Tax Planning

Modern Tax Planning

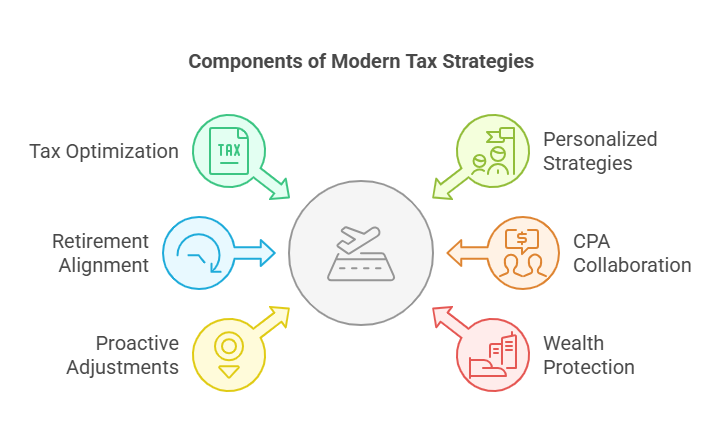

At Modern Wealth, we use proactive tax planning to help you keep more of what you earn. Our strategies are designed to reduce your tax burden while boosting long-term investment returns, giving you greater control over your financial future. By minimizing taxes, we enhance portfolio growth and overall financial efficiency.

We create personalized, tax-smart strategies based on your unique financial situation—ensuring your investments, retirement accounts, and income work together seamlessly. We also guide you through tax-efficient withdrawal strategies in retirement, helping to protect your wealth for the long haul.

Working closely with your CPA, we regularly review your tax returns to uncover new planning opportunities and stay ahead of tax law changes. Our approach not only simplifies the complexities of tax planning, but also strengthens your overall financial plan—so you can focus on building a future that lasts.

Simplistic Tax Insights

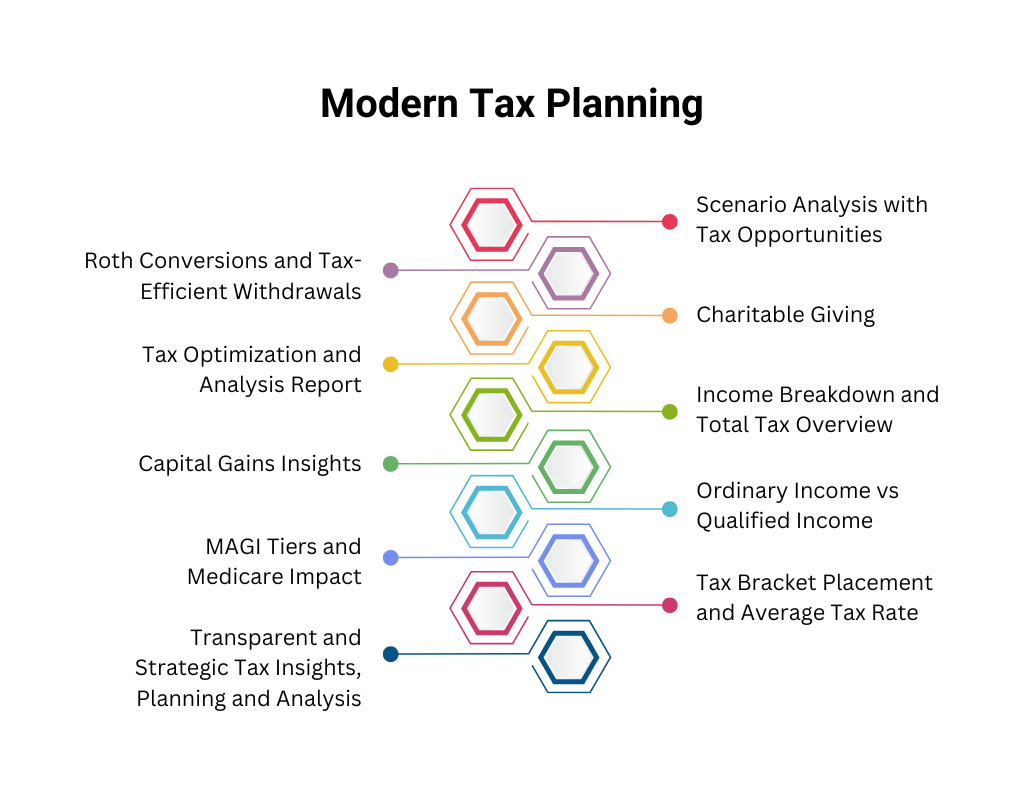

We simplify tax planning with two powerful, easy-to-understand tools: the Scenario Analysis and Tax Analysis reports. These visual summaries highlight key strategies to reduce your tax burden and align your financial plan with your long-term goals—making complex decisions feel clear and actionable.

Our Scenario Analysis pinpoints strategic opportunities, such as Roth conversions, tax-efficient withdrawals, and charitable giving. It also identifies critical income breakpoints—helping you make informed moves before crossing into higher tax brackets. This clarity empowers you to maximize retirement account growth and charitable impact while minimizing future taxes.

The Tax Analysis Report offers a breakdown of your Total Income, AGI, Capital Gains, and more—all explained with simple tooltips for full transparency. It categorizes income types, explains their tax treatment, and gives you a clear picture of your tax position. With these reports, Modern Wealth makes tax strategy easy to understand—and even easier to put into action.

Modern Tax Strategies

At Modern Wealth, we simplify tax planning with two dynamic tools: the Scenario Analysis and Tax Analysis reports. These user-friendly reports turn complex tax data into actionable insights, helping you make informed decisions to reduce your tax burden and grow your wealth. From identifying key income breakpoints to optimizing strategies like Roth conversions and charitable giving, our Scenario Analysis highlights real-time opportunities tailored to your financial goals.

We go further by breaking down essential tax details in the Tax Analysis Report, including Total Income, AGI, Capital Gains, and more—complete with clear tooltips to explain every term. You’ll also gain clarity on the tax treatment of ordinary vs. qualified income, capital gains strategies, and the impact of Modified Adjusted Gross Income (MAGI) on Medicare premiums. This comprehensive view ensures your income is aligned with the most effective tax brackets and your average tax rate is fully understood.

Our transparent and modern approach to tax planning gives you the confidence to act with purpose. With these clear, personalized reports, you’ll stay ahead of tax laws, reduce unnecessary liabilities, and create a tax-smart plan that supports your broader financial goals.

The Tax Lab

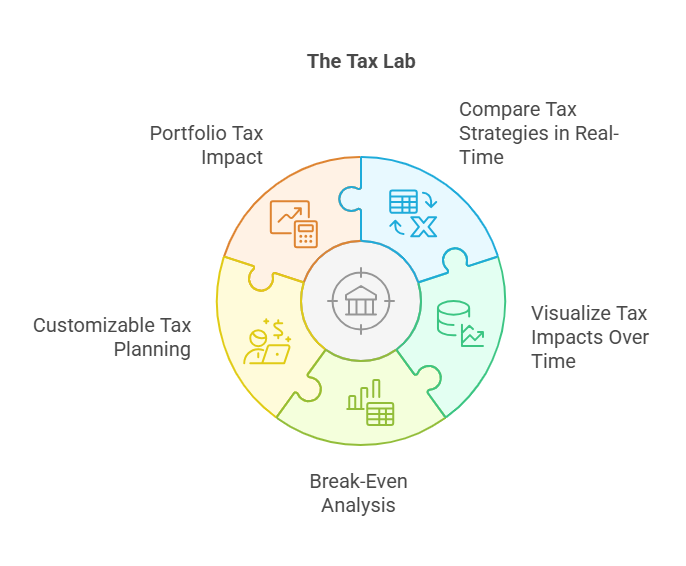

We leverage Tax Lab—a powerful, next-generation tax planning tool—to bring clarity, precision, and efficiency to your financial strategy. Tax Lab allows us to model and compare multiple tax scenarios in real time, helping you make smarter, data-driven decisions that reduce your lifetime tax liability and enhance overall wealth.

With side-by-side visual comparisons, Tax Lab shows how strategies like Roth conversions, tax deferral, and tax-free withdrawals impact your income, tax brackets, and net worth over time. We also conduct break-even analyses, so you know exactly how long it takes for each strategy to pay off—bringing confidence to every move you make.

Best of all, it’s fully personalized. From avoiding costly Medicare surcharges to optimizing your portfolio’s tax impact, we tailor every recommendation to your specific goals and financial situation. With Modern Wealth and Tax Lab, tax planning becomes a strategic advantage—not a guessing game.

Let's Chat

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!