Navigating the 2024 Election Season

Friday, November 1, 2024

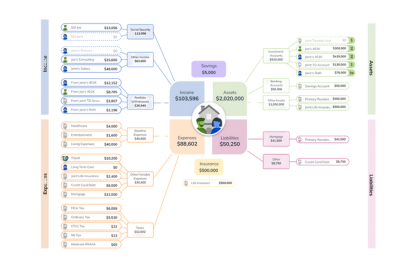

As the 2024 presidential election season approaches its conclusion, the stakes are high, not just in terms of political outcomes but also for financial markets. It’s natural for investors to wonder how the election results might impact their portfolios and whether they should make any changes. Let’s dig into what history and current research tell us about this unique election cycle and the broader financial implications for both the short and long term.

Historical Context: What the Data Tells Us

First, it’s crucial to remember that U.S. markets have historically risen during election years. Since 1950, U.S. stocks have averaged returns of 9.1% in these years, according to research by Fidelity’s Denise Chisholm, director of quantitative market strategy (source: Fidelity’s Denise Chisholm, November 2023). A blend of anticipation and uncertainty often marks the election year, but the long-term data reveals an upward trend across most election cycles.

The S&P 500’s performance data from post-election periods is insightful as well. The index has historically averaged an 8.3% return in the first year following an election. Year two shows a more modest 3.4%, year three boasts 14.7% and year four matches the election-year average at 9.1%. It’s clear that while election years can be turbulent, the stock market has historically weathered them quite well. The adage holds that past performance does not guarantee future results, but it offers context and reassurance (source: Haver, FactSet, FMR, November 2023).

Elections and Market Performance: A Nonpartisan Analysis

One of the most persistent myths is that one party is inherently better for the stock market than the other. The reality? Markets are nonpartisan. The historical data shows no consistent advantage for either Democrats or Republicans. The S&P 500 has averaged positive returns under nearly every combination of political control (source: Strategas Research Partners, November 2023).

Robust historical analysis supports the idea that markets rise over the long term, regardless of which party holds power. While the U.S. stock market has historically performed better under Democratic presidents by a wide margin, that data is skewed by the significant economic recoveries following major crashes, such as those in 1929 and 2008, which happened under Republican administrations (source: Rob Arnott, Bradford Cornell, and Vitali Kalesnik, 2017).

Ultimately, investors need to remember that political headlines may create short-term volatility, but markets are driven by much more than presidential policies. Corporate earnings, economic growth, interest rates, and inflation have a far greater impact on market trajectories than which party holds office (source: U.S. Bank Asset Management Group).

The Impact of Political Gridlock

One of the most exciting insights from historical data is that markets often thrive under a divided government. This may seem counterintuitive, but a closer look reveals why this is true. Significant policy shifts are less likely when different parties control the presidency, Senate, and House, and the status quo is maintained. Markets favor stability, which political gridlock often provides (source: Darrow Wealth Management).

Darrow Wealth Management and other experts have pointed out that divided government scenarios result in higher stock market returns. Returning to 1958, elections with split-party outcomes have averaged two-year S&P 500 gains of 20.7%, compared to 14.2% for one-party rule. This stability can reduce policy-driven uncertainty, making it easier for businesses to plan and for markets to stay on an even keel (source: U.S. Bank Asset Management Group).

Market Movement in Election Seasons

Investors often ask, “Has the market already priced in the election?” The short answer is yes, to some extent. Markets are forward-looking and adjust to perceived outcomes well before the results are officially in. For example, prediction markets such as Kalshi and Polymarket show a higher likelihood of a Donald Trump win in late October 2024 (source: Polymarket, October 2024). These indicators inform market expectations, but surprises can still move markets significantly.

What if Kamala Harris wins? While the race remains too close to call, a Harris victory could lead to more market movement due to lower current expectations of her winning than Trump. The most significant policy impacts will come from how power is divided in Congress, not just who sits in the Oval Office (source: Rob Haworth, U.S. Bank Asset Management).

Policies and Sector Impacts

While making investment decisions based on anticipated policy impacts is tempting, this is often a risky strategy. Historically, there has been little consistency in how specific sectors perform during election years, regardless of who wins (source: Fidelity’s Anu Gaggar). For example, renewable energy stocks surprisingly performed well under Trump, while traditional energy companies have done well during Biden’s term. The unpredictability of sector performance makes placing bets on individual industries risky.

Furthermore, academic research, including a 2024 regression-based study by the Bank of Italy, highlights that specific policy expectations (e.g., Trump’s tariff plans or Harris’s proposed tax changes) can be correlated with market responses but are challenging to predict with certainty (source: Bank of Italy, 2024).

Economic Fundamentals Over Politics

As investors, we need to stay focused on fundamentals. Corporate earnings, economic growth, and inflation trends matter far more for long-term market performance than political outcomes. Anu Gaggar of Fidelity points out that politically driven economic cycles are more relevant to emerging markets with weaker institutions, not developed markets like the U.S. (source: Fidelity’s Anu Gaggar).

Moreover, trying to time market moves based on election outcomes or campaign promises is often a mistake. Proposals on the campaign trail frequently change once a candidate is in office. Instead of making adjustments based on speculation, it’s wiser to build a well-thought-out, diversified financial plan (source: Naveen Malwal, Strategic Advisers, LLC).

Sticking to Your Long-Term Plan

It’s easy to get caught up in the noise surrounding election cycles. The headlines may be alarming, with each candidate portraying economic doom if their opponent wins. However, as seasoned investors know, reacting impulsively to political rhetoric can backfire. Even in years following presidential elections, when markets show weaker performance, the long-term trend remains positive (source: Darrow Wealth Management, U.S. Bank Asset Management Group).

As Jurrien Timmer, Fidelity’s director of global macro, aptly puts it, “Elections tend to have less impact on the markets than politicians may like to believe” (source: Jurrien Timmer, Fidelity).

Final Thoughts

The 2024 election will undoubtedly be historic, and its results could introduce short-term market movements. However, as investors, we should focus on long-term goals, diversified portfolios, and sound financial principles. Whether the next president is Kamala Harris or Donald Trump, whether Congress stays divided or shifts to single-party control, the most important takeaway is this: stay invested, stay diversified, and trust the process (source: Multiple).

Remember, markets are resilient and have historically risen through all political climates. Your financial plan should be built to withstand not just elections but the ups and downs of all market cycles. So take a deep breath, stay informed, and rest assured that you can weather whatever comes next with a thoughtful strategy. If your financial plan or investment portfolio could use a second opinion, we’d be happy to help. Schedule an Intro Call here!

April 3, 2025

What Does Liberation Day Mean for Your Financial Plan

March 13, 2025

Understanding the Link Between Tariffs and Inflation