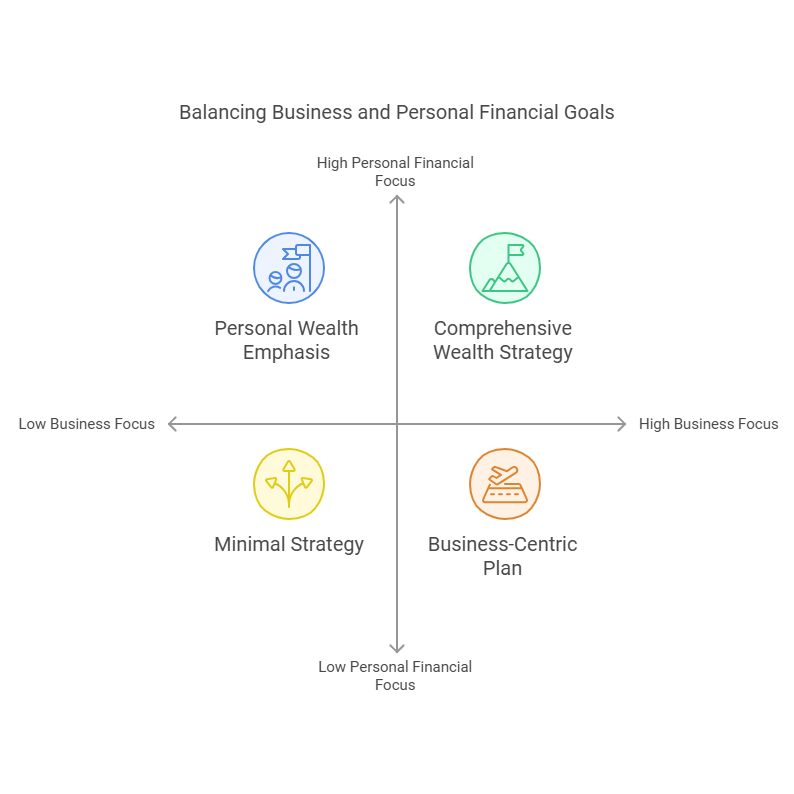

Entrepreneurs often face irregular income streams, reliance on business assets for retirement, and balancing personal and business financial goals. Our expert approach ensures that your retirement plan aligns seamlessly with your entrepreneurial journey. It secures your financial future while preserving the freedom to pursue your passions.

By crafting personalized retirement strategies, we help you optimize your wealth growth and preservation. Our comprehensive analysis evaluates business valuations, tax-efficient savings options, and diversified investment strategies to ensure your retirement plan supports your aspirations.

Effective financial planning for entrepreneurs requires strategically balancing current business demands with long-term personal wealth objectives. At Modern Wealth, we provide actionable advice and innovative tools to help entrepreneurs design a retirement financial plan.

Optimize Retirement Savings Strategies

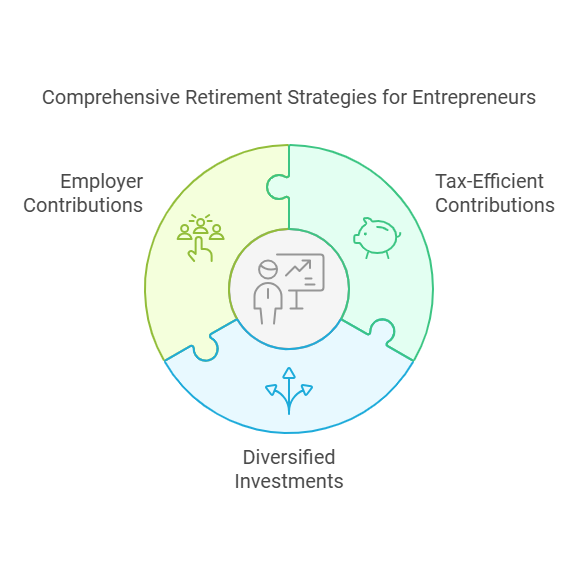

Entrepreneurs often have access to unique retirement savings vehicles, such as SEP IRAs, SIMPLE IRAs, and Solo 401(k)s. Our team evaluates the best options based on your business structure, income level, and retirement goals. Key components of our approach include:

- Tax-Efficient Contributions: Maximize your retirement savings while reducing taxable income through strategic use of contribution limits.

- Diversified Investments: Balance risk and return with portfolios that align with your financial goals.

- Employer Contributions: For those with employees, we provide guidance on matching contributions to create competitive benefits while enhancing personal savings.

By integrating these strategies into your retirement plan, we ensure your financial resources are allocated effectively to support your business and retirement aspirations.

Whether you’re exploring 401(k) for entrepreneurs or other retirement savings vehicles, we guide you toward the best fit for your goals.

Predict Your Retirement Future

At Modern Wealth, we use advanced forecasting tools, such as Monte Carlo simulations, to evaluate the success of your financial retirement plan. These simulations assess your portfolio’s performance under various economic scenarios, setting benchmarks for success.

Key Features of Our Retirement Confidence Analysis:

- Scenario Testing: Evaluate 1,000 potential outcomes to determine the likelihood of achieving your retirement goals.

- Risk Assessment: Identify your plan’s vulnerability areas and adjust savings, spending, or investment strategies accordingly.

- Benchmarking Success: Aim for an 85% success rate to ensure your retirement financial plan is robust.

These insights empower business entrepreneurs to make informed decisions. It balances current business investments with future personal financial stability. We simplify these insights for beginners in retirement planning to help them start on the right path.

Visualize Your Retirement Path

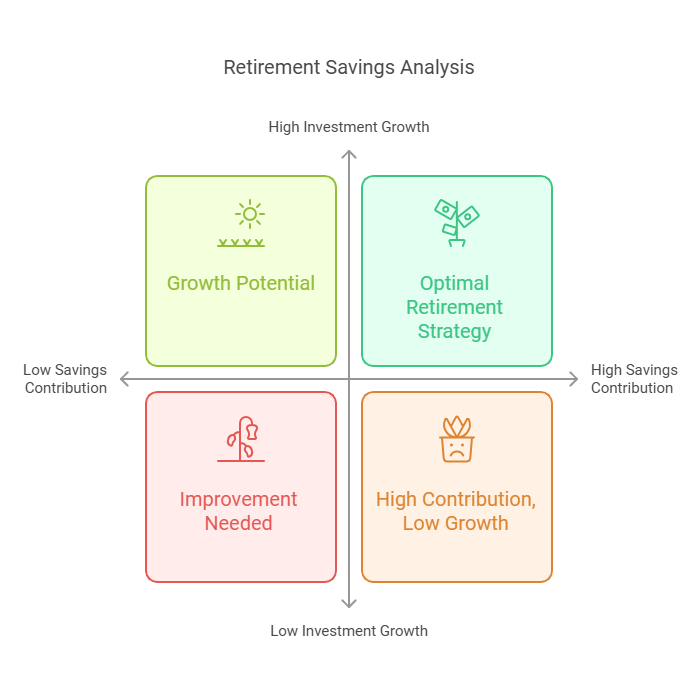

Our Retirement Savings Analysis tool provides entrepreneurs with a clear view of their progress toward retirement. The tool features four essential visualizations:

- Current Year Savings: Track your savings contributions for the year.

- Savings Over Time: Monitor cumulative growth to evaluate long-term trends.

- Savings Rate: Review the percentage of your income allocated to retirement savings annually.

Total Savings and Returns: Understand the combined impact of contributions and investment growth.

Retirement Plan Analysis

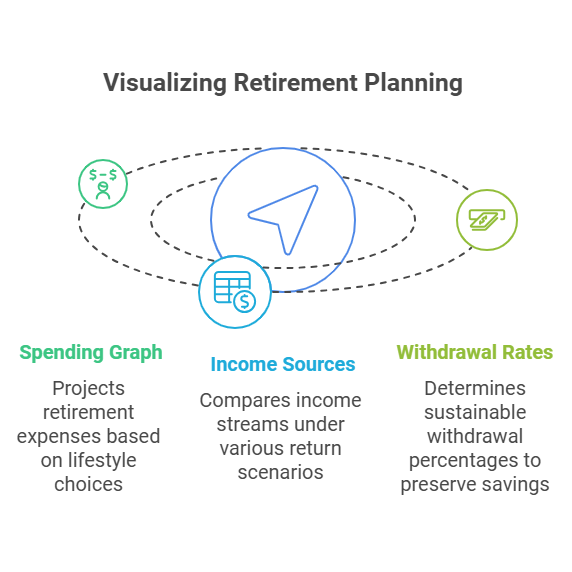

To complement your savings overview, we provide visualizations that focus on critical aspects of financial and retirement planning:

- Spending Graph: Project retirement expenses based on lifestyle choices.

- Income Sources: Compare income streams under various return scenarios.

- Withdrawal Rates: Determine sustainable withdrawal percentages to avoid depleting your savings prematurely.

These tools simplify complex financial data, helping entrepreneurs visualize their path to a secure and fulfilling retirement. Whether you’re planning for retirement for beginners or experienced investors, our tools offer clarity and confidence.

Maximize Business Valuation for Retirement

Entrepreneurs often rely on the sale or succession of their business as a significant component of their retirement strategy. Our expert advisors assist with:

- Business Valuation: Accurately assess the worth of your business to incorporate it into your retirement financial plan.

- Exit Strategies: Develop a clear roadmap for selling, transferring, or succession planning.

- Tax Mitigation: Implement strategies to minimize taxes during business transitions.

By integrating your business assets into your retirement plan, we ensure a comprehensive approach that maximizes value and aligns with your long-term goals. Tax planning for entrepreneurs plays a crucial role in making these transitions smooth and financially advantageous.

Optimize Social Security Timing

Social Security is vital to many retirement plans, but timing is critical to maximizing benefits. Our Social Security optimization tool evaluates over 700 filing strategies to identify the best approach for entrepreneurs.

Features Include:

- Customized Analysis: Personalized recommendations based on income, age, and business structure.

- Visual Comparisons: Graphical insights illustrate the financial impact of different filing scenarios.

- Integrated Planning: Align Social Security timing with your broader retirement investment plan.

This ensures you make informed decisions, maximize benefits, and secure a balanced retirement strategy. Whether you’re considering how retired people start their own business or transitioning out of a business, our approach ensures comprehensive planning.

Simplify Healthcare Decisions

Healthcare planning is a critical yet often overlooked aspect of retirement. Our Medicare Planning platform simplifies this process for entrepreneurs nearing retirement age.

Key Benefits:

- Personalized Recommendations: Customized guidance based on travel habits, health needs, and financial goals.

- Intuitive Design: Visual comparisons highlight coverage details, helping you make informed choices.

- Integration with Financial Plans: Ensure healthcare decisions align seamlessly with your overall retirement strategy.

By addressing healthcare costs and coverage early, entrepreneurs can reduce stress and focus on enjoying their retirement.

Actionable Retirement Planning for Entrepreneurs

At Modern Wealth, we understand the unique challenges entrepreneurs face in planning for retirement. Our holistic approach encompasses wealth growth, business transition strategies, tax-efficient savings, and optimized Social Security and Medicare planning.

By integrating innovative tools and expert advice, we empower entrepreneurs to craft a retirement plan that reflects their ambitions and ensures financial stability.

Let us help you design a retirement financial plan as dynamic and resilient as your entrepreneurial journey. Contact us now to start planning for a secure and fulfilling retirement.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!