Risk Management

Benefits Package Review

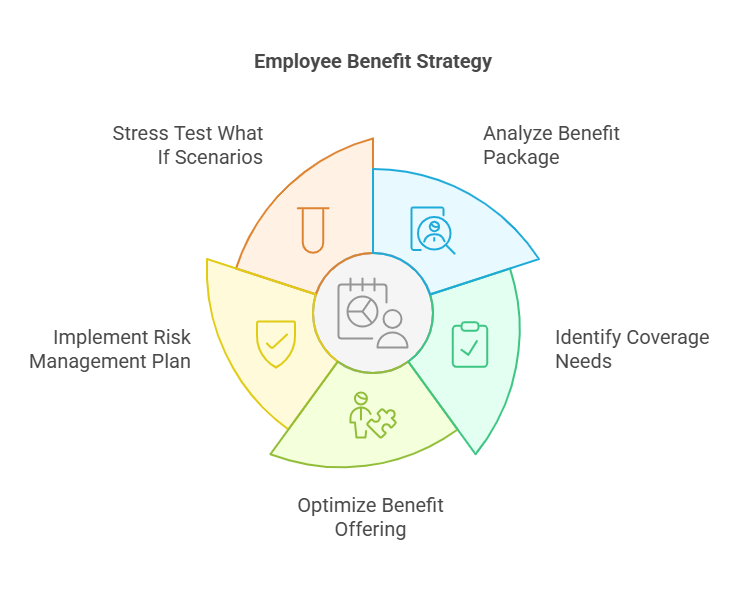

At Modern Wealth, we help our clients get the most out of their workplace benefits by ensuring every offering supports financial security and overall well-being. We take the guesswork out of benefits by providing a precise, strategic analysis designed to help you maximize what you already have and uncover what might be missing.

Our process begins with thoroughly reviewing your current benefits, including health, dental, vision, life, and disability coverage. We identify gaps, overlaps, and opportunities to strengthen your protection—so you’re not paying for what you don’t need and not missing what you do.

By aligning your benefits with your personal goals and lifestyle, we help you make smarter, more informed decisions. Whether navigating open enrollment or planning long-term, Modern Wealth ensures your benefits work harder for you—boosting confidence, saving money, and supporting your future.

Employee Benefit Optimization

We tailor your employee benefits to fit your life—not just your job. By aligning benefit options with your household’s unique needs, we help you unlock more value from your coverage, ensuring it remains practical, relevant, and supportive throughout every life stage.

We also implement innovative risk management strategies to strengthen your benefits package. From reducing financial exposure to improving plan efficiency, our approach helps safeguard your well-being and long-term security while making your benefits easier to understand and use.

We run “what-if” stress tests on your plan to ensure you’re prepared for the unexpected. These simulations reveal how your benefits would perform during life’s curveballs, allowing us to fine-tune your resilience and peace-of-mind strategy. With Modern Wealth, your benefits aren’t just optimized—they’re built to last.

Optimize Your Coverage

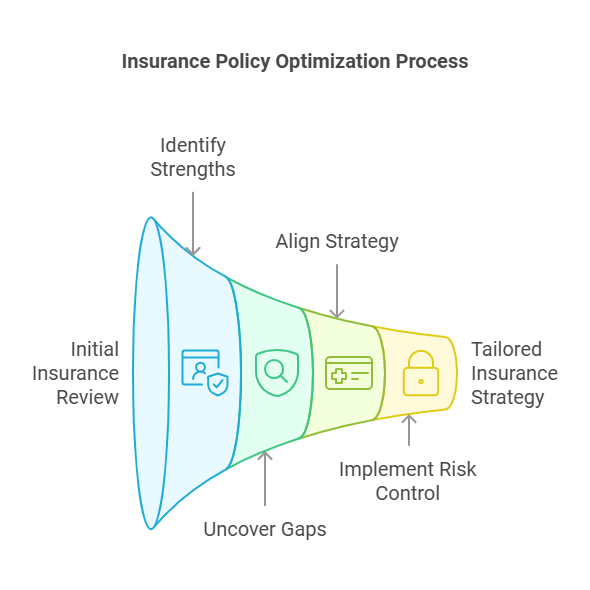

At Modern Wealth, we take a proactive approach to insurance by regularly reviewing your coverage through a risk management lens. Our goal is simple: to ensure your policies—whether life, disability, long-term care, homeowners, auto, or umbrella—are always aligned with your life and financial goals.

Life changes, and your insurance should, too. Our team evaluates your coverage to identify strengths, eliminate gaps, and find cost-saving opportunities. By applying proven risk management techniques, we ensure that you’re protected not just today but well into the future.

With personalized recommendations and stress-tested strategies, we help your insurance evolve alongside you. At Modern Wealth, our risk-managed approach provides peace of mind, allowing you to avoid costly surprises and stay confidently on track through every life stage.

Permanent Life Insurance

We use permanent life insurance as a strategic tool to deliver long-term protection, financial flexibility, and lasting peace of mind. These policies go beyond providing a death benefit—they act as a growing, tax-advantaged financial safety net that supports your evolving goals while aligning with a strong risk management strategy.

With lifetime coverage, permanent life insurance ensures your loved ones are protected no matter what the future holds. As part of each premium, a portion accumulates tax-deferred cash value that you can access for major needs like retirement, emergencies, or education expenses—giving you both security and liquidity when you need it most.

We help you choose the right policy type—Whole Life, Universal Life, or Variable Life—based on your needs and goals. While premiums are higher than term life, the long-term value, flexible access to funds, and estate planning advantages make permanent life insurance a powerful component of a comprehensive financial plan. It’s an ideal vehicle for legacy planning, tax-efficient wealth transfer, and charitable giving—ensuring your plan grows with you and supports your vision for the future.

Term Life Insurance

Term life insurance is a simple, cost-effective way to protect your loved ones during key stages of life. With fixed premiums and coverage typically lasting 10 to 30 years, it offers high protection at a lower cost than permanent life insurance—making it ideal for temporary needs like paying off a mortgage, funding education, or replacing income during your working years.

Unlike permanent policies, term life doesn’t accumulate cash value—its sole purpose is protection. This straightforward structure keeps costs low while still offering peace of mind. If you pass away during the term, your beneficiaries receive the full death benefit; if not, the policy simply ends without any residual value.

Many term policies include a conversion option, allowing you to switch to permanent coverage later—often without a new medical exam. At Modern Wealth, we incorporate this flexibility into your financial plan using proven risk management strategies, keeping you informed of key dates so your protection evolves with your life. Term life is an accessible way to build financial security today with the ability to adapt for tomorrow.

Disability Insurance

Your income powers your lifestyle, goals, and future—making disability insurance a critical part of any financial plan. At Modern Wealth, we help ensure your income is protected, even if illness or injury prevents you from working. Standard group coverage often falls short, so we help you understand your options and tailor a plan that fits your needs.

We guide you through short-term and long-term disability options, explain how policies define “disability,” and clarify the differences between employer-sponsored and individual plans. Individual coverage offers greater flexibility, portability, and customization—especially important for self-employed professionals or those with specialized careers.

Our approach incorporates key tax considerations and risk management strategies to help you maintain financial stability through life’s uncertainties. Whether you’re a high-income earner, in a hard-to-insure field, or just want peace of mind, we design income protection solutions to safeguard what matters most—your ability to earn and thrive.

Long-Term Care Insurance

Long-term care insurance (LTCi) is a vital part of protecting your future and preserving your independence. It covers the cost of extended care for daily living activities like bathing, dressing, and eating—support you may need due to aging, illness, or cognitive decline. Without coverage, these services can quickly deplete your savings.

LTCi helps shield your retirement assets by covering expenses for nursing homes, assisted living, or in-home care. Policies are customizable, allowing you to tailor benefit periods, daily payouts, and inflation protection to suit your lifestyle and budget. Applying earlier typically leads to lower premiums and easier health qualification.

For added flexibility, hybrid policies combine long-term care coverage with life insurance or annuities—providing a death benefit if care isn’t used. At Modern Wealth, we integrate long-term care planning into your broader financial strategy, ensuring you’re prepared for life’s “what-ifs” without compromising your financial security or quality of life.

Property and Casualty Insurance

At Modern Wealth, we help safeguard your home, vehicle, and personal assets with comprehensive property and casualty insurance strategies. By integrating risk management into your financial plan, we ensure you’re protected from unexpected events like accidents, natural disasters, or liability claims—so your wealth stays secure.

Our coverage solutions include homeowners, renters, auto, and commercial property insurance, all tailored to your specific personal or business needs. These policies protect your physical assets and provide essential liability coverage if you’re found responsible for injury or property damage.

We also offer flexible policy enhancements like flood insurance, umbrella liability, and business interruption coverage to address unique risks. Whether insurance is required or chosen for peace of mind, Modern Wealth helps you stay protected and prepared—so your financial future remains resilient through life’s uncertainties.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!