The Modern Entrepreneur Blog

Thursday, April 3, 2025

What Does Liberation Day Mean for Your Financial Plan

What Is Liberation Day—and Why Should You Care?

Liberation Day is the nickname for the day the U.S. unveiled a bold, sweeping shift in global trade policy. Announced dramatically, the move marked the beginning of a new era of tariffs—an era no longer defined by free trade but by reciprocal tariffs designed to rebalance America’s trade relationships.

The policy shocked many analysts with its scale:

- Average U.S. import tariffs rose from an expected 10% to approximately 25%

- Over 60% of imports were impacted

- Roughly $650 billion in potential new tariff revenue—similar in size to total U.S. corporate income tax receipts

But what does this mean for your financial plan?

At Modern Wealth, financial decisions should be grounded in understanding—not reaction. In this blog, we summarize the impact of Liberation Day in plain terms and explain how it may influence inflation, interest rates, and the broader economic outlook in ways that matter to you.

Understanding Tariffs and Their Role in Economic Policy

Tariffs are taxes placed on imported goods. While often discussed in political or global terms, tariffs affect consumers, investors, and the economy. They’re used to:

- Protect domestic industries

- Encourage reshoring of manufacturing

- Influence trade partners

- Raise government revenue

On Liberation Day, the U.S. imposed reciprocal tariffs targeting trade imbalances. While key items like autos (already tariffed), steel, aluminum, semiconductors, pharmaceuticals, and energy were exempt, most consumer goods are now subject to new duties.

The global reaction was swift. Trade partners and financial markets scrambled to assess the implications. But for long-term investors and financial planners, the focus should be on the economic mechanisms behind these changes—and how they ripple through spending, inflation, and risk management.

Do Tariffs Automatically Lead to Inflation?

A common question is: “Don’t tariffs just mean higher prices for everyone?” The answer? Not exactly.

Tariffs raise the prices of affected goods at the margin, but they also tend to act as a fiscal drag on the economy—pulling down overall consumer spending and, in some cases, reducing broader inflation.

Example: The Gas Tax Analogy

Imagine a new $2-per-gallon gas tax, raising prices from $3 to $5. That could temporarily increase the inflation rate by 2% but also leave consumers with $270 billion less to spend elsewhere. Over time, that drop in demand across other goods and services could lower inflation more broadly.

Economists estimate that after such a shock, long-term inflation could be knocked off by about 0.7%—even though short-term prices jump.

This is how Liberation Day’s tariffs may function:

- Short-term impact: Higher prices on select goods

- Longer-term effect: Reduced spending, slower growth, potentially lower inflation

How the Federal Reserve May React (and Why It Matters to You)

Since the Federal Reserve controls interest rates, understanding how it might respond to these new tariffs is critical for financial planning.

Here’s what we know:

- The Fed looks beyond short-term price increases and focuses on sustained inflation trends

- If tariffs slow the economy, the Fed may hold or even lower rates—not raise them

- This would affect mortgage rates, loan costs, savings yields, and market expectations

Translation: Just because prices rise in the near term doesn’t mean interest rates will follow. That’s why a financial plan should be based on durable principles, not short-term assumptions.

Liberation Day’s Global Impact: A Quick Overview

Europe

- EU hit with 20% tariffs, U.K. with 10%

- German exports, particularly autos, now face steep costs

- Luxury brands (Gucci, Burberry, LVMH) exposed due to high U.S. sales share

Asia

- Tariffs above 40% hit countries like Vietnam, Cambodia, Bangladesh, and Indonesia

- Supply chains in retail, apparel, and electronics are being reexamined

- Many companies are considering new manufacturing hubs or shifting markets

Shipping and Logistics

- Companies like Maersk and DSV expect trade volumes to decline

- Tariffs applied at export rather than at U.S. arrival adds new complexities

Pharmaceuticals & Utilities

- Pharma was initially spared but flagged for future review

- Utilities emerged as short-term defensive plays amid volatility

What Liberation Day Means for Your Financial Plan

So how does this all tie back to your finances? Let’s break it down into actionable insights:

1. This Is a Structural Shift, Not a Passing

Trend Liberation Day wasn’t a one-time shock—it reflects a fundamental change in how the U.S. approaches trade. A well-designed financial plan should account for structural change, not just market cycles.

2. Inflation Will Be Uneven

Prices on specific imported goods may rise, but overall inflation could moderate. Tariffs reduce spending power, which slows demand and can ease price pressures across the broader economy.

3. Interest Rates May Not Spike

The Federal Reserve will likely interpret these changes cautiously, especially if demand and growth slow. That means your borrowing and investment strategy should stay balanced and informed, not reactionary.

4. Diversification Still Matters

Industries exposed to global trade (luxury, autos, retail) may see headwinds. Others (utilities, domestic services, and health care) may stay more resilient. A well-diversified investment portfolio is your best defense.

5. You Already Have a Plan—for This

At Modern Wealth, we build financial plans to be resilient—through inflation, recession, market cycles, and yes, even global tariff shifts. Liberation Day doesn't change your goals—it just reminds us why clarity, strategy, and discipline are so important.

Looking Ahead: A Turning Point in Global Trade

While we’re not here to predict the future, we can say this: Liberation Day marked a turning point. Whether this leads to new trade agreements, economic slowdowns, or greater regional self-reliance remains to be seen.

But one thing is clear: we’re not returning to the old free and open trade model without conditions.

For investors, families, and business owners, the key is to stay informed and keep perspective.

Final Thought: Don’t React—Respond with Purpose

Liberation Day may have changed the global trade landscape. Still, it didn’t change the fundamentals of financial planning:

- Know your goals

- Understand your risks

- Diversify your strategy

- Stay focused on what you can control

We’re here to help you do exactly that.

Let’s Talk About What This Means for You

If you’re wondering how tariffs, inflation, or policy shifts could impact your financial plan, let’s talk. Schedule a free consultation today, and let Modern Wealth help you navigate this new era with clarity and confidence.

Thursday, March 13, 2025

Understanding the Link Between Tariffs and Inflation

When discussing inflation, tariffs often enter the conversation as a key concern. Many fear that new tariffs on imported goods will trigger rising prices across the board, fueling inflation and squeezing household budgets. While this may seem logical on the surface, the broader economic reality is more complex. At Modern Wealth, we aim to provide financial clarity so you can make informed decisions. Let’s explore the true impact of tariffs on inflation and what it means for your financial plan.

Understanding the Link Between Tariffs and Inflation

At their core, tariffs are a form of taxation on imported goods. When a tariff is imposed, the price of the affected product generally increases. However, the price hike is not always equal to the full tariff amount, as exporters and supply chain intermediaries absorb some of the cost before it reaches consumers. Given this, the logic seems straightforward: tariffs raise the price of certain goods, so they must be inflationary. But does this mean inflation will rise across the economy? Not necessarily.Tariffs as a Disinflationary Force

While tariffs may increase the price of specific goods, they do not automatically lead to sustained, broad-based inflation. Instead, tariffs act as a form of fiscal contraction—reducing consumer spending power. When consumers have less disposable income due to higher costs on tariffed goods, they often cut back on spending elsewhere. This, in turn, can lead to lower demand for non-tariffed goods, causing their prices to stagnate or even decline. A real-world example of this effect is seen in gas taxes. Suppose the U.S. government imposed a $2 per gallon gas tax on the 135 billion gallons of fuel sold annually. If the full tax were passed to consumers, gas prices would jump by 67% from a national average of $3 per gallon to $5. This shock would initially push the Consumer Price Index (CPI) up by roughly 2%, making inflation appear high in the short term. However, as a result, consumers would have $270 billion less to spend on other goods and services. After accounting for demand elasticity, the net gas tax revenue collected would be $306 billion, leading to an overall consumption drop of about 1.39%. That shift in spending behavior would eventually lower prices in non-energy sectors, reducing inflationary pressure over time. In fact, assuming a general elasticity of -1, about 0.7% would be knocked off the overall inflation rate after the initial shock.What This Means for Investors and Financial Planning

Understanding the true economic impact of tariffs can help us make smarter financial decisions. Here’s what you should keep in mind: Market Reactions Can Be Overblown – Tariffs often create short-term market volatility. However, the Federal Reserve and long-term economic trends matter more in shaping inflation than isolated policy changes. Interest Rates May Not Respond as Expected – Since tariffs can ultimately be disinflationary, they may not lead to higher interest rates as some fear. The Federal Reserve looks past one-time price increases and focuses on sustained inflation trends when making rate decisions. Diversification is Key – If tariffs shift consumer spending patterns, certain sectors may feel the impact more than others. A well-diversified investment portfolio helps mitigate risks associated with these economic shifts. Long-Term Perspective Wins – Economic conditions fluctuate, but a well-structured financial plan accounts for uncertainties like tariffs, inflation, and market swings. By staying disciplined and avoiding reactionary decisions, you can keep your financial goals on track.A Final Thought on Tariffs

At Modern Wealth, we believe in cutting through financial noise and focusing on what truly matters for your long-term financial well-being. While tariffs can affect prices in the short term, they don’t necessarily drive long-term inflation. Instead, they may act as a drag on economic growth and consumer spending. If you have concerns about how inflation, tariffs, or other economic changes could impact your financial plan, let’s talk. Schedule a free consultation today, and let’s navigate the evolving market landscape together.

Friday, January 31, 2025

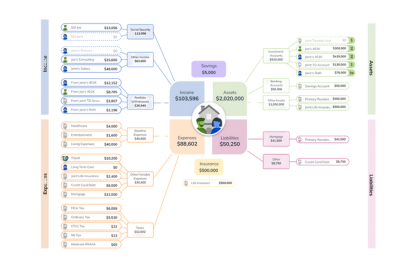

Welcome to LifeHub at Modern Wealth

At Modern Wealth, we believe that financial planning should be more than just numbers on a page—it should be a dynamic, interactive experience that brings your financial future to life. That’s why we leverage Life Hub, an innovative financial visualization tool designed to provide clarity and confidence in retirement income strategies, scenario analysis, and tax planning. In this article, we’ll introduce Life Hub, explore how it enhances financial planning, and explain how we integrate it with our comprehensive approach at Modern Wealth.