Retirement Planning

Optimize Workplace Retirement

At Modern Wealth, our retirement planning is built around your goals—crafted to help you preserve wealth, grow it wisely, and retire with confidence. We take a strategic, forward-looking approach that balances long-term growth with innovative risk management, always keeping your financial future at the forefront.

We focus on maximizing returns while minimizing unnecessary costs, including expense ratios that can quietly eat into your savings over time. By evaluating the balance between active and passive strategies and optimizing every dollar you invest, we help ensure your retirement plan remains efficient and aligned with your vision.

From salary deferrals and employer matches to evolving tax laws, we guide you through every opportunity to strengthen your retirement strategy. The result is a personalized, tax-aware plan designed to deliver clarity, control, and peace of mind—so you can step into retirement ready and empowered.

Retirement Plan

We bring clarity to your retirement planning by using advanced simulations that test your financial strategy across 1,000 possible outcomes. Our goal is simple: to help you retire confidently, aiming for an 85% success rate—meaning your plan is built to last through life’s uncertainties.

If your score is below 85%, we help adjust key factors like retirement age, spending, or savings. If it’s too high, you may be over-saving at the expense of living fully today. This flexible, data-driven approach ensures your retirement plan is realistic and optimized for your lifestyle.

By visualizing a range of outcomes and highlighting what’s most likely, we make complex projections feel simple and actionable. You walk away with a balanced, personalized strategy designed to deliver peace of mind so you can move into retirement with clarity and control.

Retirement Savings Plan

At Modern Wealth, we give you a clear, visual roadmap for your retirement savings journey. Our Retirement Savings Analysis highlights your progress year by year—showing how much you’ve saved, how your savings grow over time, and how your returns are building toward your goals. It’s designed to help you stay on track and make smarter decisions.

Complementing this, our Retirement Plan Analysis focuses on what your retirement will look like financially. We break down projected spending, income sources, and sustainable withdrawal rates so you can understand how your future lifestyle aligns with your financial plan.

Together, these tools create a powerful, personalized retirement strategy. With clear insights and actionable guidance, we help you plan confidently—ensuring you’re saving and building a future that fits your goals and gives you peace of mind.

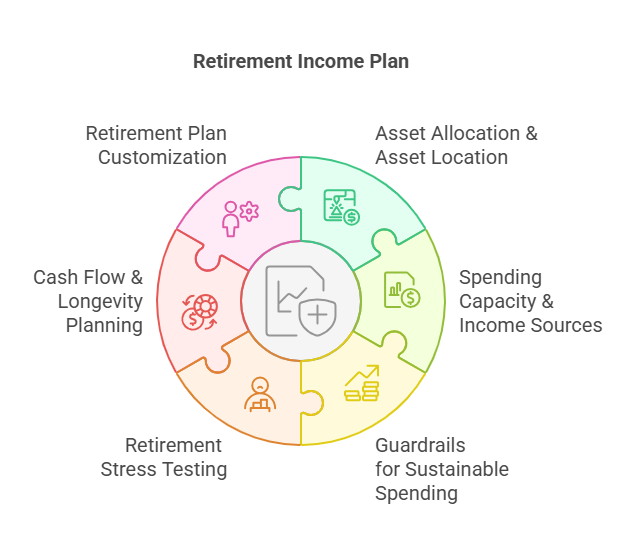

Retirement Income Plan

Our Retirement Income Dashboard gives you a clear, real-time view of your financial readiness for retirement. It shows where you stand today—account balances, assets, liabilities—and helps you adjust your plan as life evolves, keeping your goals front and center.

We break down your asset allocation and how your accounts are taxed—taxable, tax-deferred, or tax-free—so you can make the most of every dollar. You’ll also see how money flows through your plan over time, helping you stay in control and proactive with your strategy.

Just as important, we show what you can safely spend in retirement. By mapping out your income sources alongside your expenses, taxes, and projected surplus or shortfall, you gain the clarity needed to make confident, informed decisions—now and in the future.

Retirement Guardrails

At Modern Wealth, we bring structure and flexibility to your retirement strategy with personalized guardrails that guide sustainable spending. By setting upper and lower portfolio balance thresholds, we help you know when to adjust income—whether to preserve assets or enjoy a well-earned boost—based on your risk tolerance and lifestyle goals.

Our Retirement Income Dashboard also includes powerful stress testing, showing how your plan would have held up in past economic downturns. Knowing that your retirement strategy is built to weather market shifts while staying aligned with your long-term vision gives you peace of mind.

From tracking monthly cash flow to customizing your plan with scenario comparisons and legacy goals, everything is designed to adapt as your life evolves. With Modern Wealth, your retirement plan is more than a projection—it’s a living, responsive strategy that keeps you financially confident for decades.

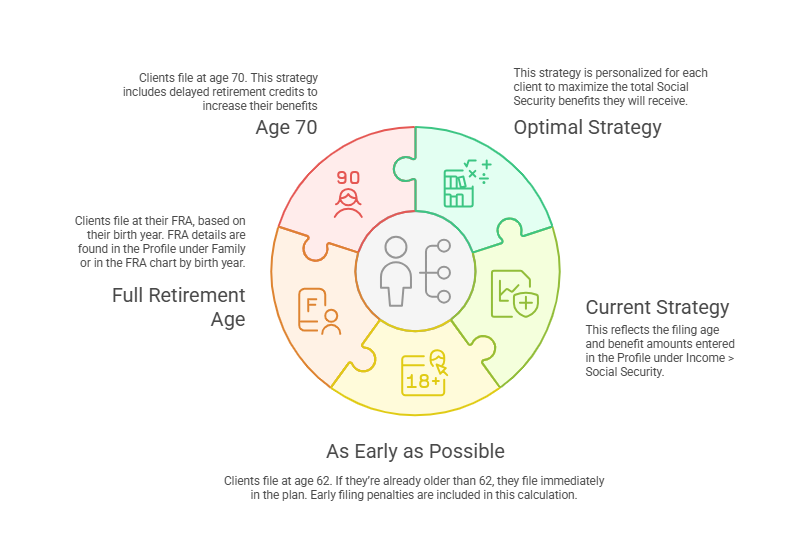

Maximize Social Security

We simplify one of retirement’s most complex decisions—when and how to file for Social Security. Our advanced planning tool compares hundreds of potential strategies and recommends the optimal approach to help you maximize lifetime benefits.

From filing early at age 62 to waiting until age 70 to unlock delayed retirement credits, we evaluate each option against your goals and timeline. You’ll see clear comparisons, personalized insights, and visual projections that make the impact of each choice easy to understand.

This tailored approach ensures that Social Security becomes a strategic asset in your retirement plan. By aligning your filing strategy with your broader financial plan, we help you capture more value and retire with greater clarity and peace of mind.

Medicare Made Simple

Choosing the right Medicare plan starts with three core questions: where you live (and travel), your health needs, and your comfort with financial risk. These guide selecting a plan that fits your care preferences and your budget.

Once a plan is selected, you’ll see exactly what it covers, how to enroll, and what key steps you need to take based on factors like your Social Security status or existing group coverage. It’s a clear, step-by-step path built to eliminate confusion.

Helpful tips along the way ensure you avoid common pitfalls and feel confident in your decision. At Modern Wealth, we make navigating Medicare straightforward so you can focus on your health, not the paperwork.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!