Financial Planning for Business Owners

Thursday, May 16, 2024

Running a successful business requires more than just a great product or service. It also entails diligent financial planning and management. As a business owner, you have the responsibility to ensure that your finances are in order and that you are making informed decisions that drive growth and profitability. Financial planning is not just about managing your current finances; it also involves forecasting future scenarios and preparing for potential challenges. Business owners need to consider factors such as market fluctuations, industry trends, and regulatory changes when creating a financial plan. By conducting thorough research and staying informed about external influences, you can adapt your financial strategies to stay ahead of the curve.In addition to setting financial goals and creating budgets, business owners should also prioritize risk management in their financial planning process. This involves identifying potential risks that could impact your business’s financial health, such as economic downturns, natural disasters, or changes in consumer behavior. By developing contingency plans and establishing emergency funds, you can mitigate the impact of unforeseen events and ensure the stability of your business operations. Furthermore, financial planning is not a one-time task but an ongoing process that requires regular review and adjustments. As your business grows and evolves, your financial goals and priorities may change, requiring you to update your financial plan accordingly. By regularly monitoring your financial performance and revisiting your strategies, you can ensure that your business remains on track to achieve long-term success.

Setting Clear Financial Goals for Your Business

One of the first steps in financial planning for business owners is to establish clear and measurable financial goals. These goals should be realistic, time-bound, and aligned with your overall business objectives.

For example, if your goal is to increase revenue by 20% in the next year, you can break it down into smaller, actionable steps. This may involve developing a marketing strategy to reach new customers, optimizing your pricing strategy, or launching new products or services.

By setting clear financial goals, you can track your progress, stay motivated, and make the necessary adjustments to achieve them. Regularly reviewing and revising your goals ensures that you are on track and allows you to adapt to any changes in the business environment.

Furthermore, setting financial goals can also help you prioritize your spending and investment decisions. It allows you to allocate resources effectively towards activities that directly contribute to achieving your objectives. For instance, if one of your goals is to expand your business internationally, you may need to budget for market research, legal fees, and operational costs associated with entering new markets.

Additionally, clear financial goals provide a benchmark for evaluating the performance of your business. By comparing your actual financial results to the goals you have set, you can identify areas of strength and weakness, enabling you to make informed decisions to drive growth and profitability.

Strategies for Managing Cash Flow Effectively

Managing cash flow is a common challenge for many business owners. However, with proper planning and effective strategies, you can ensure that your business has enough cash on hand to cover its expenses and maintain operations.

One of the best ways to manage cash flow effectively is to create a cash flow forecast. This involves projecting your future income and expenses to identify any potential shortfalls and plan accordingly. By spotting any potential issues ahead of time, you can take proactive measures, such as negotiating better payment terms with suppliers or adjusting your pricing structure.

Additionally, it’s crucial to have a good working relationship with your bank. Regularly communicating with your bank and having an open line of credit can provide a safety net during periods of financial strain.

Another essential strategy for managing cash flow effectively is to closely monitor your accounts receivable. Keeping track of the payments owed to your business and following up on any overdue invoices can help improve your cash flow. Implementing clear payment terms and offering incentives for early payments can also encourage clients to settle their accounts promptly.

Furthermore, diversifying your revenue streams can help stabilize your cash flow. Relying on a single source of income can make your business vulnerable to fluctuations in the market. By expanding your product line or services, targeting new customer segments, or exploring different sales channels, you can create a more resilient business model that can withstand economic uncertainties.

Tax Planning Tips for Business Owners

Taxes are an unavoidable part of running a business, but that doesn’t mean you can’t optimize your tax strategy to minimize liabilities and maximize savings. Effective tax planning involves understanding the tax laws, taking advantage of tax incentives, and properly documenting your business expenses.

Working closely with a qualified tax professional can help you navigate the complexities of the tax code and identify legitimate deductions and credits. They can also advise you on the best structure for your business, whether it’s a sole proprietorship, partnership, corporation, or LLC, to optimize your tax situation.

Keeping accurate and thorough records is also essential for tax planning. Implementing a robust accounting system and diligently tracking your income and expenses will ensure that you are well-prepared come tax season.

Another crucial aspect of tax planning for business owners is understanding the different tax deductions available to you. Common deductions include expenses related to office space, equipment, employee wages, and marketing costs. By leveraging these deductions effectively, you can reduce your taxable income and ultimately lower your tax bill.

Furthermore, staying informed about changes in tax laws and regulations is key to successful tax planning. Tax codes are constantly evolving, and being aware of new developments can help you adapt your tax strategy accordingly. Consider attending tax seminars, subscribing to tax newsletters, or consulting with your tax professional regularly to stay up-to-date.

Investing in the Growth of Your Business

While financial planning is essential for managing day-to-day operations, it is equally important for positioning your business for long-term growth. Investing in your business allows you to expand your operations, reach new markets, and stay competitive in a rapidly changing business landscape.

Identify areas of your business that have the most growth potential and allocate resources accordingly. This could involve investing in research and development, hiring additional staff, or upgrading your technology infrastructure. By making strategic investments, you can drive innovation, improve efficiency, and ultimately increase your bottom line.

Moreover, investing in marketing and branding can also play a crucial role in the growth of your business. Building a strong brand presence through targeted marketing campaigns and engaging with your audience on social media platforms can help increase brand awareness and customer loyalty. Additionally, investing in customer service training for your employees can enhance the overall customer experience, leading to repeat business and positive word-of-mouth referrals.

Furthermore, exploring strategic partnerships and collaborations with other businesses in your industry can open up new opportunities for growth and expansion. By leveraging the strengths and resources of complementary businesses, you can tap into new markets, access new technologies, and benefit from shared expertise. Collaborative efforts can lead to mutual growth and success, creating a win-win situation for all parties involved.

Protecting Your Business and Personal Assets

Running a business comes with risks, and it’s crucial to take steps to protect your business and personal assets. This involves having the right insurance policies in place, implementing robust cybersecurity measures, and having legally binding contracts with your suppliers, employees, and clients.

Insurance coverage, such as liability insurance, property insurance, and business interruption insurance, can safeguard your business against unexpected events and mitigate financial losses. Cybersecurity measures, such as firewalls, encrypted communications, and regular data backups, are essential for protecting your business from cyber threats.

Having legally binding contracts with suppliers, employees, and clients helps establish clear expectations and protects your business interests. Consulting with a qualified attorney can ensure that your contracts are sound and that you are adequately protected.

Retirement Planning for Business Owners

As a business owner, it’s essential to plan for your retirement. While running your business may be your primary source of income, it’s crucial to have a retirement plan in place to ensure financial stability and security during your golden years.

Consider setting up a retirement account, such as an Individual 401(k) or a Simplified Employee Pension (SEP) IRA. These retirement plans offer tax advantages and allow business owners to contribute more significant amounts compared to traditional IRAs.

It’s also important to regularly review and adjust your retirement plan as your business evolves. As your business grows, you may have additional opportunities for tax-deferred contributions, and it’s essential to take advantage of them.

Succession Planning: Passing on Your Business Legacy

While retirement planning is essential, it is equally important to plan for the future of your business after you retire or decide to move on. Succession planning involves identifying and preparing a successor to ensure a smooth transition of ownership and leadership.

Start by determining your goals for succession. Are you looking to sell the business to an external party, pass it on to a family member, or internalize it through a management buyout? Once you have clarity on your goals, you can start grooming a successor and putting a plan in motion.

This may involve delegating responsibilities and gradually transferring ownership, training potential successors, or seeking the help of professionals, such as business brokers or consultants, to find suitable buyers or partners.

By carefully planning the succession of your business, you can preserve your legacy, ensure continuity, and set your business up for continued success.

Conclusion

Financial planning is a critical component of running a successful business. It allows you to set clear goals, manage cash flow effectively, optimize tax strategies, invest in growth opportunities, and protect your business and personal assets. Additionally, retirement planning and succession planning ensure financial security and a smooth transition for the future. By taking the time to develop a comprehensive financial plan, you can position your business for long-term success and achieve your entrepreneurial dreams.

January 31, 2025

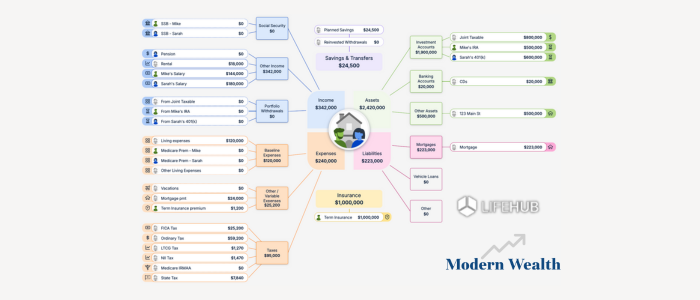

Life Hub at Modern Wealth

January 22, 2025

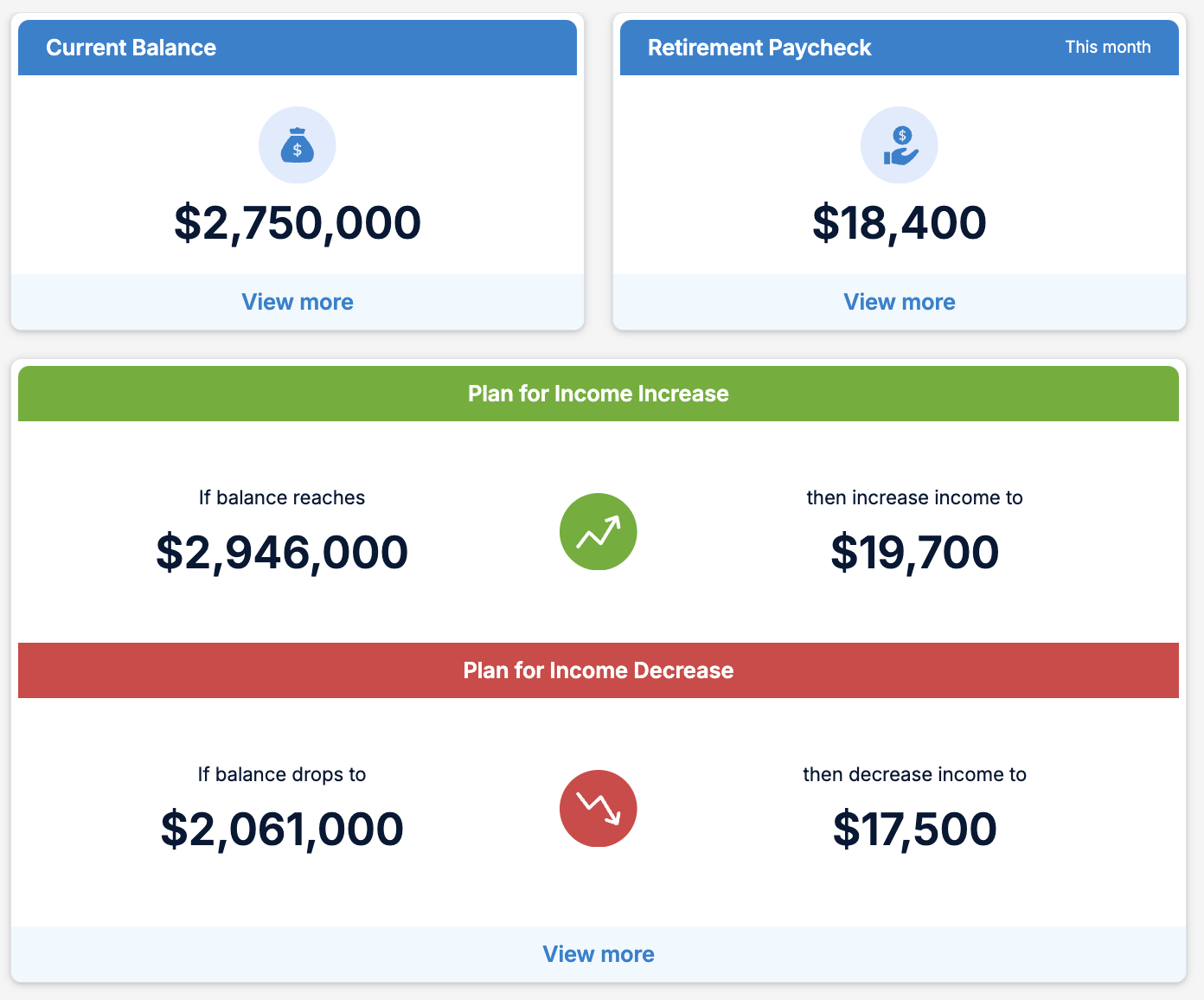

Modern Wealth’s Retirement Optimizer