Education Planning

Education Savings Plan

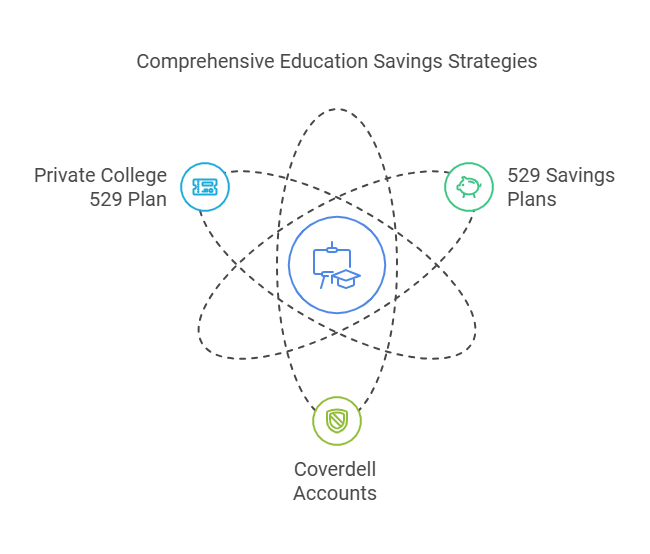

At Modern Wealth, we help you prepare for one of life’s most important investments—your child’s education. Our education planning services are designed to provide clarity and strategy, with expert guidance on tax-advantaged savings tools like 529 Plans, Coverdell Education Savings Accounts, and the Private College 529 Plan.

We walk you through each option, starting with 529 Plans, which allow your investments to grow tax-free and be used for qualified educational expenses. We also advise on Coverdell accounts, which offer flexible spending for a range of educational costs and broader investment choices. For families eyeing private institutions, the Private College 529 Plan offers the advantage of locking in today’s tuition rates.

We aim to create a tailored education funding strategy for your family’s financial goals and timeline. With Modern Wealth, you’re not just saving for college—you’re building an innovative, forward-looking plan that supports your child’s future without compromising your own.

Financial Aid Planning

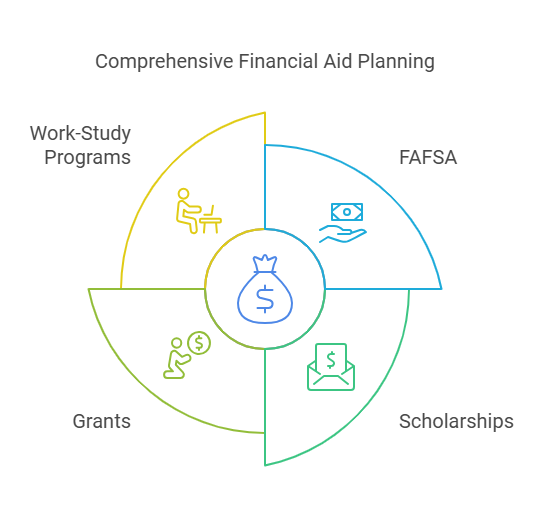

We guide families through the complex financial aid landscape, ensuring you’re fully equipped to make informed decisions about funding education. From understanding available options to submitting key applications, we help you build a strategic, stress-free education financial plan.

Filing the FAFSA is a critical first step, unlocking access to federal loans, scholarships, and work-study opportunities. We walk you through the process and explain how each type of aid fits into your broader financial picture—ensuring no opportunity is missed.

We also provide expert insight into scholarships, grants, and work-study programs. Scholarships and grants can significantly reduce education costs, while work-study programs offer valuable income without jeopardizing aid eligibility. With Modern Wealth, you gain a partner in navigating education aid so you can confidently invest in your child’s future.

Alternative Funding Strategies

At Modern Wealth, we help families fund education costs without compromising long-term financial stability. Our strategic approach explores various options—from leveraging home equity to utilizing life insurance—while always considering the impact on your broader financial picture.

For homeowners, tapping into home equity can offer tax advantages, but it’s crucial to weigh the risks. We guide you through the pros and cons to ensure this option aligns with your financial capabilities. Likewise, while retirement savings like 401(k)s and Roth IRAs can be accessed for education, we advise caution to avoid penalties and preserve your future retirement security.

Permanent life insurance offers another flexible route—borrowing against its cash value can provide fast, aid-neutral funding. However, this may reduce your death benefit, so evaluating this strategy carefully is essential. At Modern Wealth, we tailor education funding plans that support your child’s future while safeguarding your own.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!