Education Planning

Optimize Education Savings

Modern Wealth provides expert guidance on educational planning to secure your child’s academic future. Our education planning services include advising on 529 Savings Plans, which are educational financial plans designed to grow tax-free.

These investment accounts allow for tax-free withdrawals for qualified educational expenses. While contributions are made with after-tax dollars, 529 Plans have no annual contribution limits, only state-dependent lifetime caps, making them a key tool for financial planning for education.

We also offer counsel on Coverdell Education Savings Accounts, a valuable option for education fund planning. These tax-advantaged accounts have annual contribution limits and can be used for a broader range of educational expenses.

Coverdell funds must be utilized before the beneficiary turns 30 and provide more diverse investment opportunities than standard savings accounts. In addition, we assist with the Private College 529 Plan, a federal program that enables families to prepay tuition at current rates for various private colleges.

This strategy helps protect against future tuition increases and supports higher education financial planning. At Modern Wealth, we deliver personalized education planning services to meet your family’s needs. We ensure you’re well-prepared for the significant investment in your child’s education.

Master Financial Aid Planning

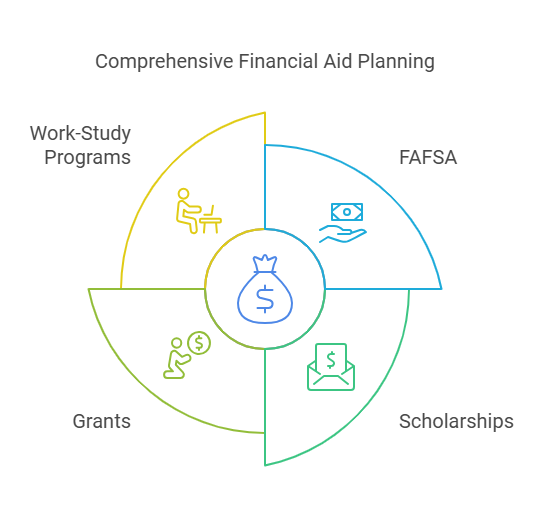

Modern Wealth assists families in understanding and applying for various types of aid. We ensure families are well-prepared for financial planning for education.

Submitting the FAFSA is the first step in estimating potential assistance to university students. It includes loans, scholarships, and work-study programs, which are critical to an educational financial plan.

Scholarships and grants are important in education fund planning, with scholarships being merit-based and grants need-based. Both can substantially lower the cost of education, making them vital tools in higher educational planning.

Additionally, we provide guidance on work-study programs, which offer part-time jobs to students without impacting their financial aid eligibility. These programs are an excellent option for families focused on educational planning.

Alternative Funding Strategies

At Modern Wealth, we provide strategic education financial planning solutions to help families fund education costs while considering their long-term financial health. For homeowners, home equity can serve as a tax-efficient option.

Loans secured against home equity may offer tax deductions. It makes them a viable tool for education fund planning. However, it’s essential to weigh the lack of flexibility if your financial circumstances change.

We recommend a cautious approach for parents considering tapping into retirement savings. Using 401(k) or Roth IRA accounts can have tax consequences and penalties, which may affect your retirement plans. Balancing immediate educational funding with long-term retirement goals is crucial in educational planning.

We also explore using permanent life insurance cash values as a flexible funding source. Borrowing against these policies provides immediate funds without impacting financial aid eligibility.

However, it’s important to understand that this may reduce the policy’s death benefit. Modern Wealth’s education planning services are designed to help you craft an educational and financial plan that aligns with your goals.

Our expertise ensures you can make proper decisions about higher education financial planning. It will secure your child’s academic future while maintaining your financial health.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!